房貸佔比受限?AH銀行股今日集體下挫,招商銀行大跌超6%

今日,港股市場39支銀行股中有20支下跌。其中,招商銀行跌幅一度接近6.5%,收於35.75港元,創7月以來最低。交通銀行、中國光大銀行、農業銀行、恆生銀行、哈爾濱銀行跌幅均超過3%。

A股市場上,平安銀行跌幅最大,為3.33%。招商銀行、寧波銀行、常熟銀行跌幅炒超過2%。3大國有行:中國銀行、建設銀行、工商銀行在港股及A股均有不同程度的下跌。

消息面上,有業內人士表示,9月27日有大行收到通知,稱監管機構近期將要求大型商業銀行壓降、控制個人住房按揭貸款等房地產貸款規模。

此外,上半年已有部分銀行釋放出了個人按揭貸款額度緊張的信號,並且呼籲客户辦理房貸提早還款業務,以騰挪房貸額度。

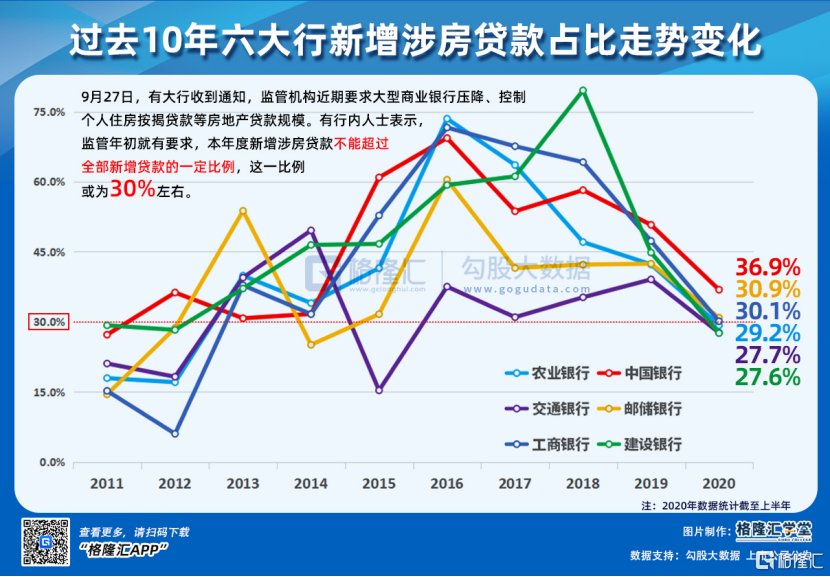

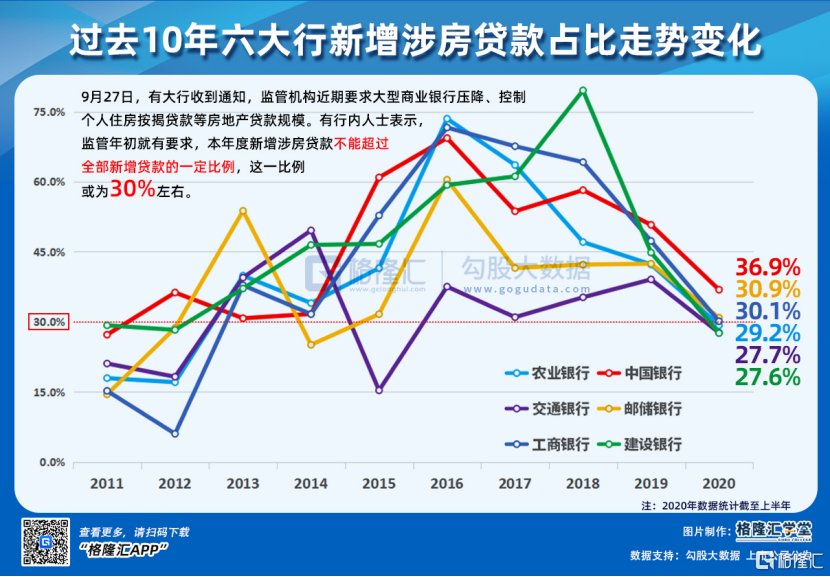

一位大行人士表示,監管年初就有要求,本年度新增涉房貸款不能超過全部新增貸款的一定比例,這一比例或為30%左右,但尚未得到證實。

據測算,新增貸款比例為30%,大概是2015年房地產去庫存政策推出之前的水平,去庫存政策出台後的2016年,新增涉房貸款比例猛增至了44%以上。

2020年上半年,受疫情影響,新增房地產貸款及佔比都有大幅的下降。

業內人士稱,在嚴格的監管政策下,銀行對房地產企業的房地產開發貸款規模很小,相比之下,個人住房按揭貸款的比例相對較高。

同時,上半年受疫情影響,銀行更傾向於選擇抵押貸款和撥備比例較低的個人按揭貸款,因此上半年貸款放量普遍較大。

“房住不炒”政策雖然持續升温,但“金九銀十”的房地產市場需求依然旺盛。以廣州為例,近兩個月中,廣州樓市回暖明顯。

根據國家統計局發佈的《2020年8月份70個大中城市商品住宅銷售價格變動情況》,8月份廣州二手房價格環比上漲1.7%,在全國70個大中城市中排名第一,房價連續兩個月領漲全國。

但是,由於房地產金融政策的收緊,不少銀行在貸款需求持續增長的情況下反而呼籲客户提前償還貸款,以降低銀行的涉房貸款規模。

回看往年,4季度本來就是銀行按揭額度最少的一個季度,只是今年房地產金融政策的限制使得額度更為緊張。

2020年上半年,在股份制銀行中,招商銀行、浦發銀行、興業銀行、平安銀行4家銀行的新增房地產貸款佔比超過30%。其中平安銀行新增涉房貸款佔比超過50%。

而6家國有銀行中,除中國銀行外,其他國有大行上半年的新增涉房貸款佔比都調整到了30%以下。

包括“房住不炒”政策在內,金融風險防控已被監管部門反覆強調多年。而房地產作為與金融深度融合的行業,自然是重點關注的對象。

9月14日,保監會銀監局副局長朱彤在新聞發佈會上表示,保監會繼續在30多個重點城市開展房地產貸款專項整治,加大對首付貸款和消費貸款資金流入樓市的查處力度,引導銀行資金重點支持民生工程,住房貸款餘額穩步增長,房地產金融化、泡沫化傾向得到有效遏制。

從一系列的的消息與監管部門的動作來看,對房地產金融的監管的力度將會持續加大,以踐行“房住不炒”的政策基調。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.