每日大行评级 | 大行对绩后的腾讯、小米看法不一

uSMART盈立智投 03-25 14:53

今日看点

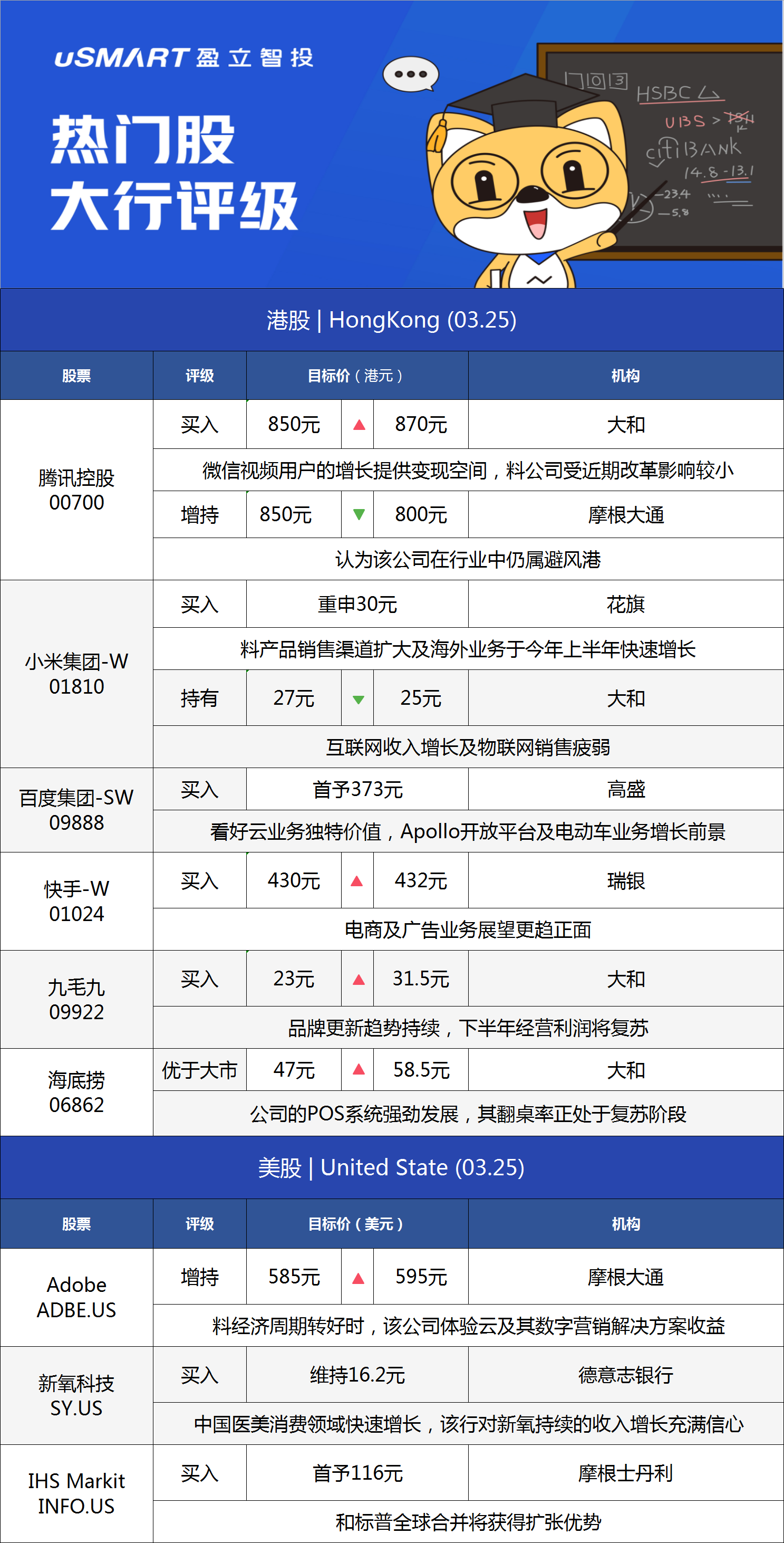

1. 大和升腾讯控股(00700)目标价2.4%至870港元,评级为“买入”,该行看好微信视频和其在游戏领域的影响,预计金融科技领域改革对其影响不大。摩根大通则下调腾讯目标价至800港元,评级为“增持”,认为腾讯目前估值合理,可轻微跑赢同业。

2. 花旗重申小米集团-W(01810)“买入”评级,目标价为30港元,预计首季前景强劲,主要受益产品组合改善及减低宣传。大和则降小米目标价至25港元,忧网游业务令互联网收人增长受压和智能手机供应链存在风险。

3. 高盛首予百度集团-SW(09888)“买入”评级,目标价373港元。认为疫情对百度核心广告业务最坏时刻已过,其非核心云业务及智能驾驶业务的进展可观,将释放重大价值。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.