uSMART盈立智投11月17日消息,巴菲特旗下的伯克希爾哈撒韋公司披露了Q3美股持倉報告,Q3持倉49只股票,持倉總市值約2288.91億美元,蘋果仍是第一重倉股,新建倉一些醫藥巨頭。

新建倉醫藥公司:艾伯維、輝瑞、默沙東、施貴寶

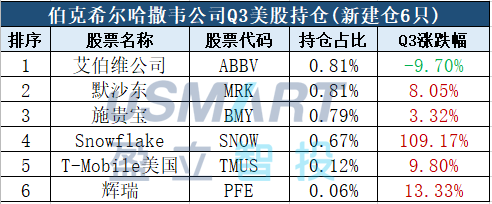

伯克希爾哈撒韋公司Q3新建倉6家公司,其中4家是醫藥大公司:艾伯維(ABBV)、輝瑞(PFE)、默沙東(MRK)、施貴寶(BMY)。

另外2家分別是雲端軟件商Snowflake(SNOW)、美國電信運營商T-Mobile美國(TMUS)。

數據來源:whalewisdom.com

巴菲特向來對科技股態度謹慎,卻早在上市前投資5.7億美元於Snowflake,Snowflake於9月16日上市,Q3漲幅高達109.17%。

T-MobileQ3營收和利潤都超過了華爾街的預期,市場預期其將成爲美國5G時代的運營商領導者。

清倉好市多

大筆減倉金融銀行股:摩根大通、富國銀行、PNC金融、美國製商銀行

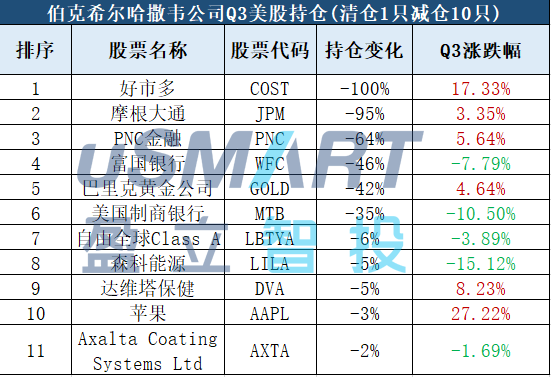

Q3清倉1只股票:連鎖超市好市多(COST)。

減倉10只股票:其中,大幅減持金融銀行股,摩根大通、富國銀行、PNC金融、美國製商銀行,減倉幅度高達42%-95%,亦大幅減倉巴裏克黃金公司(GOLD),輕微減倉蘋果。

值得注意的是,伯克希爾二季度唯一建倉的公司就是巴裏克黃金公司,罕見買入黃金股,引發市場討論,不過,時間來到三季度,伯克希爾便將該股倉位近乎砍半。

數據來源:whalewisdom.com

一如既往鍾愛:蘋果、可口可樂

美股銀行躍居第二大重倉股

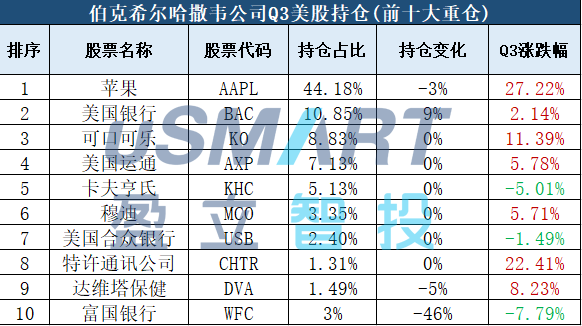

伯克希爾哈撒韋公司Q3的前十大重倉股分別是:蘋果(AAPL)、美國銀行(BAC)、可口可樂(KO)、美國運通(AXP)、卡夫亨氏(KHC)、穆迪(MCO)、美國合衆銀行(USB)、特許通訊公司(CHTR)、達維塔保健(DVA)、富國銀行(WFC)。

數據來源:whalewisdom.com