波司登(03998.HK):十一假期降温帶動銷售,拉開旺季序幕,維持“買入”評級

機構:浙商證券

評級:買入

報告導讀

10 月以來全國降温帶動銷售高增,旺季即將開啟,公司零售情況值得持續關注。

投資要點

事件:十一降温帶動波司登品牌線上銷售高增。十一假期期間全國大部分地區迎來降温,波司登羽絨服銷售季節正式到來,以淘數據監測的銷售數據來看,10 月 1 日 至 6 日波司登品牌旗艦店銷售額同比增長 574%至 1910 萬元,銷售件數同比增長300%至 1.85 萬件,銷售平均單價由去年同期的 613 元提升到 2020 年的 1034 元,十一銷售超預期。

疫情+暖冬影響上財年去化,渠道庫存健康化為本財年主旋律。公司 2020/3/31 為止財年受到暖冬及疫情影響致春節後無法正常銷售、損失 10%左右零售,從渠道存貨來看,上財年經銷商普遍售罄率為 6-7 成(正常年份 9 成,兼有 10%-15%退貨額度),並用足退貨額度 15%,由此渠道存貨預計在經銷商去年訂貨額的 15%-20%之間,而公司報表體系除承擔直營體系存貨外還需承擔加盟商退貨,20/3/31 產成品存貨為 22.6 億元,較上財年同期增加 8.6 億元左右。

本財年主要基調為恢復庫存健康,由此公司採取措施包括: 1)更靈活的銷售策略:本財年期貨比例進一步由往年的 40%下降到 30%,鼓勵經銷商謹慎訂貨,後期根據渠道實際零售情況靈活補貨; 2)温和的提價政策:公司在過去的 19/20 財年提價幅度分別在 25%-30%/15%-20%之間,品牌升級成果斐然,但本財年考慮到零售環境及上財年庫存去化,採取平穩的價格政策,在產品持續創新的同時價格帶保持穩定,以完成平穩過渡; 3)積極的庫存處理:除了傳統的線上通過唯品會、天貓奧萊,線下通過奧萊去化同時,由於上財年庫存多數為 12 月拉式補貨訂單,貨品款式新,將在旺季採取老融新動作完成去化,同時在以往退貨政策的基礎上本財年給予經銷商少量換貨額度,促進區域庫存消化; 4)精耕細作的渠道策略:疫情下線上渠道發展得到促進,公司上財年線上銷售佔比 23%,本財年預計達到 25%-30%;線下方面,經歷了連續兩個財年積極的渠道擴張,本年度將把重點放在已有門店的店效提升,尤其上財年多數新店為旺季開出,春節後受疫情影響未發揮銷售作用,本財年該等次新店將貢獻自然增長; 5)謹慎的費用投放:公司上兩個財年在品宣上分別投入 5/7 億元,通過央視/分眾廣告/國際時裝週/設計師聯名/楊冪等代言人聘請/KOL 合作等方式完成了品牌勢能的持續提升,本年度投放動作仍將繼續,但疫情下將採取更精準投放策略,預計品宣整體預算有望節省 20%,疊加疫情以來的租金減免,以及上財年投入的 4000 萬元左右捐贈成本以及 8000 萬元左右的應收賬款減值撥備本財年將大幅縮減,為公司疫情下節流打下基礎。

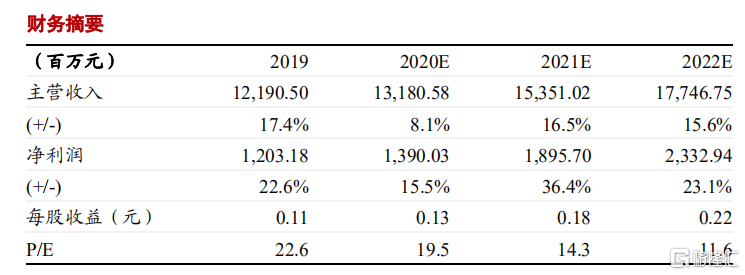

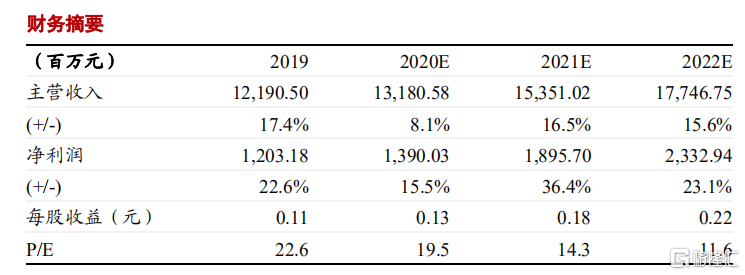

盈利預測及估值:目前公司已進入本財年銷售旺季,十一降温為旺季銷售初步打開局面,經銷商的第一輪拉式補貨也陸續展開,公司零售情況值得持續關注,考慮到上財年暖冬+疫情+春節靠前諸多不利因素齊聚,我們認為本財年、尤其銷售旺季後期的零售表現值得期待。公司過去三年的從品牌建設、產品創新到零售運營上的努力效果依舊明顯,作為國產品牌中難得的品類龍頭,預計 FY20/FY21/FY22 淨利潤 13.9 億/19.0 億/23.3 億元,消費同比增長 15.5%/36.4%/23.1%,對應 PE 20X/14X/12X,若本財年去化順利,對應下財年估值有吸引力,“買入”評級。

風險提示:新冠肺炎影響大於預期、天氣變化下終端零售不及預期。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.