財報前瞻 | 不利因素接踵而至,FacebookQ3能否“逆風翻盤”?

Facebook將於美東時間10月25日美股盤後公佈2021年第三季度財報。

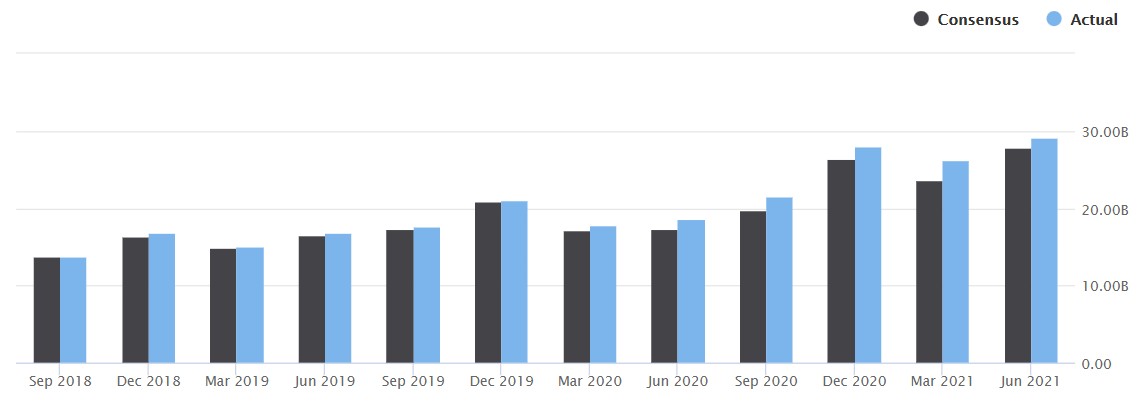

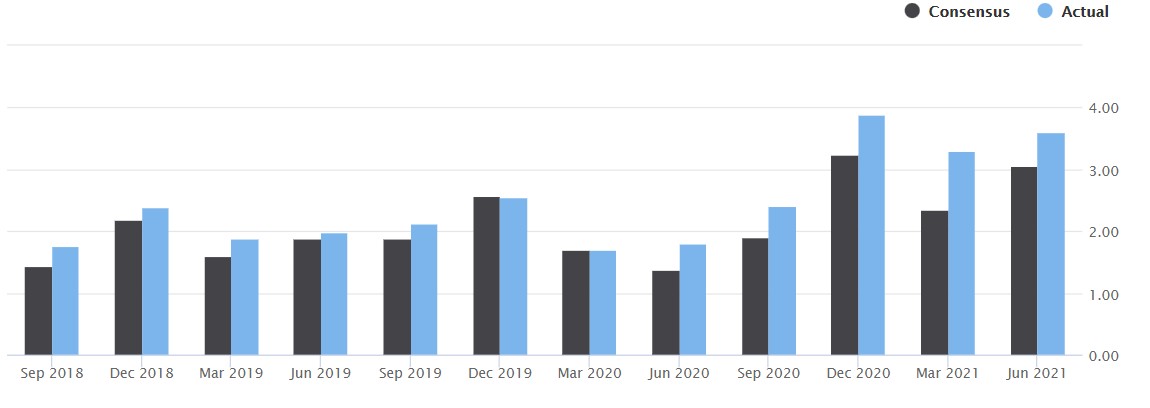

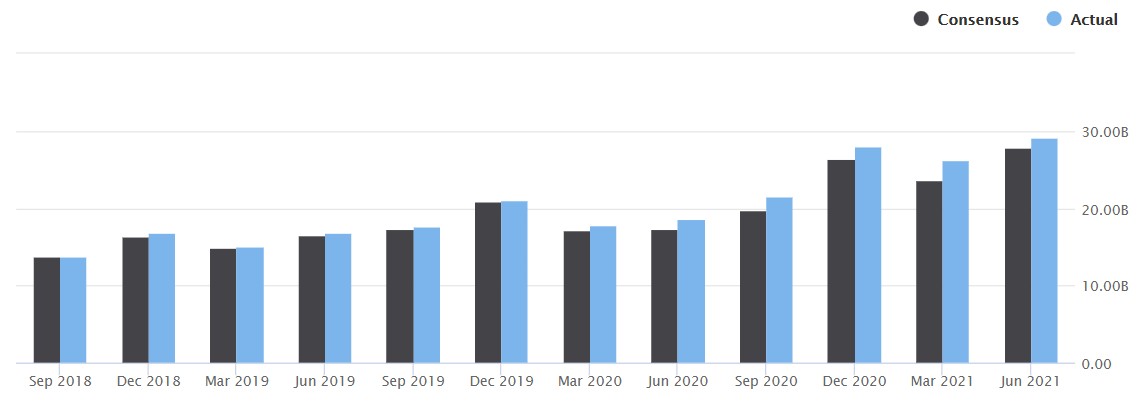

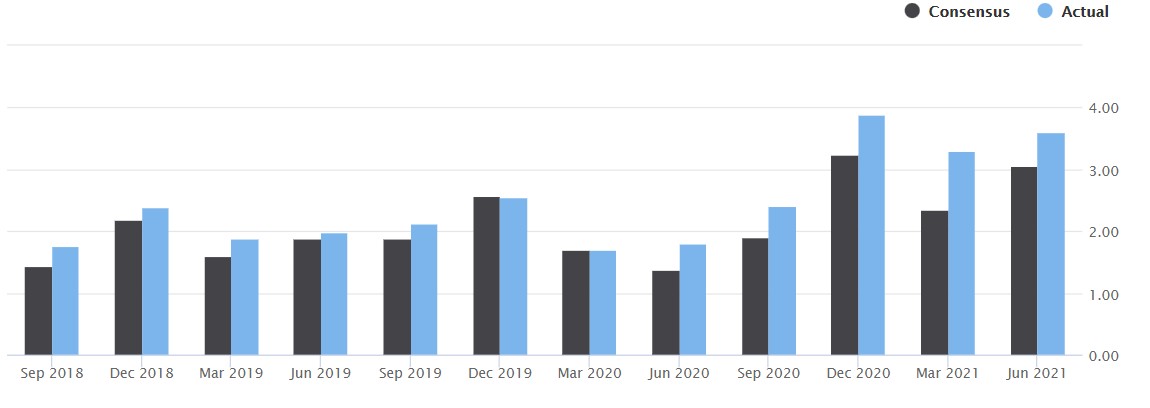

目前,分析師普遍預計,Facebook第三季度營收將達到296億美元,較去年同期增長約38%,而這與Facebook第二季度56%的營收增長率相比有所放緩。每股收益方面,目前分析師普遍預計爲3.18美元,比去年同期高出15.6%。

但需要注意的是,Facebook在2021年第二季度的業績增幅得益於2020年的低基數,當時廣告等各項收入受到與新冠疫情相關的封鎖政策的負面影響。

據統計,Facebook近幾年的實際季度營收與實際每股收益已多次超出分析師普遍預期。

上週五Snap在業績報告中表示,由於全球供應鏈受阻和勞動力短缺,導致Snap縮減了廣告支出,因此公司的業績出現了下滑。另外,Snap還表示,蘋果(AAPL.US)今年早些時候推出的隱私變更損害了Snap的數字廣告定位和衡量能力,並表示iPhone的隱私設置對Snap廣告業務的影響超出了此前預期,預計蘋果的隱私變更和全球供應鏈的中斷將持續到第四季度。

而投資者目前非常擔心Facebook也遭遇同樣甚至更嚴重的負面影響,這一預期也反映在了上週五Facebook的股價上,該股截至收盤下跌超5%。

在Snap(SNAP.US)上週五公佈的營收等全面不及預期後,以及連續兩名“吹哨人”的指控可能使得Facebook面臨鉅額罰款等其它懲罰,許多投資者預計Facebook第三季度營收和Q4營收指引將低於分析師預期。

但是有市場觀點認爲,這家社交網絡巨頭有可能憑藉強大的運營實力和用戶基礎戰勝Snap所面臨的挑戰,至少可以在一定程度上避開與蘋果iOS有關的一些不利因素。

與Snap旗下的Snapchat不同的是,Facebook不僅在移動端,它在桌面端也有很大的影響力,這決定了其在營銷網絡和功能基礎上表現出的能力強於Snapchat。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.