瑞銀Q2持倉:建倉鬥魚看漲期權,減持阿裏巴巴

據美國證券交易委員會(SEC)披露,瑞銀集團(UBS.US)遞交了截至2021年6月30日的第二季度持倉報告(13F)。

據統計,瑞銀二季度持倉總市值達3101.74億美元,上一季度總市值爲3013.26億美元,環比增長2.94%。瑞銀在二季度的持倉組合中新增了1345只個股,增持了3647只個股。同時,瑞銀還減持了4215只個股並清倉了928只個股。其中前十大持倉標的佔總市值的14.55%。

瑞銀二季度建倉Coinbase看跌期權(COIN.US,PUT)、Roku看漲期權(ROKU.US,CALL)、鬥魚看漲期權(DOYU.US,CALL)等,清倉極光(JG.US)和西南航空看漲期權(LUV.US,CALL)等。

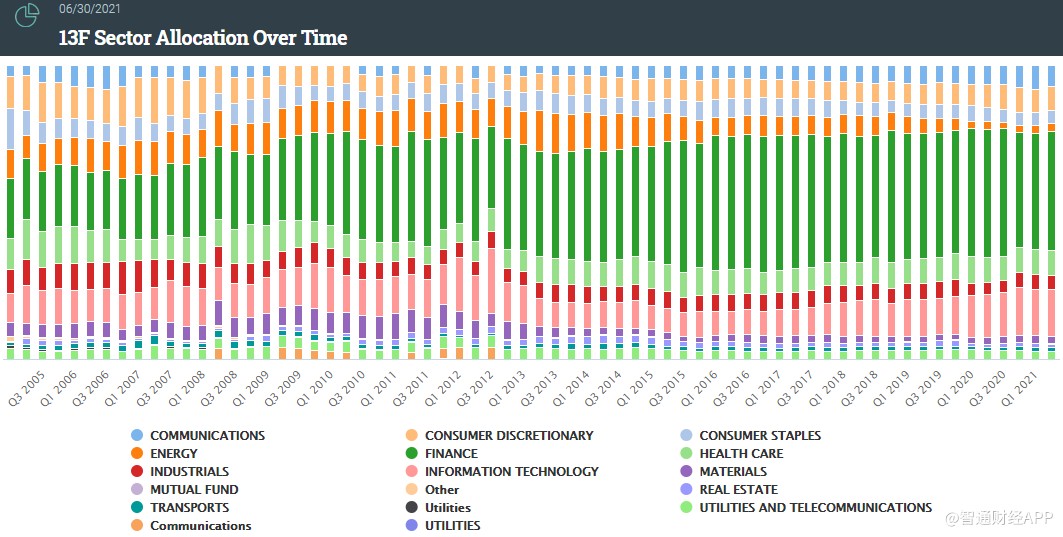

從持倉偏好來看,金融、IT類及非必需消費品個股位列前三,佔總持倉的比例分別爲40.64%,16.18%以及8.32%。

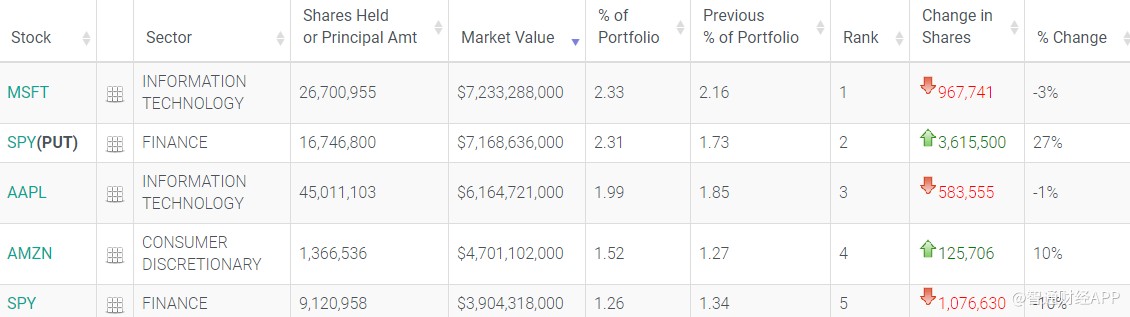

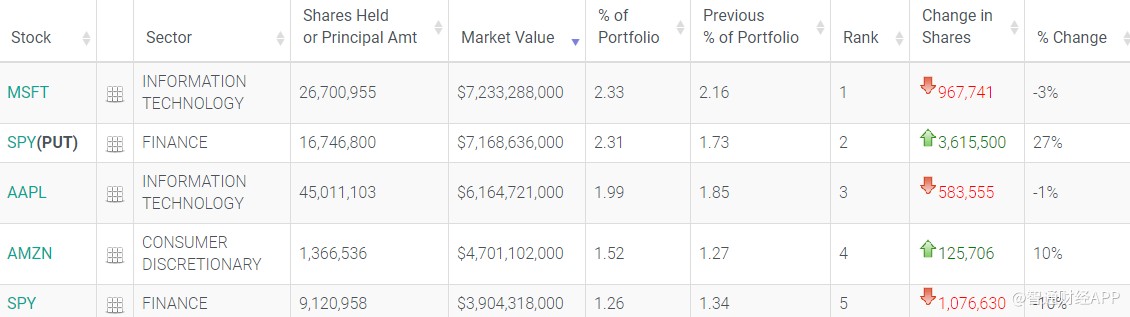

在前五大重倉股中,微軟(MSFT.US)位列第一,持倉約2670.10萬股,持倉市值爲72.33億美元,較上季度持倉數量下降3%。

標普500指數看跌期權(SPY.US,PUT)位列第二,持倉約1674.68萬股,持倉市值約爲71.69億美元,較上季度持倉數量增長27%。

蘋果(AAPL.US)位列第三,持倉約4501.11萬股,持倉市值約爲61.65億美元,較上季度持倉數量下降1%。

亞馬遜(AMZN.US)位列第四,持倉約136.65萬股,持倉市值約爲47.01億美元,較上季度持倉數量增長10%。

標普500指數ETF(SPY.US)位列第五,持倉約912.10萬股,持倉市值約爲39.04億美元,較上季度持倉數量下降10%。

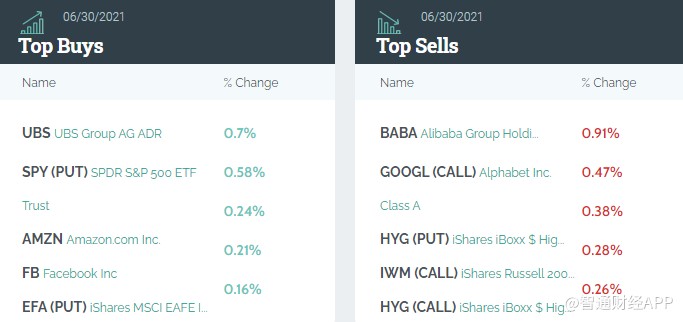

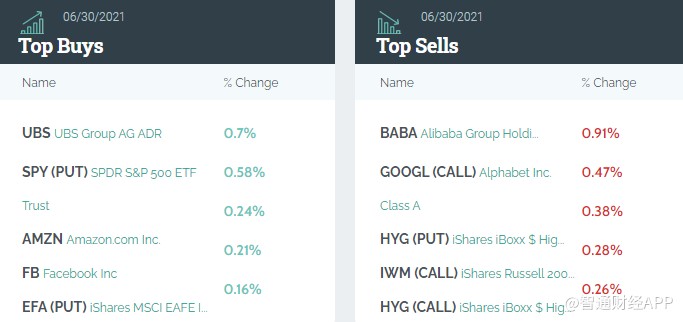

從持倉比例變化來看,前五大買入標的分別是:瑞銀(UBS.US)、標普500指數看跌期權(SPY.US,PUT)、亞馬遜(AMZN.US)、Facebook(FB.US)和歐澳遠東指數ETF-iShares MSCI看跌期權 (EFA.US,PUT)。

前五大賣出標的分別是:阿裏巴巴(BABA.US)、谷歌A看漲期權(GOOGL.US,CALL)、債券指數ETF-iShares iBoxx高收益公司債看跌期權(HYG.US,PUT)、羅素2000指數ETF看漲期權(IWM.US,CALL)、債券指數ETF-iShares iBoxx高收益公司債看漲期權(HYG.US,CALL)。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.