丘钛科技(01478.HK):2020年出货量数据点评,给予“买入”评级

机构:东北证券

评级:买入

事件:

公司近期公布2020年12月主营产品销售数量数据,单月摄像头模组出货量3,720万件,同比下降1.3%,指纹识别模组出货量1,030万件,同比增长6.3%。

摄像头模组全年销售数量合计3.92亿件,同比下滑3.34%。受疫情下手机出货量下滑及手机供应链中重要零部件供货短缺影响,公司全年摄像头模组出货量3.92亿件,同比下滑3.34%。其中3200万像素及以上的摄像头模组出货量约1亿件,占摄像头模组出货量的26%,高于公司此前25%的出货指引。我们预计2021年手机零部件供应链将逐步恢复供应能力,摄像头模组销量将回到正轨。公司布局高端制造领域,在光学防抖、多倍变焦、潜望式等多方面加大研发投入,随着市场对手机模组配置需求的提升,公司在高阶摄像头模组出货量上仍有较大提升空间。

指纹模组全年销售数量合计0.92亿件,同比下滑9.74%。受疫情下手机出货量下滑及手机供应链中重要零部件供货短缺影响,公司全年指纹模组出货量0.92亿件,同比下滑9.74%。其中屏下指纹模组出货量0.45亿件,占指纹模组出货量的49%。屏下指纹模组出货量较去年有所下滑,我们认为与超薄屏下指纹渗透率不及预期有关。指纹识别作为手机移动支付和安全解锁应用方面的技术,已经成为中高端手机的重要配置。公司目前已覆盖全球主要安卓智能手机品牌客户,随着手机销量回暖,指纹模组销售数量预计将恢复增长。

车载摄像头模组、AIoT未来可期。受益ADAS渗透率提升,每辆车装配的摄像头数量大幅增加,公司与车厂长期保持良好合作关系,我们预计在ADAS需求的爆发下,公司销量将持续增长。此外,随着5G的快速发展,用户对AIoT人机交互的需求加大,摄像头作为机器的眼睛,应用领域广泛。公司大力布局该领域,市场份额有望持续提高。

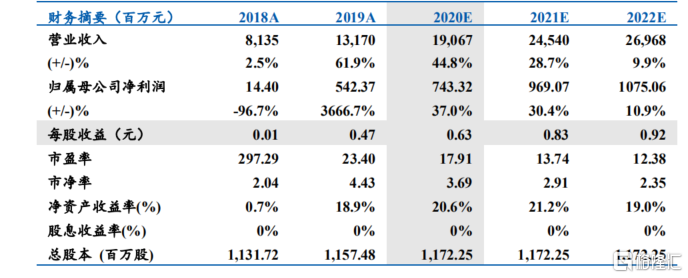

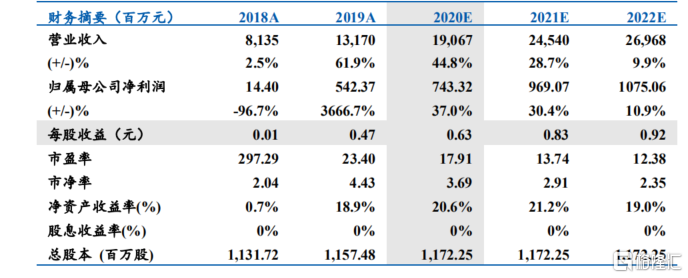

给予“买入”评级。我们预计2020-2022年EPS为0.63/0.83/0.92元,对应0.74/0.98/1.08港元,对应PE为17.91/13.74/12.38倍,参考公司历史PE中枢,给予公司2021年20倍PE,首次覆盖,给予“买入”评级。

风险提示:产品销量不及预期,行业景气度下行,盈利预测不达预期。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.