小米集團-W(01810.HK):融資攤薄效應有限,有助把握市場機遇,給予“買入”評級,目標價31.4港元

機構:中泰證券

評級:買入

目標價:31.4港元

集資約 39.9 億美元,用於業務擴張

公司 12 月 2 日午間公告(1)建議發行可轉換為公司 B 類普通股的 8.55 億美元 7 年期零息有擔保可轉換債券,發行價為債券本金額的 105.25%,初步換股價(可予調整)為每股 36.74 港元,較 12 月 1 日收市價 26.15 港元溢價約 40.5%,債券持有人可於 5年後選擇贖回,公司籌集資金淨額約 8.9 億美元;(2)將按每股 23.7 港元(12 月 1 日收市價折讓約 9.4%)以先舊後新的方式增發 10 億股份,禁售期為 90 日,籌集資金淨額約 31 億美元。本次集資所得總淨額約主要用於增加運營資金以擴大業務、投資以增加主要市場的市場份額、投資戰略生態系統及其他一般公司用途。

盈利攤薄有限,利好中長期發展

債券如果按初步換股價悉數轉換,可轉換為約 1.8 億股,會導致總股本增加 0.7%,攤薄效應較小;本次股票增發雖然會導致總股本增加 4.1%,攤薄每股盈利有限。雖然公司當前現金足以支持平穩發展,但其增長勢頭足,無論在中國還是海外手機市場均存在加速擴大市佔率的機遇,因此我們認為公司在此時融資有助通過加大研發投入增強產品競爭力、增強渠道佈局及營銷力度等方式擴大市佔率,鞏固競爭地位,中長期利好發展。此外,融資亦可為公司引入長期投資者。

略微下調目標價至 31.4 港元,重申至“買入”評級

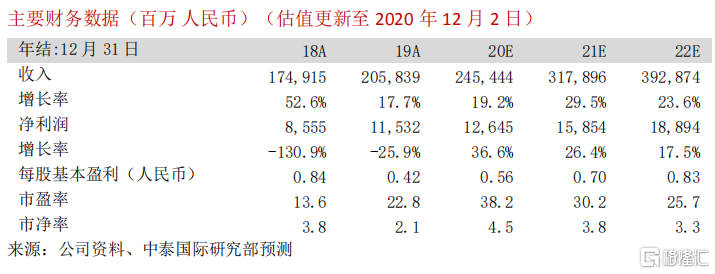

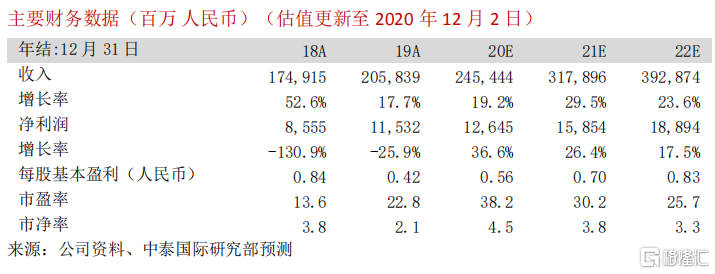

略微調整盈利預測以反映攤薄效應,20-22E EPS 分別為 0.55/0.70/0.83 元人民幣,預期智能手機、互聯網及 IoT 將分別為短、中、長期提供增長動力,智能手機出貨量高速增長還將助力互聯網服務變現及 IoT 生態圈不斷擴大,未來發展空間巨大,維持 39 倍 21E PE 估值,相應略微下調目標價至 31.40 港元,潛在升幅 29.2%,重申至“買入”評級。

風險提示:(一)全球疫情影響擴大;(二)市場競爭加劇

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.