继续崩盘!白酒股再度重挫,茅台一度跌破2100元,坤哥走下神坛?

今日,市场行情还是很惨烈,其中,白酒板块延续颓势,大有跌跌不休之势。

开盘后,山西汾酒大跌超8%,泸州老窖跌超6%,贵州茅台跌近3%,一度跌破2100元关口,五粮液、水井坊、洋河股份等纷纷跟跌,现多股均有所收窄。

值得注意的是,不同于去年一路高歌的声势,春节假期后的白酒板块不断走出下坡路,连遭重挫。

2月18日至2月25日期间,酒鬼酒、山西汾酒、水井坊、泸州老窖跌幅均超过20%,贵州茅台在6个交易日市值缩水超5600亿。

白酒指数和白酒相关的ETF也出现明显的跌幅,让市场投资者瑟瑟发抖。

数据来源:同花顺

受制于流动性收紧预期

除却此前香港上调印花税使得A股整体随着港股下跌的影响,本次以白酒为首的机构抱团股连续深度回调,主要还是基于对央行节后连续逆回购举措,而担忧流动性收紧将至。

而在前期涨得飞起的高估值板块对此表现敏感,毕竟泡沫需要被挤掉,且基于美债长端利率超出预期,在经济复苏预期下,大宗商品掀起涨价潮,市场风格的切换过程中白酒板块自然受市场情绪影响而出现盘整。

“白酒一哥”走下神坛?

而在白酒股近期萎靡不振的背景下,那些重仓白酒的明星基金的表现自然也不好过,旗下产品飘绿一片。

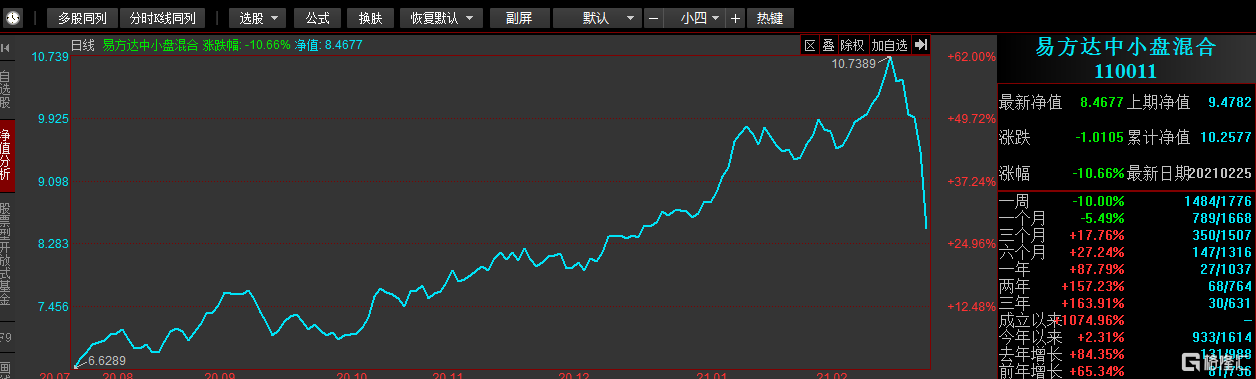

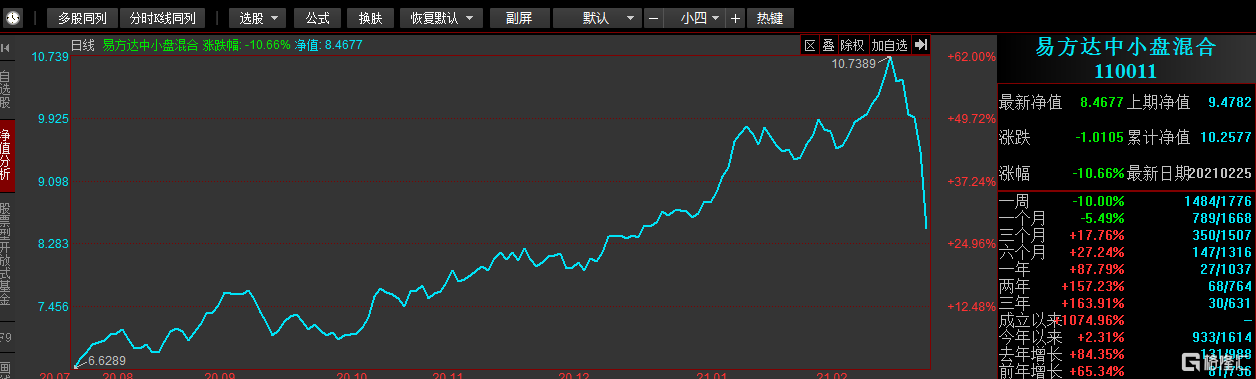

例如,被戏称为“世界第三大酒庄”——易方达似乎失去此前的高光,旗下新晋公募冠军的张坤重仓白酒的基金产品都表现不佳。

今日,张坤管理的易方达中小盘、易方达蓝筹精选净值下跌1.28%。

数据来源:同花顺

更为瞩目的是,23日张坤管理的基金易方达中小盘混合发布公告,自2月24日起暂停申购,并准备进行2021年第一次分红。

易方达中小盘混合基金十大重仓股中,贵州茅台、洋河股份、泸州老窖、五粮液占据前四,所占比例均在10%以上,且股票市值合计占比超过了40%。

数据来源:同花顺

这一举措也引起了基民的热议,一方面,基于市场近期的不振表现,这被视为保护基金份额持有人利益的安全运作手法;另一方面,这也被解读为调仓换股的信号,毕竟随着机构抱团股的持续回调,市场风格正在有所转化。

关注长期投资价值

显然,基于节前板块涨幅较大,高估值板块的泡沫正在被戳破,白酒这一板块在市场情绪呈现负面以及持仓获利离场等因素下出现了一定的调整。

虽说市场对抱团股的看法愈发谨慎,但就白酒这一市场来看,其基本面依旧较为坚挺,需求带动终端销售较旺,促进股价和业绩容易呈现一定的积极反映,行业景气度较为强势。

数据来源:微博

近期的理性回调之后,白酒等消费板块的长期投资机会还是受到一定的看好,尤其是目前高端白酒价格依旧较为坚挺,提价空间存有,业绩确定性较高,且次高端价格的空间也有所打开,在白酒分化之下,龙头标的价值还是可以重点关注。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.