公司簡介

卓越商企服務背靠的地產商是卓越集團,旗下的深圳市卓越商業管理公司位列中國房地產開發企業商業地產綜合實力第7名。目前卓越商企42%的在管面積來自卓越集團,未來三年內將交付2100萬平方米麪積,爲卓越商企的業績提供保障。

卓越商企服務是中國領先的商務物業管理服務提供商,在2020中國物業服務百強企業中排名14。以商務物業管理服務收入計算,2019年在中國商務物業管理服務提供商中排名第四,在大灣區排名第二。

收入從2017年的9.5億元增至2019年的18.36億元,複合年增長率約爲39.2%。

純利從2017年的1.4億元增至2019年的2.3億元,複合年增長率約爲30.9%。

2017-2019年,合約面積和在管面積的複合年增長率分別爲59.1%、43.9%。截至2020年5月底,合約面積爲3680萬平方米,在管面積爲2580萬平方米。

打新分析

1、招股信息

(1)簡稱及代碼: 卓越商企服務,6989.HK

(2)招股日期: 10.7-10.12

定價日期: 10.12

上市日期: 10.19

計息日: 4天

(3)發行價格: 9.3-10.68港元

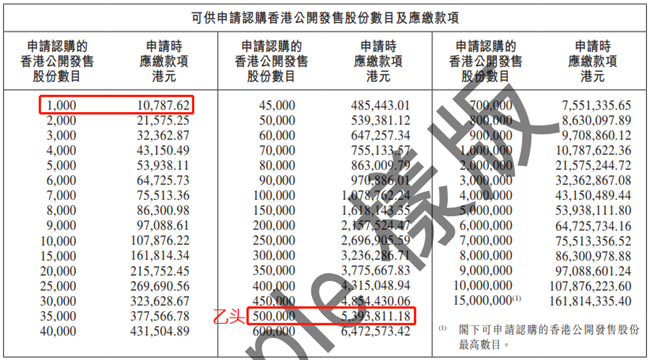

(4)入場費: 10787.62港元,乙頭需認購50萬股,金額約539萬港元

(5)發行股數: 3億股,90%國際配售,10%公開發售,1手1000股

(6)超額配股權: 有,可按發售價發行最多4500萬股(佔發售股份的15%),以補足國配的超額認購

(7)集資金額: 27.9-32.04億港元

(8)市值: 111.6-128.16億港元

(9)市盈率: 2019年PE 55-63倍

(10)保薦人及近兩年IPO首日表現:

海通國際,5漲3平3跌,代表作海吉亞醫療,首日收漲41%

招銀國際,7漲3平3跌,代表作九毛九,首日收漲56%

(11)穩定價格操作人: 海通國際證券

(12)包銷商:海通、招銀、農銀、廣發、平證證券5家,包銷傭金2.25%+獎金最高1%

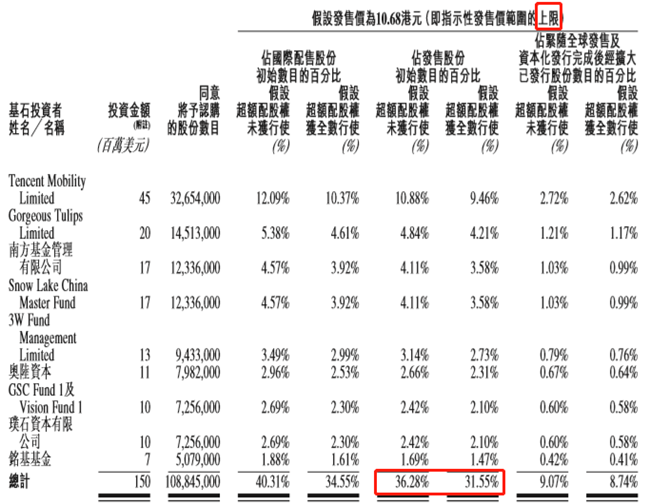

(13)基石投資者: 9名,假設超額配股權不行使,將合共認購發售股份的36.28-41.67%。

包括騰訊(Tencent)、京東(Gorgeous),這是其首次認購物業公司的基石股份。卓越商企爲各行各業的龍頭公司提供服務,爲中國十大互聯網公司中的七家提供服務。

知名機構還有南方基金,資產管理規模超過1.1萬億元,曾爲海吉亞醫療的基石,首日收漲41%;

雪湖資本(Snow Lake),曾爲華夏視聽教育、海底撈的基石,前者首日收漲59%;

3W Fund,曾爲嘉和生物-B、思摩爾國際、海普瑞的基石;

東方資管(GSC Fund、Vision Fund),曾是東軟教育、華夏視聽教育、思摩爾國際、海吉亞醫療、開拓藥業-B的基石;

銘基基金(Matthews),曾是諾誠健華-B(9.6%)、康寧傑瑞製藥-B(32%)、沛嘉醫療-B(68%)的基石。

2、回撥機制

常規回撥機制,不回撥前,甲乙組分別有約1.5萬手。

當公開發售認購15-50倍時,回撥30%,即甲乙組分別有4.5萬手。

當公開發售認購50-100倍時,回撥40%,即甲乙組分別有6萬手。

當公開發售認購超過100倍時,回撥50%,即甲乙組分別有7.5萬手。