需求前景疲軟+美聯儲暗示年底前縮減QE,油價跌破65美元水平

uSMART盈立智投 08-19 12:02

由於投資者擔心隨着全球新冠病例激增及美國夏季駕駛季節接近尾聲導致燃料需求惡化,加上美聯儲暗示將在數月內開始縮減購債規模,油價應聲跌破65美元。

WTI原油價格在亞洲早盤交易中下跌1.3%至64.60美元/桶,爲連續第六天下跌。週三,WTI原油價格一度跌至64.34美元/桶,創5月24日以來的最低盤中水平;ICE布油價格下跌1.2%至67.44美元/桶。

原油價格的額外下行壓力來自美國能源信息署(EIA)關於美國石油和產品持有量的混合報告。美國能源信息署數據顯示,原油庫存下降幅度超過預期的323萬桶,但汽油庫存卻增加69.6萬桶,爲一個多月以來的首次增加,這加劇了對燃料需求疲軟的擔憂。

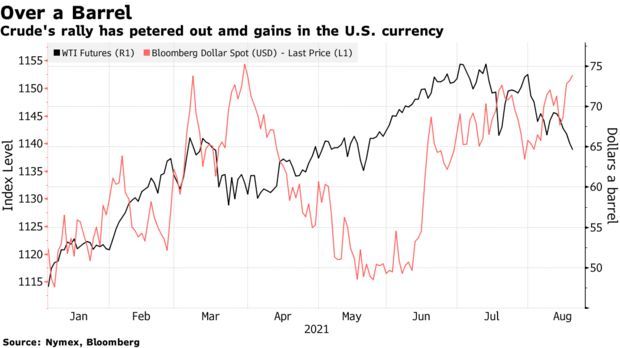

由於Delta變種病毒蔓延對需求構成威脅,原油價格上半年令人印象深刻的漲勢在7月和8月失去了動力。近幾周美元上漲也抑制了原油價格,與此同時,OPEC+也在推進逐步恢復供應。

道明證券(TD Securities)的Bart Melek表示:“EIA數據公佈後,市場最初反應積極。但隨着交易員評估需求風險的基本面, 他們改變了態度。”“歸根結底,Delta變種病毒對消費的持續威脅使市場感到不安。”

Price Futures Group的Phil Flynn表示,FOMC會議紀要暗示,美聯儲可能會在年底前開始縮減資產購買規模,此舉可能會提振美元並降低以該貨幣計價的商品的吸引力。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.