巴菲特伯克希爾一季度持倉曝光:僅建倉1只股票,清倉式減持富國銀行,不再賣蘋果

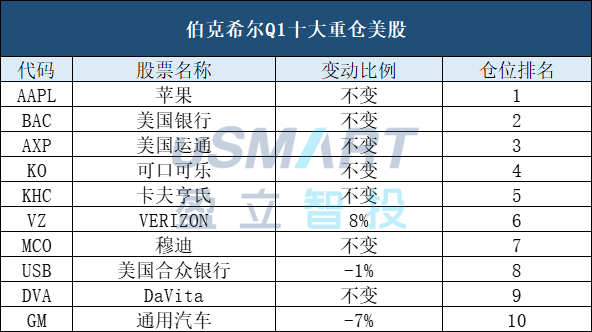

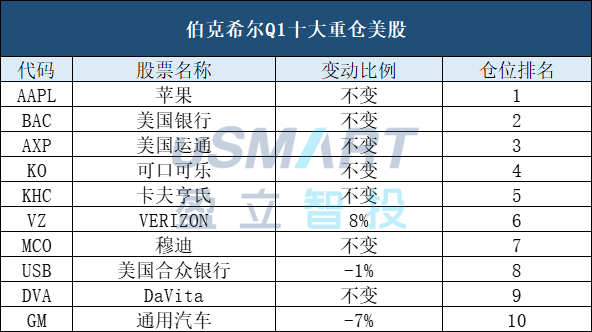

uSMART盈立智投5月20日消息,巴菲特的伯克希爾近日公佈了美股Q1持倉報告,數據顯示,截至今年一季度末,伯克希爾在美股市場持有46家公司的股票,總市值爲2704.35億美元,前十大重倉股合計持倉佔比爲86.72%。

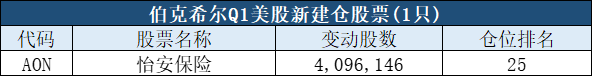

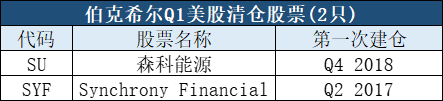

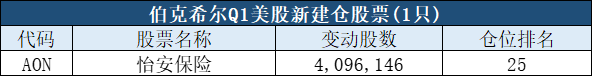

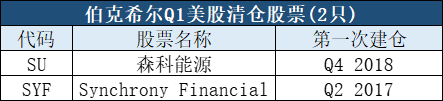

伯克希爾一季度新建倉1只股票,增持4只股票,清倉2只股票,減持11只股票,維持30只股票持倉不變。

總 結

①大部分倉位不動:2月下旬是本輪股市的一個拐點,伯克希爾的操作整體是賣出多買入少,以及"躺平不動",維持30只股票持倉不變。

一方面,巴菲特的長期價值投資理念導致持倉不會跟隨市場波動而大幅波動;另一方面則是,伯克希爾本身的倉位佈局,就是順週期股票爲主,大金融行業佔據了40.59%的倉位,這恰恰是一季度行情演繹的受益板塊(科技股承壓,大金融起飛)。

伯克希爾第二大的重倉股就是美國銀行(持倉佔比14.45%),今年以來,股價一路上揚創新高,累計漲幅39.16%。

行情來源:uSMART盈立智投

第三大重倉股就是美國運通(持倉佔比7.93%),今年以來累漲28.81%,同期標普500指數累漲9.57%,納指漲3.19%。

行情來源:uSMART盈立智投

②僅新建倉1只股票--怡安:怡安是全球最大規模的保險業集團公司之一,縱觀怡安保險一季度以來的股價走勢,無論巴菲特是一季度什麼時候建倉的,只要二季度仍持有,都已盈利頗豐,怡安保險二季度截至目前累漲9.85%。

行情來源:uSMART盈立智投

③清倉式減持富國銀行:伯克希爾一季度將富國銀行的倉位減少了98%,讓不少投資者詫異。自1989年首次購買富國銀行股票後,伯克希爾投入至少127億美元,購買了該行10%的股份。持有32年,到了長期價值兌現的時候?儘管美國銀行倉位不變,但在去年,伯克希爾也相繼出清了高盛和摩根大通的持股。

④不再賣蘋果,仍愛可口可樂:蘋果仍是伯克希爾的第一大重倉股,持倉佔比高達40.07%;可口可樂位居第四大權重股,持倉佔比7.8%,在今年的股東大會,巴菲特和芒格仍是可口可樂不離口。

持倉詳情

伯克希爾一季度十大重倉股

伯克希爾一季度新建倉1只股票

伯克希爾一季度增持4只股票

伯克希爾一季度清倉2只股票

伯克希爾一季度減持11只股票

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.