輪證日報 |恆指再度走低,熊證漲超100%

| 今日市場短評

港股收盤,恆指收跌0.83%,恆生科技指數盤中刷新歷史低位,收跌1.75%;在線教育、影視娛樂、餐飲、物業管理等板塊齊挫;恆騰網絡逆市大幅收漲33%。

| 窩輪焦點

中芯國際(00981)

中芯認購證(11981)到期日:2022年6月槓桿:5.48倍

國君香港:半導體景氣度高企 第三代半導體前景廣闊 建議低吸華虹和中芯國際

全球半導體產業鏈轉移、5G產品迭代、新能源汽車需求放量疊加疫情導致的半導體產能利用率降低等因素,導致全球半導體行業供需持續失衡。2021 年以來,半導體行業高速擴張持續,行業景氣度高企。

半導體行業高速擴張持續,銷售額創新高:數字轉型推動許多顛覆性應用需求激增,進入下半年以來,全球範圍內半導體擴張速度在經歷過短暫增幅縮窄後恢復高增速趨勢。根據 SEMI 數據,2021年11月北美半導體設備製造商出貨金額爲39.3億美元,同比增長50.6%;北美 1-11 月半導體設備總出貨總額爲 390.4 億美元,同比增長約 44.2%。同時,2021 年全球半導體設備出貨額將高達1,030 億美元,同比增長 56.5%。根據 SIA 數據,今年全球半導體的銷售額將達到5,530 億美元,創下新高,同比增長 25.6%。我們認爲半導體行業供需失衡仍未到拐點,行業景氣度將會持續。

| 牛熊證焦點

恆生指數(HSI)

恆指熊證(59928)到期日:2022年6月回收價:23421槓桿:43.56倍

瑞信下調恆指3個月目標位至24000點 明年轉折點或在兩會後

據香港經濟日報週三報道,瑞信大中華區首席投資總監邵志銘表示,其已把恆指未來3個月目標價由25000點下調至24000點。週三午盤初,恆指報23053.85點,跌0.97%。

他認爲,潛在轉折點將出現2022年3月的全國兩會。若中央沒有給出更大經濟振興措施並對地產行業作出更大動作,投資者將繼續觀望態度,香港市場將難以反彈。

他表示,明年投資主題是政策受惠股,包括新能源、半導體及電動車。電動車方面,他較爲看好產業鏈中上遊公司,專注能見度較高及業務好的企業。新能源方面,太陽能板塊除了政策支持,供不應求將持續,加價後銷售仍然良好。

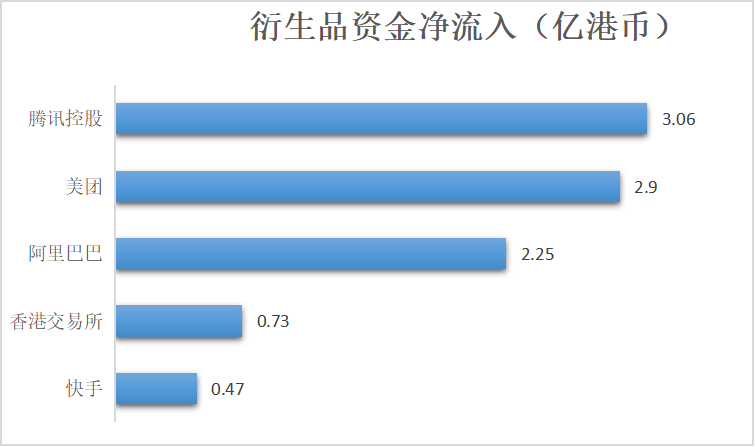

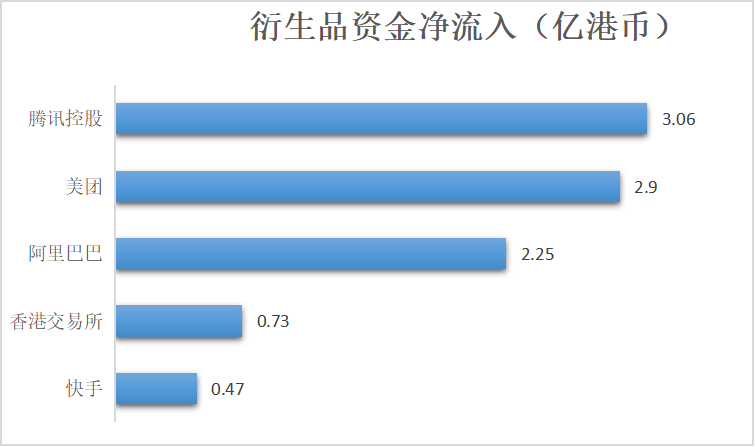

| 衍生品資金流入/流出

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.