IPO周报 | 医渡、稻草熊、车市狂撒红包,快手最快25日招股

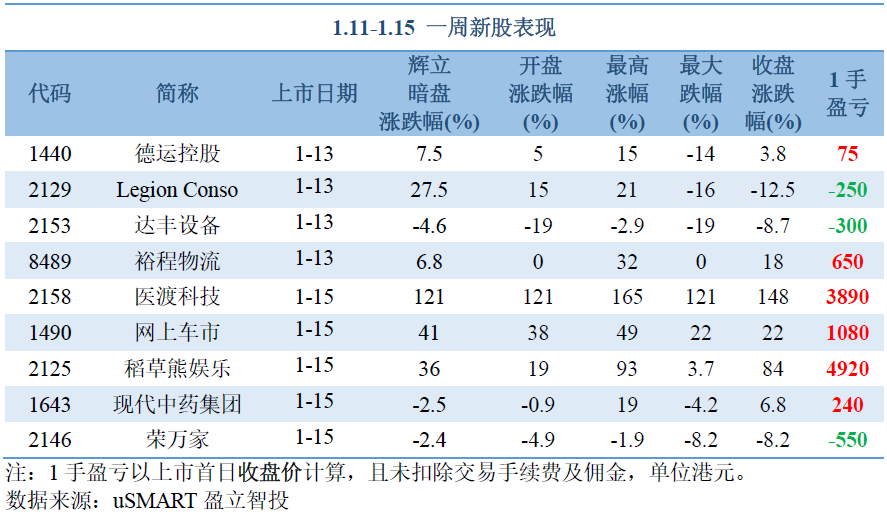

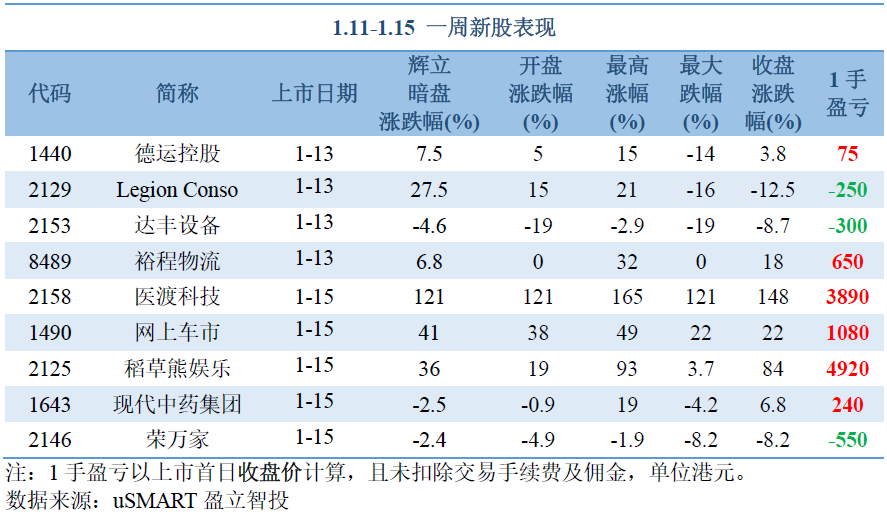

| 新股表现

本周9只新股上市,周五3只热门票狂撒红包。医渡科技最高涨幅达到165%,盘中市值突破600亿。稻草熊盘中一度接近翻倍,成功从“熊”变成一头“牛”,一手盈利接近5000,超过医渡科技。此外,网上车市一手盈利也超过1000。相较于盈利,3只破发新股的亏损都非常有限。

| 新股解盘

本周新股市值最大的是医渡科技,也是确定性最强、基本面最佳的一只。其余新股都是炒作为主,总体来说跟着市场热度走,认购过百倍,回拨50%的票表现都还不错。

| 正在招股

目前正在招股的是星盛商业,截至1月15日17:00,孖展超购已经达到212倍。这是大湾区领先的商用物业运营服务供应商,旗下品牌包括COCO Park、COCO City、ICO等。按照运营的购物中心数量计算,在深圳排名第一,大湾区排名第四。

公司近年来业绩维持平稳增长,毛利率及利润率均维持在行业较高水平(55%/29%)。

按照公司预估的2020年净利润1.43亿港元计算,发行市值32-38.8亿港元对应20年PE为22-27倍,处于行业较低水平。

目前市场给予商管更高溢价,港股已上市的商业物业标的走势喜人,宝龙商业、华润万象生活上市后累计涨幅分别高达181%、91%。

| 即将上市

下周将有2只新股上市,宋都服务、麦迪卫康将分别于18、19日挂牌交易。

| 已过聆讯

市场消息,快手已经通过聆讯,将于下周一起进行预路演,最快本月25日开始招股,计划2月5日上市,集资50亿美元,目标估值500亿美元。

另外,此前经济通报道,癌症早期筛查产品制造商诺辉健康拟在港上市,本周进行上市聆讯,集资最多3亿美元(约23.3亿港元),高盛及瑞银为联席保荐人,不过目前并无新的进展。

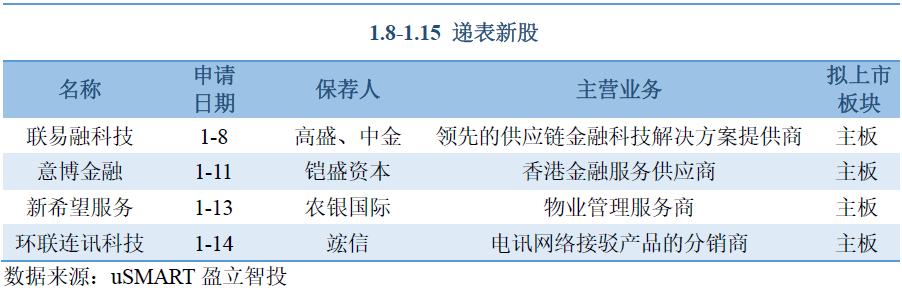

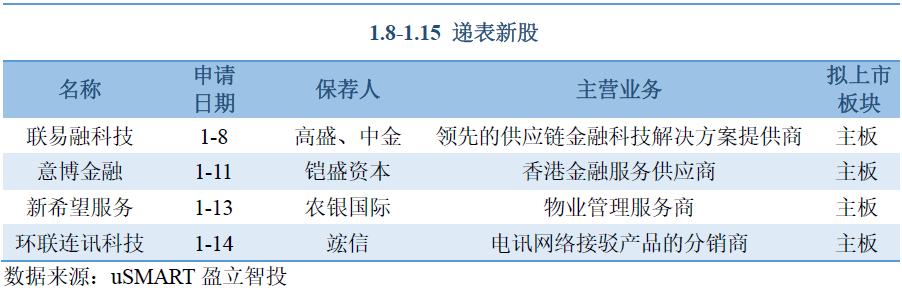

| 最新递表

| 新股消息

传嘀嗒出行寻求本月通过上市聆讯

据路透社旗下媒体IFR报道,嘀嗒出行寻求本月通过上市聆讯,在港募资约39亿港元。

中概股再度开启回港上市潮

据路透社旗下媒体IFR报道,腾讯音乐考虑在香港二次上市中募资20亿美元。

携程计划今年上半年在港二次上市,募资最少10亿美元,中金、高盛、摩根大通为承销行。

唯品会计划今年下半年来港第二上市,计划拨出5-10%的股份在香港上市,最高融资20亿美元,已委托高盛、摩根大通和摩根士丹利负责上市事宜。

此前,哔哩哔哩、汽车之家、百度已传出消息在港上市。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.