數萬美國人上書要求首富貝佐斯留在太空

01

新冠疫情和隨之滔天“大水”再度讓美國的貧富差距加大。這對美國的富人來說可謂喜憂交加。比如最近發生了一件尷尬的事,亞馬遜公司(Amazon)創始人傑夫·貝佐斯(Jeff Bezos)近日表示,他將於下個月和弟弟作爲自己家造的藍色起源(Blue Origin)飛船的首批乘客之一進入太空。

藍色起源是貝佐斯創辦的太空旅行公司。貝佐斯在Instagram上發帖稱,太空飛行是他“一生”都想做的事情。

明明是件喜氣洋洋可以大幅炫耀的事兒,然而最近有將近5萬名美國股民上網請願,要求貝佐斯不要再回地球,留在太空。署名的人數還在不斷增加。網民們大聲疾呼:你們可以把一個億萬富翁送到太空,爲啥不把所有億萬富翁都送過去?

以下爲網上署名網站的截圖。

貝佐斯是世界上最富有的人之一。據《福布斯》雜誌數據,他的淨資產爲1862億美元(1315億英鎊)。和他一起太空旅行的有他的弟弟和另外一位付了2800萬美元的匿名乘客。

02

美國人民的仇富心理正白熱化發展。6月8日週二,美國新聞網站發佈報告,揭示了最富有的美國人如何大舉避稅。根據上述網站從美國國稅局(IRS)獲得的機密稅務文件,在2014年-2018年期間,最富有的25位美國人共繳納136億美元聯邦所得稅。跟他們在此期間獲取的財富相比,也僅是九牛一毛。

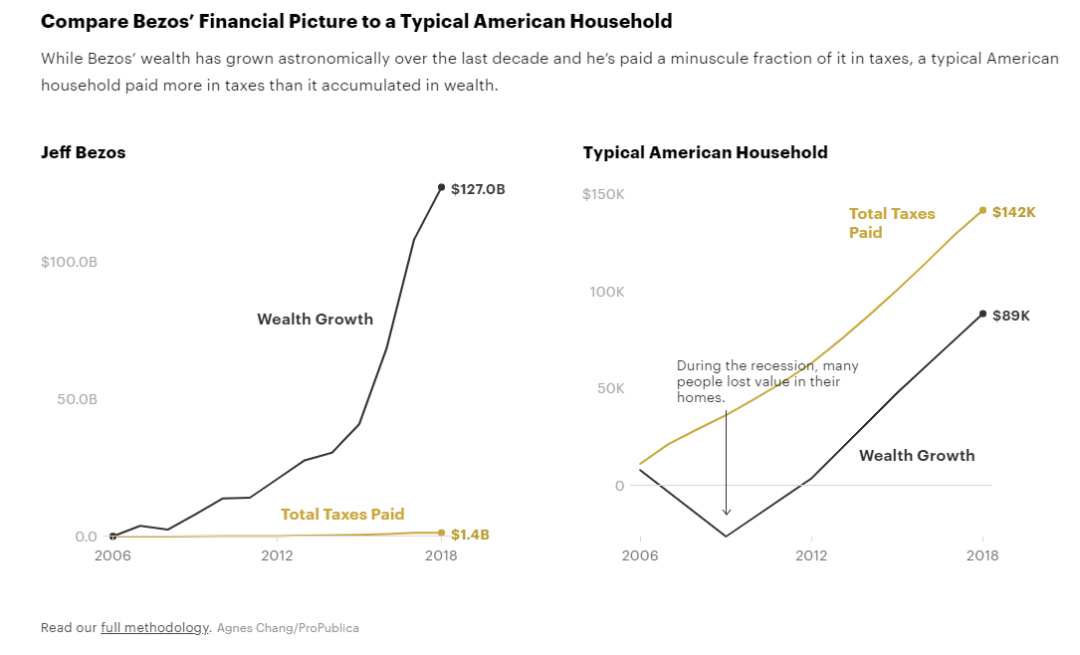

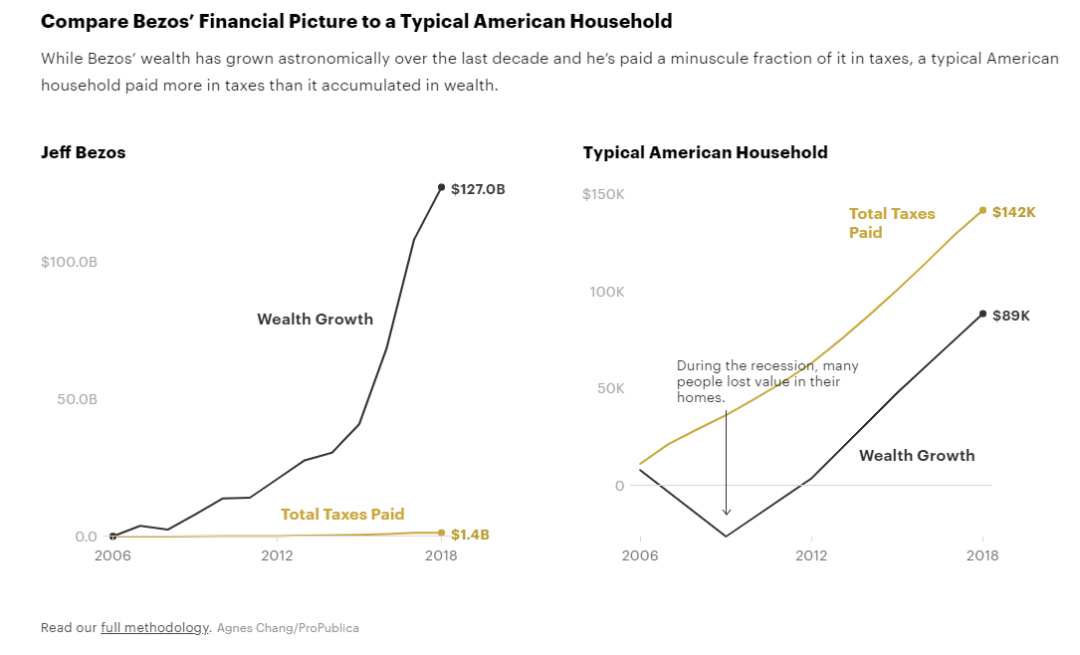

貝佐斯與美國普通家庭財務、納稅狀況對比

圖源:ProPublica

比如在這五年間財富增長243億美元的巴菲特僅繳納了2370萬美元的稅款,實際稅率爲富人最低,僅爲0.1%。身家漲了990億美元的貝佐斯緊隨其後,實際稅率爲0.98%;布隆伯格和馬斯克的實際稅率則分別爲1.3%和3.27%。

關於美國面臨的問題,有時間建議大家不妨讀讀《21世紀資本論》這本書。它是法國經濟學家湯瑪斯·皮克提著書,它討論了自18世紀以來歐美的財富和收入不均的問題。這本書的主要觀點認爲貧富不均不是意外,而是資本主義的一個特點,並且只能通過國家幹預來扭轉。因此這本書認爲除非資本主義進行改革,否則真正的民主秩序將受到威脅。

貝佐斯去留如何,我們將拭目以待。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.