知名基金經理做空蘋果:年底或回調10%-20%

uSMART盈立智投 09-15 22:31

Satori Fund創始人兼投資組合經理Dan Niles週二表示,他的基金正在做空蘋果(AAPL.US),因爲該公司面臨與新冠時期業績的嚴峻對比,以及在產品發佈後股價往往會走低。

這位知名分析師告訴媒體,他還預計整個市場會下跌,預計今年年底前會有10%到20%的回調。Niles認爲,蘋果的股價通常會在產品發佈之前上漲,但在這家科技巨頭真正將新機型交付市場後,就會回吐漲勢。

雖然蘋果發佈了新的產品支撐了他的賣空時機,但Niles認爲,更深層次的基本面問題可能也會給蘋果公司帶來壓力。

Niles指出,蘋果在疫情期間受益,因爲許多消費者在居家工作或學習的新常態期間升級了他們的個人科技產品。他表示,這將使蘋果在未來幾個季度難以與去年同期相比,許多產品的銷售可能會同比下降。

至於他對整體市場的看法,Niles指出,通脹、疫情擔憂和高估值是可能出現回調的主要理由。他斷言,在通脹驅動成本上升的情況下,利潤受到壓縮。而且, delta病毒已經導致一些公司的銷售放緩。與此同時,Niles指出,與收益相比,股價已經達到歷史高點。

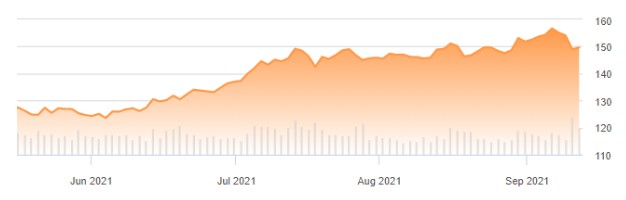

美東時間9月14日,蘋果收跌0.96%,報148.12美元。本月早些時候,該股曾反彈至157.26美元的52周盤中高點,但最近有所放緩。蘋果現在需要有超過6%的漲幅才能重拾高點:

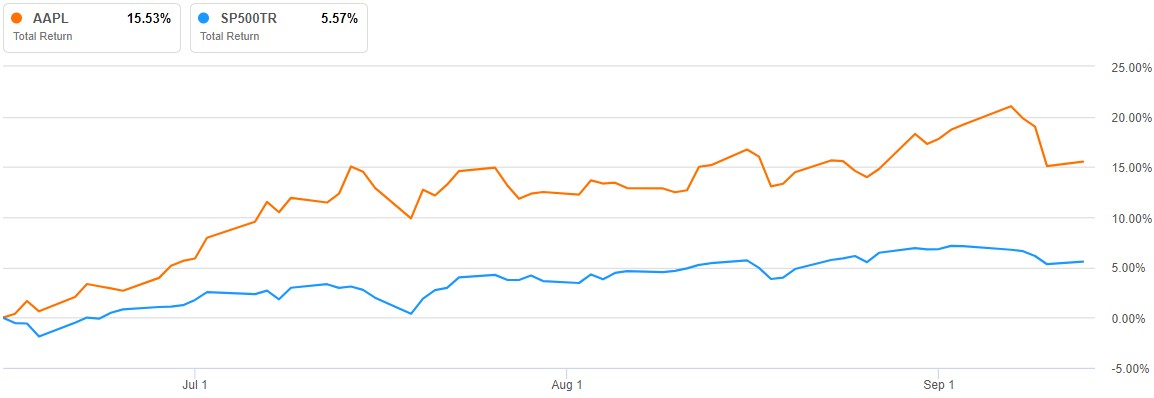

儘管如此,在過去的三個月裏,蘋果還是跑贏了整個市場。在此期間,該股的回報率接近16%,而標普500指數的回報率略低於6%。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.