透視港股通丨思摩爾國際遭淨賣出逾12億港元

北水總結

3月23日港股市場,北水淨流出44億,其中港股通(滬)淨流出14.77億港元,港股通(深)淨流出29.23億港元。

北水淨買入最多的個股是騰訊(00700)、吉利汽車(00175)、中國電信(00728)。北水淨賣出最多的個股是思摩爾國際(06969)、中海油(00883)、藥明生物(02269)。

數據來源:盈立智投APP

十大成交活躍股

數據來源:盈立智投APP

個股點評

騰訊(00700)獲淨買入4.91億港元。消息面上,騰訊將於明日公佈2020年全年業績,綜合券商預測,按非通用會計準則計算,純利介乎1192.98億至1328億元人民幣,同比升26.4%至40.75%;中位數預測爲1230.54億元,同比升30.42%。券商普遍對騰訊業績樂觀,預計遊戲收入增長強勁。

吉利汽車(00175)獲淨買入3.95億港元。消息面上,吉利汽車公佈2020年業績,實現收益約人民幣921.14億元,公司股權持有人應佔溢利約55.34億元,每股盈利0.56元,建議末期股息每股0.2港元。公告顯示,2020年,集團於中國境內批發量約124.75萬部。另一方面,該集團推出多款新產品至出口市場,2020年的出口銷量因而同比持續強勁增長25%至約7.27萬部。

中國電信(00728)獲淨買入3.38億港元。消息面上,工信部發布2021年1-2月通信業經濟運行情況。1-2月,電信業務收入累計完成2373億元,同比增長5.8%,增速同比提高4.3個百分點。按照上年不變價計算的電信業務總量爲2491億元,同比增長25.9%。然而同屬電信股的中國移動(00941)今日遭淨賣出1171萬港元。

信達生物(01801)遭淨賣出1.24億港元。消息面上,近日有媒體報道,信達生物旗下PD-1藥物——達伯舒(信迪利單抗注射液)因業績縮水而主動下調銷售指標。信達生物方面迴應稱,關於“達伯舒銷售縮水”的猜測不屬實。信達生物方面表示,在公司與禮來合作以及新肺癌適應症獲批的幫助下,達伯舒銷售狀況穩定,具體業績會根據香港聯交所信息披露要求發佈。

中海油(00883)再遭淨賣出7.37億港元。消息面上,中海油將於週四(25日)公佈去年業績,綜合16間券商預期,中海油去年純利介乎190.58億元至310.8億人民幣,較2019年純利610.45億人民幣,同比下跌49.1%至68.8%,中位數243.6億人民幣,同比跌60%。

思摩爾國際(06969)遭淨賣出12.26億港元。消息面上,工信部昨天在網站發佈了公開徵求對《關於修改〈中華人民共和國菸草專賣法實施條例〉的決定(徵求意見稿)》的意見。意見提出,電子煙等新型菸草製品參照本條例中關於捲菸的有關規定執行。中信證券點評,《徵求意見稿》的出臺提升了政策走向專賣管理的可能性,但不意味着未來一定走向專賣管理。極端情形下思摩爾2021年淨利潤預期下修20%-25%,成長中樞由40%下修至30%左右,但後續經營確定性顯著提升,大幅回撤後建議積極配置。

此外,中芯國際(00981)遭淨賣出1.07億港元。

當日港股通淨買入和淨賣出排行榜

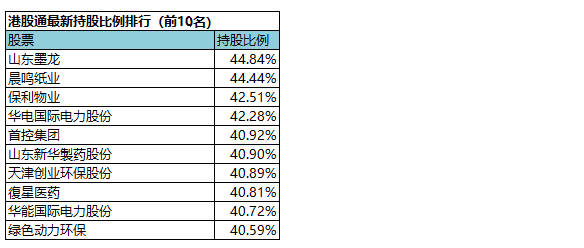

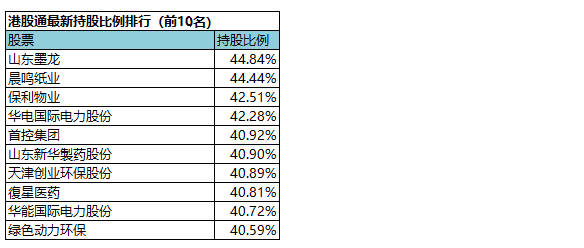

(港股通持股比例排行,交易所數據T+2日結算)

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.