大行每日評級 | 業績超預期,瑞銀升中興通訊目標價

uSMART盈立智投 03-17 14:59

今日看點

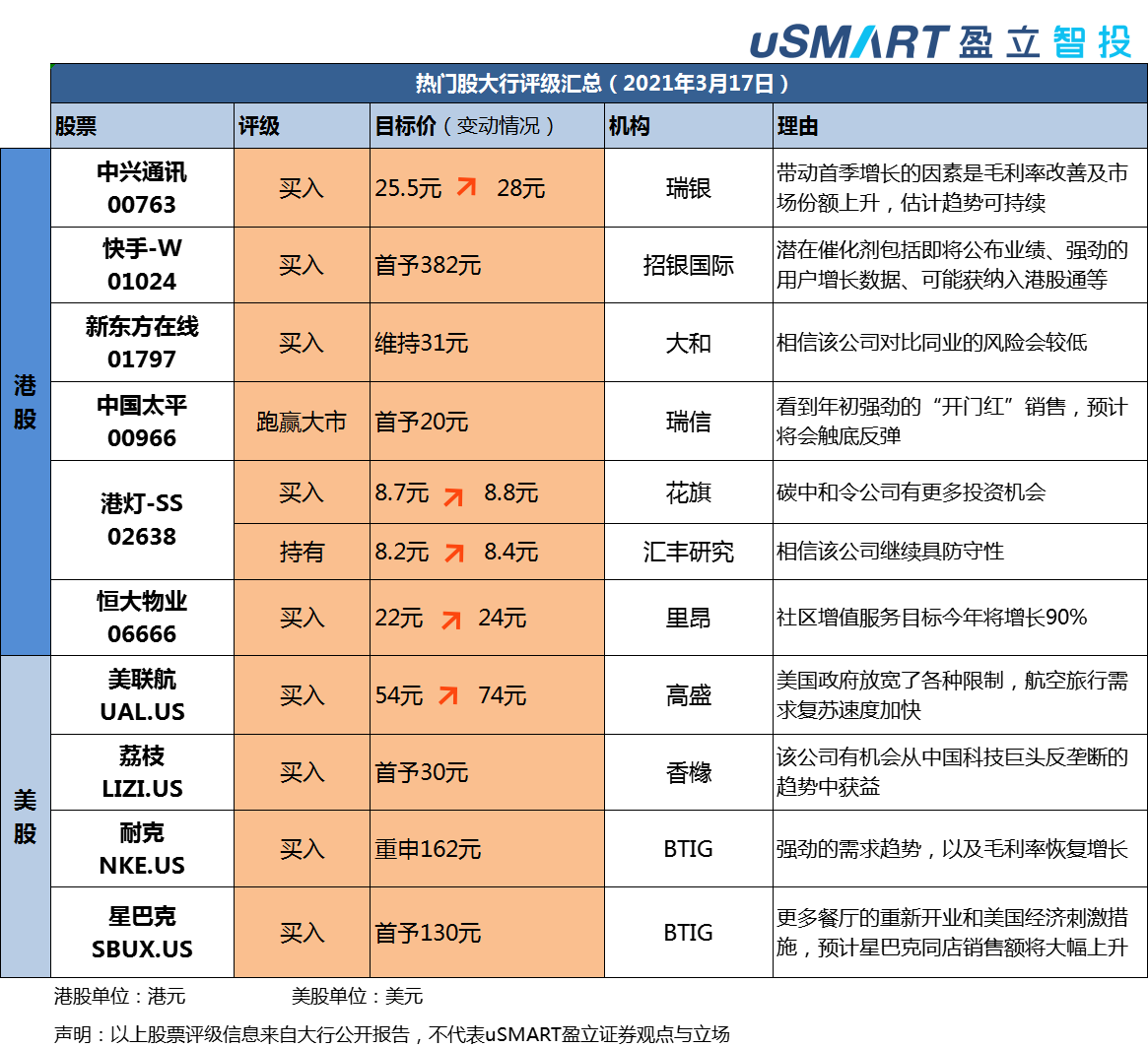

1.瑞銀重申中興通訊(00763)“買入”評級,目標價上調9.8%至28港元。該行認爲集團昨日(3月16日)收市價20.3港元,相當於2021年預測市盈率14倍,低於歷史平均水平約15%。中興通訊公佈財報後股價暴漲,截至發稿,漲超10%。

2.招銀國際首予快手-W(01024)“買入”評級,目標價382港元。該行預期公司能捕捉行業增長機遇、將繼續擴大用戶羣及提升變現能力。

3.花旗、匯豐研究紛紛上調港燈-SS(02638)目標價分別至8.8元和8.4元。大行認爲主要受惠於利息支出較預期低,股票市場由增長股輪換至價值股。

4.高盛上調美聯航(UAL.US)目標價至74美元,維持“買入”評級。該行認爲航空旅行需求復甦可期,在航企中,美聯航是最具吸引力的選擇之一。

5.香櫞做多荔枝(LIZI.US),給予目標價30美元。消息傳出後,荔枝股價拉昇,一度觸及熔斷,恢復交易後漲幅擴大超37%。該行表示,作爲中國領先的音頻流媒體平臺,該公司現估值偏低。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.