小米集團-W(01810.HK):小米的終局,維持“推薦”評級

機構:方正證券

評級:推薦

本篇是科技終局系列之小米的終局。我們認為小米的終局分三塊:

1、基於toThings喚醒萬物的次時代科技浪潮,小米的終局是第一個聚焦人居的物聯網2T生態。

2、基於中國的第三次消費浪潮覺醒,小米的終局是第一個有着廣泛世界影響力的中國消費品牌。

3、騰訊背靠微信流量用資本戰投賦能互聯網生態,小米同樣基於巨大終端吞吐量,產業投資賦能和綁定上游零部件供應鏈生態,成為硬科技世界級資本生態。

飛輪模型:為終局提供動力。我們此前基於亞馬遜原始飛輪的核心思想構建了小米成長的飛輪模型,其終局的實現仍需要以下三個飛輪的快速正反饋:

1、智能手機是飛輪旋轉的起點,以獲取流量和客基為戰略目標,以銷售額擴大為戰術目標,以超低毛利帶來的極致性價比為實現手段,最終實現小米整個生態開啟的第一步。

2、IoT硬件生態是智能手機的第二曲線,通過在白電、黑電、小家電、日用品等幾千個SKU,在全球範圍內宣導小米式的極簡美學和iPhone級別的工業設計,最終實現擴大銷售額和留住客户的戰術目標以及創造可連接的粘性MAU的戰略目標。

3、互聯網業務則是小米實現戰略自洽的核心落腳點,以10%左右的營收體量實現了將近80%的淨利潤,通過鉅額利潤實現小米三大飛輪的可持續發展。

終局本質:為社會創造價值。互聯網的盈利並不是小米的終局,終局是一個更高維度的價值表達,本質是為全社會創造的價值,是帕累託改進的增量博弈,而不是存量市場的零和廝殺。我們再次回顧小米的三大終局:

1、小米的IoT生態終局,將是物聯網時代四大場景之一,佔據未來世界科技的制高點。

2、小米的世界級品牌,將作為載體把中國現代工業文明傳播到全世界,成為中國的Sony、MUJI、大眾。

3、小米的產業投資,將成為中國乃至世界重要的硬科技產業鏈(縱向)+小米生態鏈(橫向)股權投資生態,成為下一個騰訊戰投或是硬科技的紅杉。

小米集團:為消費者讓利。我們將企業家分為兩種:1、優秀企業家以盈利為終極目標;2、偉大企業家以創造社會價值為目標。小米公司硬件超低毛利倒逼供應鏈提高效率,通過極致的成本管控和升維盈利,造就了自身無與倫比的效率護城河,並讓利給廣大消費者,創造了巨大社會價值。基於此,我們重申小米的推薦評級。

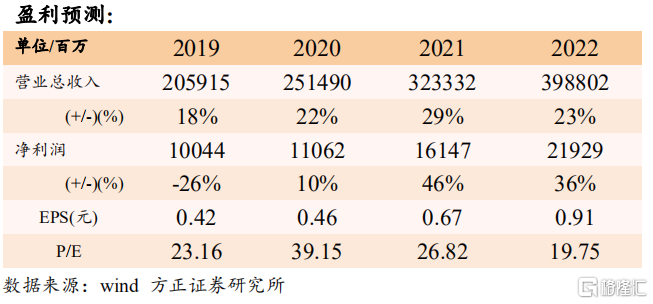

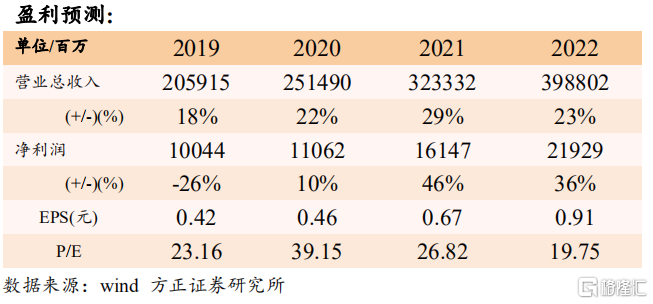

盈利預測:我們長期看好小米集團的公司文化、產品競爭力和業績成長。我們預計公司20-22年實現收入2,515/3,233/3,988億人民幣,GAAP淨利潤分別為110/161/219億人民幣,給予“推薦”評級。

風險提示:疫情或對2020年業績產生影響;行業競爭加劇;中美貿易摩擦加劇;產品研發不及預期。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.