ARK持倉追蹤 | ARKK週二跌至18個月最低點

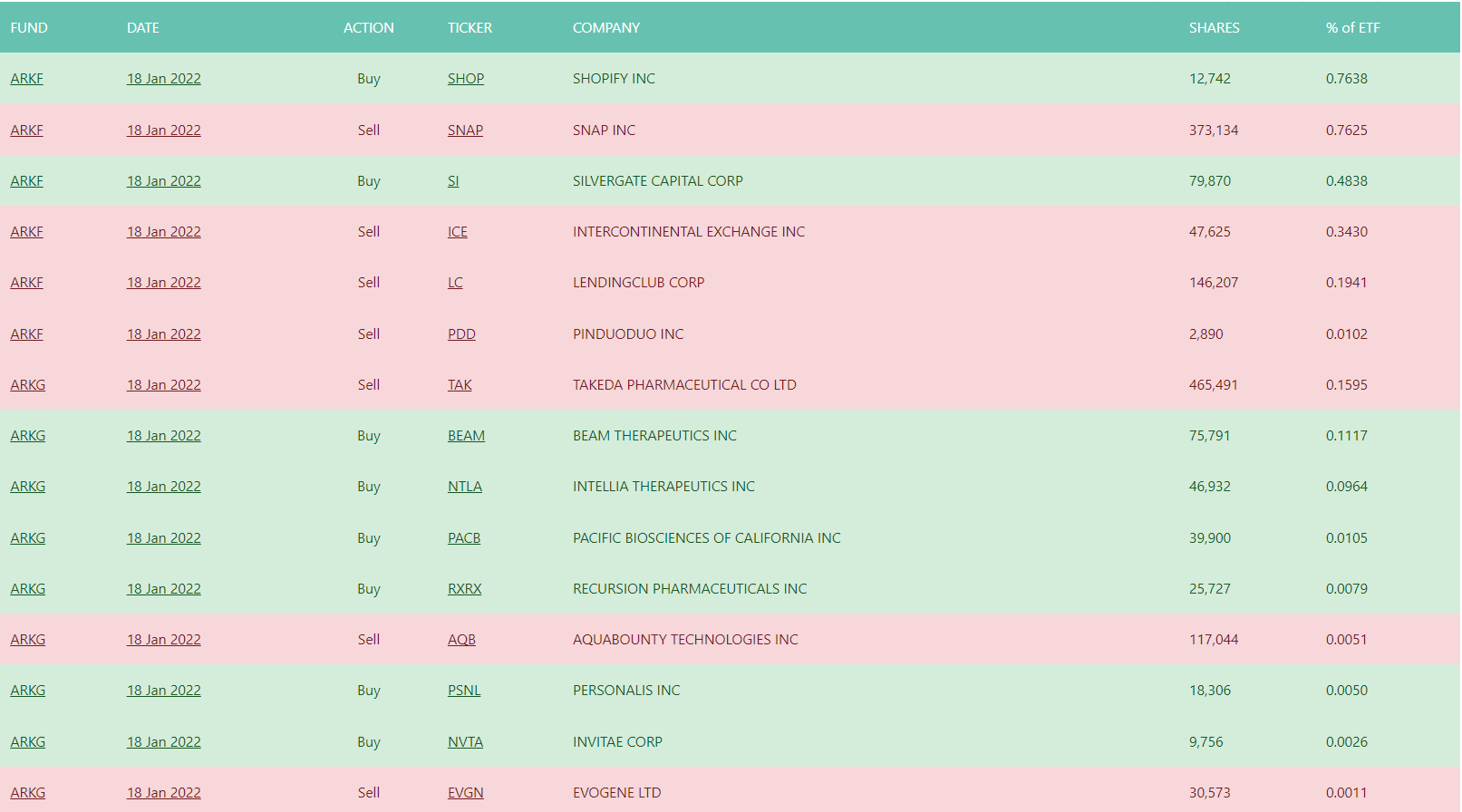

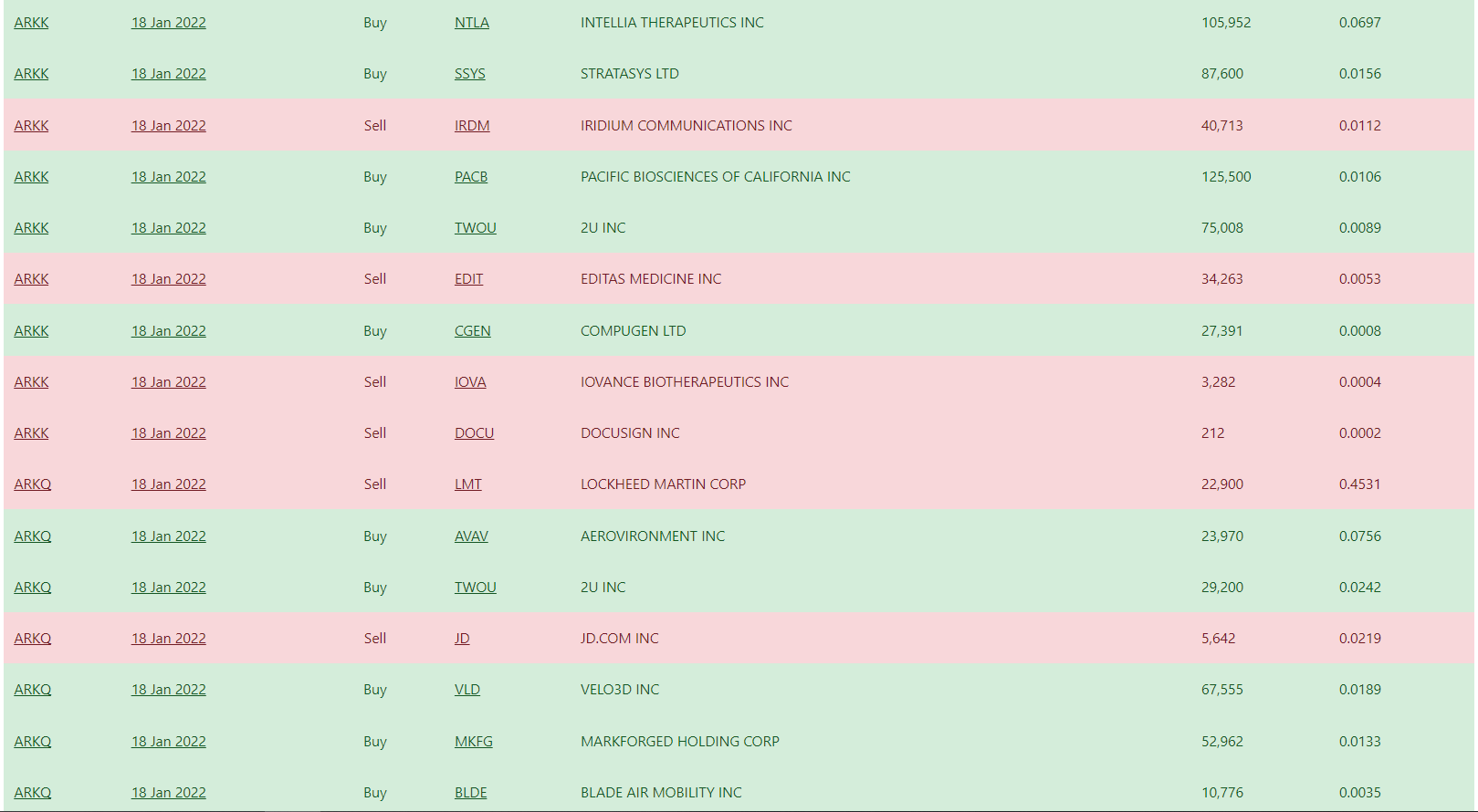

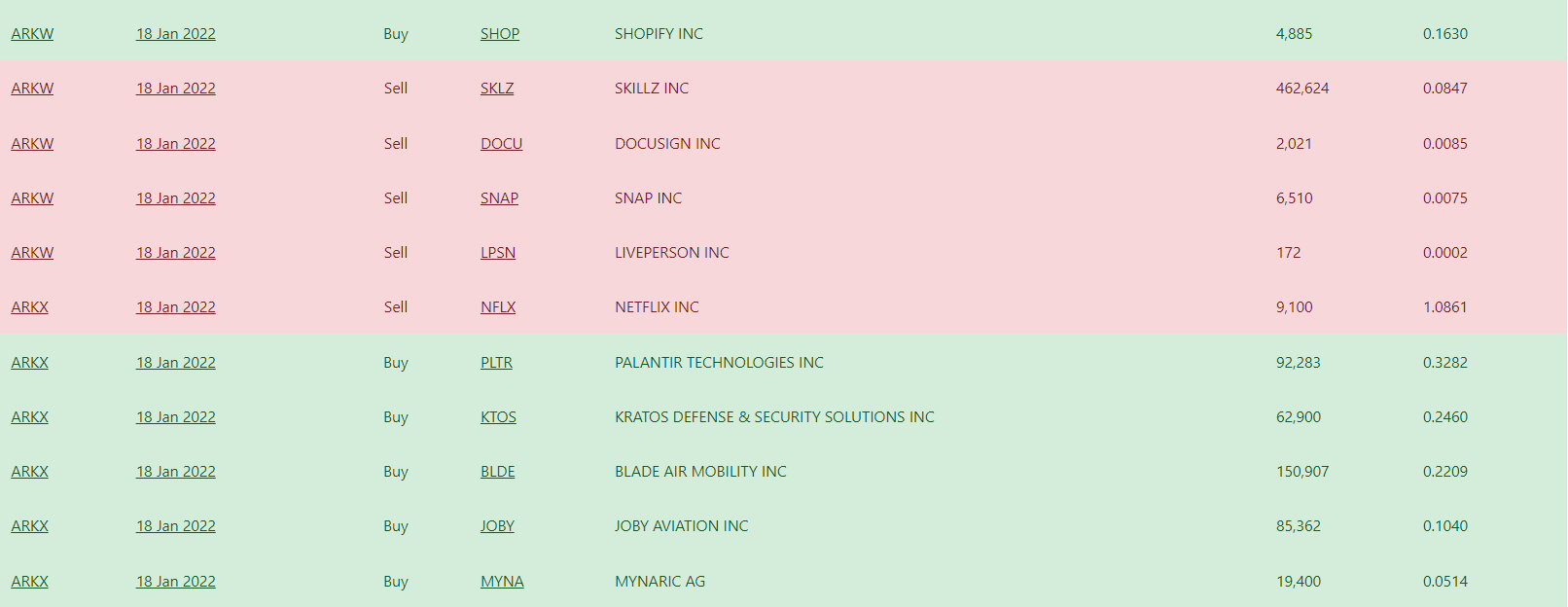

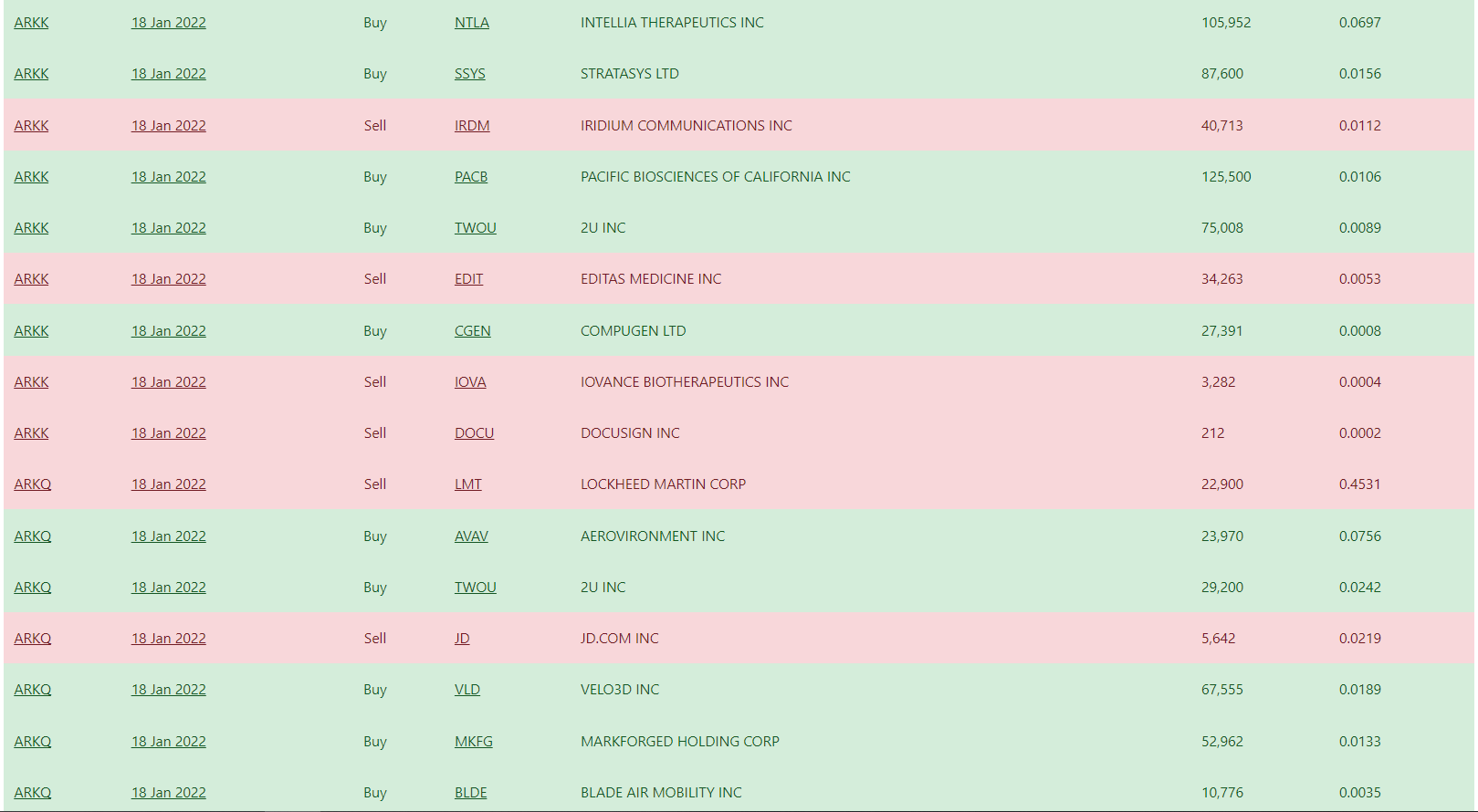

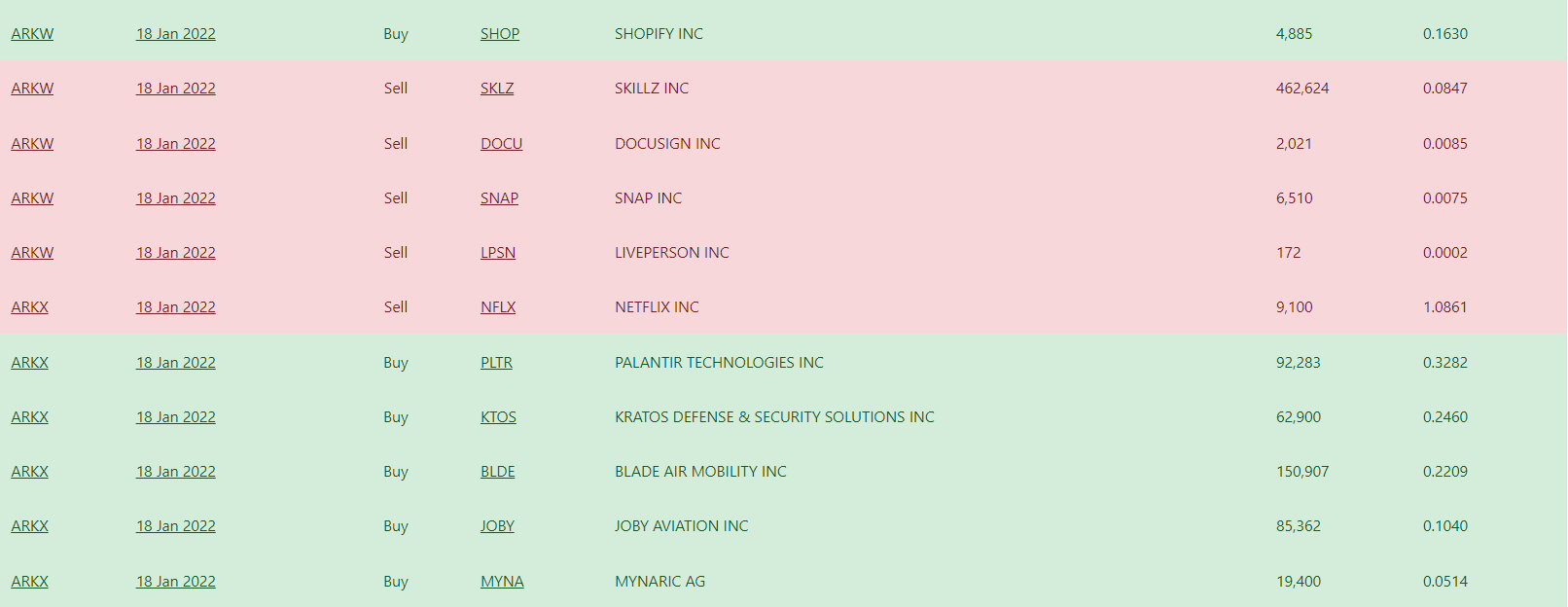

【Ark旗下基金持倉變化小結,2022年01月18日】

隨着美聯儲加息預期提前,美債收益率躍升,科技股新年跳水,令明星基金經理凱西·伍德(木頭姐)在2022年迎來了一個慘淡的開局,且事情還在變得更糟。截止週二收盤,木頭姐的旗艦基金ARK Innovation ETF (ARKK.US)跌至18個月來最低點,其持有的44只股票均接近下跌,該基金今年迄今跌幅爲19.9%。

智通財經APP獲悉,隨着美國2年期和10年期國債收益率分別上漲7個和10個基點,投資者逃離高增長空間,ARKK下跌4.1%,納斯達克指數下跌2.6%。以下是ARKK旗下44只股票在週二當天及今年迄今的表現。

據瞭解,ARKK週二表現最差的兩隻股票分別是10x Genomics(TXG.US)和Pacific Biosciences of California(PACB.US),前者收跌10.8%,後者收跌10.5%。其中,10x Genomics是ARKK的第24大持股,權重爲1.45%,而Pacific Biosciences of California是該基金第28大持股,權重爲1.06%。

Berkeley Lights(BLI.US)是ARKK基金今年以來表現最差的股票,跌幅爲47.5%,權重爲0.33%,是第39大持股公司。

今年開年來,木頭姐的麻煩可謂接連不斷。上週ARKK基金遭遇投資者撤資3.52億美元,創去年3月以來最大資金流出。

【ARK系列ETF介紹】

①ARKK:以顛覆性創新產業爲主要投資標的

ARKK專門投資革命性創新的公司,在5個美股ETF中,ARKK投資的公司類型最多元化,包括基因科技、全自動化、物聯網及金融科技相關的公司,可以說是其餘4個ETF的合體。

②ARKQ:以自動科技自動機器人技術爲主要投資標的

ARKQ投資的公司專注於機器人自動化相關的公司,當中投資自動駕駛的公司佔比最多,其次爲自動化機器人、3D打印、儲能技術、太空探索等的相關公司。

③ARKF :以金融科技創新爲主要投資標的

ARKF主力投資金融科技相關公司,其中包括交易平臺、區塊鏈、衆籌平臺等等相關公司。

④ ARKW:以"下一代網絡"爲主要投資標的

ARKW專門投資"下一代網絡"的公司,當中佔比最多的公司爲雲計算、其次爲網絡安全、電子商務、大數據、人工智能等相關公司。

⑤ ARKG:以生物基因科技創新爲主要投資標的

ARKG這隻ETF主要專注於基因革命領域,包括基因編輯技術CRISPR、基因診斷治療、靶向治療、生物信息。

⑥ ARKX: ARKX是美股市場裏的第一支太空概念ETF。

ARKX基金中80%的資金將投資於探索地球表面以外的技術類、產品類、服務類的領先公司。

【uSMART目前支持部分美股10倍槓桿日內交易】

以上數據爲Cathie Wood個人/所在機構的過往操作,其交易背後之投資邏輯並不明確,不代表投資建議,注意風險

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.