“新式茶飲第一股”奈雪的茶今啟招股,預計6月30日登陸港交所

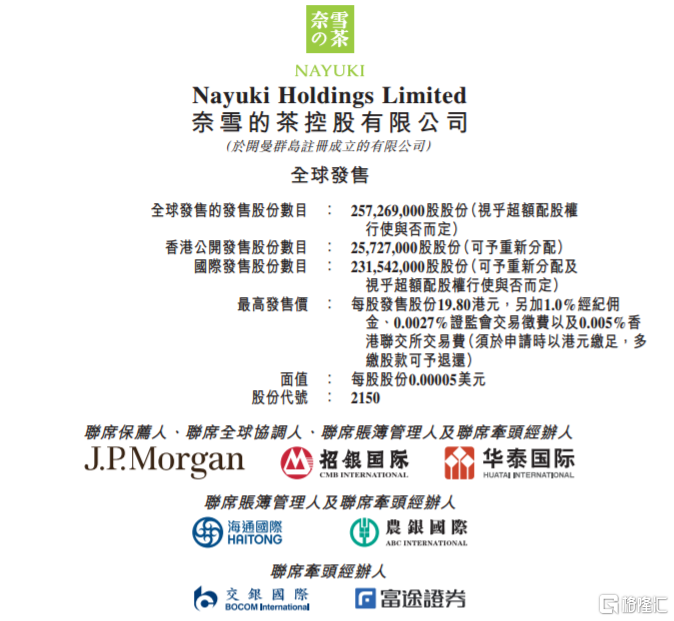

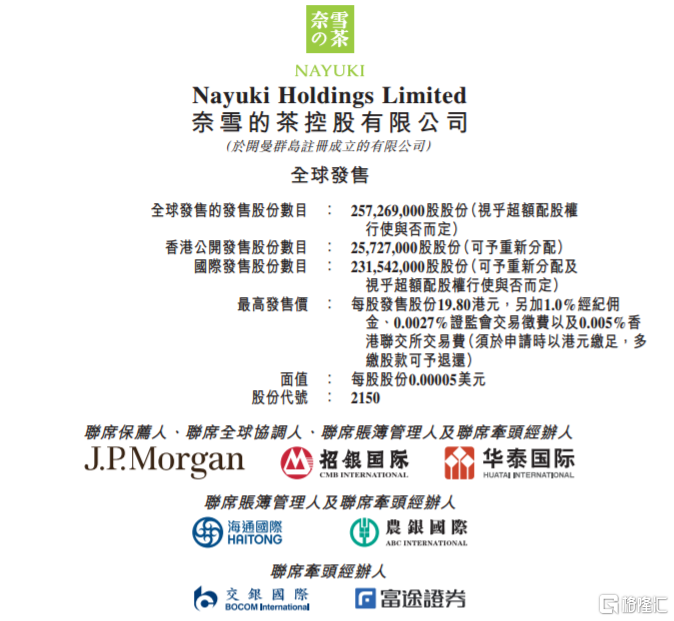

據格隆匯新股消息,奈雪的茶(2150.HK)今起正式招股,招股時間為6月18日-6月23日,招股區間為17.20-19.80港元,每手500股,入場費9999.77港元,計息天數6天,全球發售25726.9萬股,有綠鞋,預計6月30日港交所上市。摩根大通、招銀國際和華泰國際為其聯席保薦人。

圖源:招股書

奈雪的茶已與基石投資者瑞銀基金、匯添富基金、廣發基金、南方基金管理、乾元復興訂立基石投資協議,基石投資者已同意在若干條件規限下,按發售價認購以總金額1.55億美元。

奈雪的茶此次最高募資總額或達到58.58億港元,公司計劃將全球發售所得款項淨額用於:

約70.0%在未來三年用於擴張茶飲店網絡並提高市場滲透率;約10.0%將在未來三年用於通過強化技術能力,進一步提升公司的整體運營,以提升運營效率;約10.0%在未來三年用於提升公司的供應鏈及渠道建設能力,以支持公司的規模擴張,約10.0%將用作營運資金及作一般企業用途。

奈雪的茶成立於2015年,是中國領先的高端現製茶飲連鎖店,也是國內第一家主打“現製茶+烘焙”的新式茶飲品牌,主要運營兩個茶飲店品牌-旗艦品牌奈雪的茶及子品牌台蓋。灼識諮詢資料顯示,按2020年零售消費總價值計,奈雪的茶在中國高端現製茶飲店市場中為第二大茶飲店品牌,市場份額為18.9%。

近年來,奈雪的茶門店數量迅速擴張,公開資料顯示,由截至2017年12月31日的44間增長至截至目前的562間。

與此同時,其會員黏性高於行業平均。奈雪的茶會員體系中有超過3500萬名註冊會員,其中,2020年,奈雪的茶訂單總數中約49.0%來自會員。

財務方面,其營收能力穩步增長,2018年至2020年收益分別為10.87億、25.02億、30.57億元,年複合增長率達67.7%。隨着盈利能力的提升,奈雪的茶經調整淨虧損由2018年的5658萬元大幅減少至2019年的1174萬元,並進一步扭轉為2020年的經調整淨利潤1664萬元。

事實上,中國的現製茶飲市場發展愈加迅速,並逐漸呈現出高端化、多元化的趨勢。奈雪的茶作為茶飲市場龍頭品牌,在全球有着龐大茶飲消費羣體的情況下,未來盈利成長性不容小覷。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.