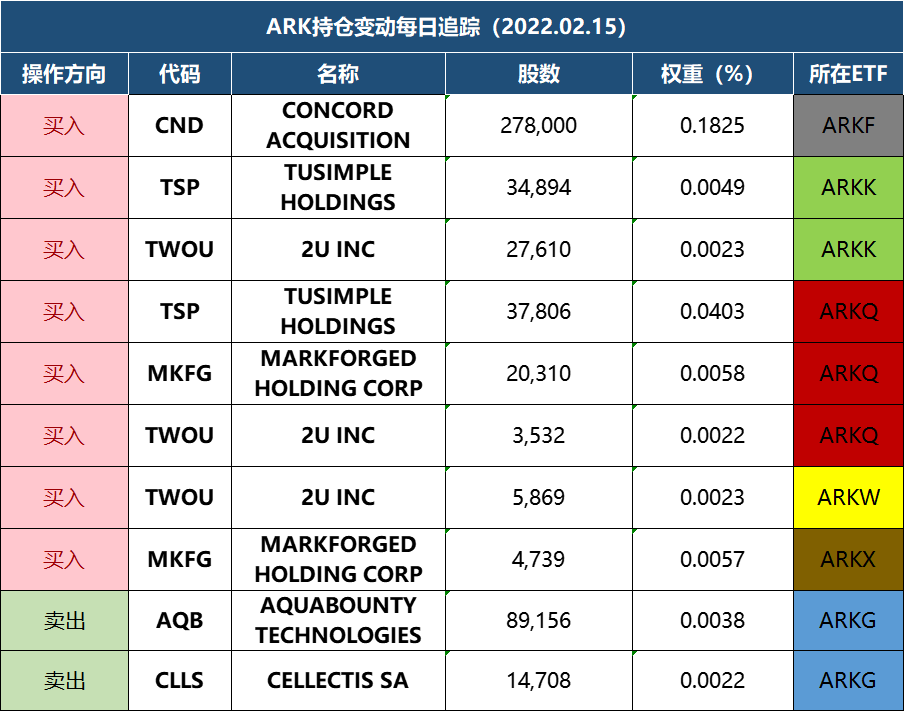

【Ark旗下基金持倉變化小結,2022年02月15日】

在過去兩週,木頭姐管理的ETF基金ARK Innovation(ARKK)抄底超過4億美元的高增長科技股,其中包括“元宇宙第一股”Roblox、支付終端Block和在線券商Robinhood。

在今年前六週,這三隻科技股的跌幅都至少達到了25%。而ARKK的前三大持倉股:特斯拉、美版“小米盒子”Roku和遠程醫療服務提供商Teladoc Health在今年的跌幅也都至少達到19%。

據FactSet數據顯示,在進入2022年之後ARKK中有超過一半的股票已經下跌至少20%,ARKK的整體跌幅也達到24%。

有人歡喜有人憂。在ARKK遭到重創的同時,做空ARKK的反向基金—Tuttle Capital Management旗下的Short Innovation ETF(SARK)卻強勢大漲。

迄今爲止,該基金今年漲幅已達到24%,淨流入資金達到2億美元,總資產也被推高至3.098億美元。

Tuttle Capital的首席執行官Matthew Tuttle認爲:

面對緊縮之路,木頭姐堅持:不要輕視“顛覆式創新”

在低利率政策和刺激措施“橫行”的時代,高成長科技股如魚得水,木頭姐帶領她的ARKK成爲絕對贏家。

然而隨着通脹持續爆表,美聯儲逐步走上激進的緊縮之路,利率政策的收緊使得依賴未來現金流的科技股陷入困境,投資者對於當下無利可圖的高估值個股再沒有往日的寬容。

【ARK系列ETF介紹】

①ARKK:以顛覆性創新產業爲主要投資標的

ARKK專門投資革命性創新的公司,在5個美股ETF中,ARKK投資的公司類型最多元化,包括基因科技、全自動化、物聯網及金融科技相關的公司,可以說是其餘4個ETF的合體。

②ARKQ:以自動科技自動機器人技術爲主要投資標的

ARKQ投資的公司專注於機器人自動化相關的公司,當中投資自動駕駛的公司佔比最多,其次爲自動化機器人、3D打印、儲能技術、太空探索等的相關公司。

③ARKF :以金融科技創新爲主要投資標的

ARKF主力投資金融科技相關公司,其中包括交易平臺、區塊鏈、衆籌平臺等等相關公司。

④ ARKW:以"下一代網絡"爲主要投資標的

ARKW專門投資"下一代網絡"的公司,當中佔比最多的公司爲雲計算、其次爲網絡安全、電子商務、大數據、人工智能等相關公司。

⑤ ARKG:以生物基因科技創新爲主要投資標的

ARKG這隻ETF主要專注於基因革命領域,包括基因編輯技術CRISPR、基因診斷治療、靶向治療、生物信息。

⑥ ARKX: ARKX是美股市場裏的第一支太空概念ETF。

ARKX基金中80%的資金將投資於探索地球表面以外的技術類、產品類、服務類的領先公司。

【uSMART目前支持部分美股10倍槓桿日內交易】

以上數據爲Cathie Wood個人/所在機構的過往操作,其交易背後之投資邏輯並不明確,不代表投資建議,注意風險。