輪證日報 |贛鋒鋰業午後拉昇,牛證漲50%

| 今日市場短評

港股三大指數收盤漲跌不一,恆指收漲0.24%,國指收跌0.09%,恆生科技指數收跌0.89%。盤面上,恆大系、中醫藥股表現強勢,電力股、短視頻概念股、綠電概念股、生物醫藥板塊下挫。個股方面,中國恆大(03333.HK)收漲9.46%,贛鋒鋰業(01772.HK)收漲3.52%,世茂集團(00813.HK)收漲5.77%,恆騰網絡(00136.HK)收跌4.33%,火巖控股(01909.HK)收跌11.5%,騰訊控股(00700.HK)收跌2.13%。

| 窩輪焦點

青島啤酒股份(00168)

青啤認購證(23480)到期日:2022年4月槓桿:4.05倍

高盛:青島啤酒評級升至“買入” 華潤啤酒獲納“確信買入”名單

高盛發佈研究報告,將青島啤酒評級由“中性”上調至“買入”,但維持青島啤酒“中性”評級,並將華潤啤酒列入“確信買入”名單,主因強勁的行業增長,高端細分市場,提高平均售價及預估利潤率將持續擴大至2025年。

該行預計,華潤啤酒未來兩年高端產品銷量將增長逾2成,進一步提價將抵消2022年的成本壓力,預測2022-23年EBIT同比增長29%/21%。

| 牛熊證焦點

贛鋒鋰業(01772)

贛鋒牛證(62771)到期日:2022年11月回收價:110槓桿:6.81倍

瑞銀:升贛鋒鋰業評級至買入 目標價上調至182.6港元瑞銀髮表報告,認爲市場沒有充分認識到贛鋒鋰業在行業上升期的利潤增長潛力,認爲進一步提高自給率會是銷量的催化劑,評級由中性升至買入,目標價由94.5港元大升至182.6港元。瑞銀將贛鋒鋰業2021年至2023年的每股盈利預期提高了73%至168%,以反映更新後的鋰價預測。據該行目前預測,明年碳酸鋰/氫氧化鋰/鋰輝石的價格將分別爲每噸25,000/25,000/1,800美元,並料贛鋒鋰業今年已經改善的利潤率將在明年及後年很好地維持。

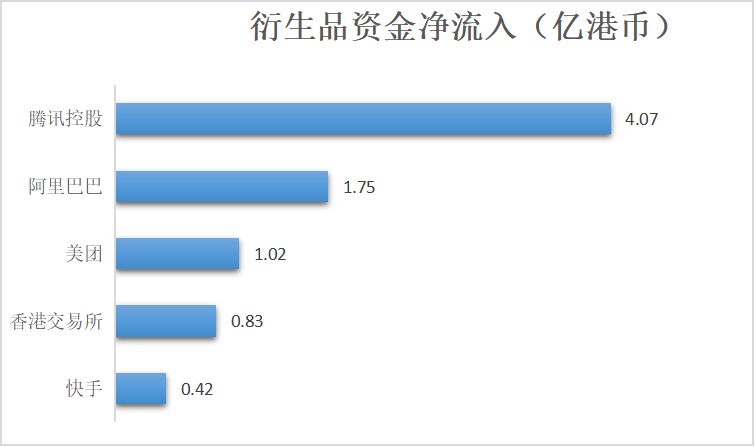

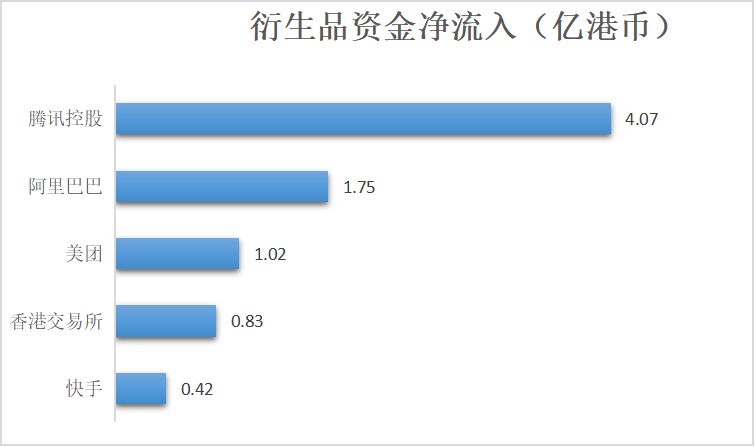

| 衍生品資金流入/流出

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.