人民幣升值了,紙也變貴了?港股紙業板塊3天漲超10%

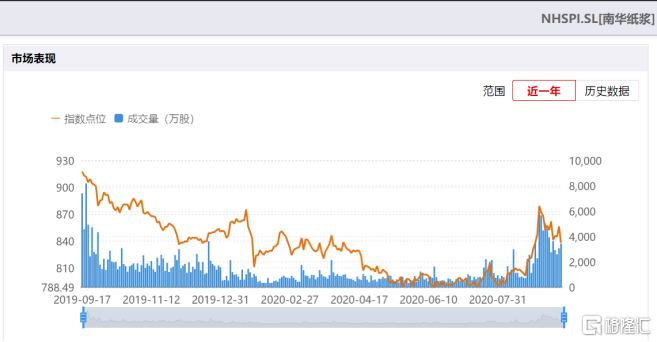

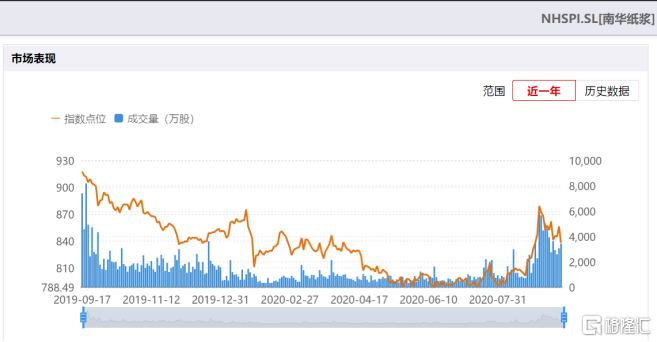

截至今日,港股紙業股板塊自上週五起已連續4個交易日上漲,本週至今3日累漲超過10%。

其中,理文造紙領漲板塊,截至發稿漲幅達8.57%,本週累漲超過18%。玖龍紙業本週累漲9.13%,陽光紙業本週累漲6.67%。

分析人士指出,人民幣近期不斷升值或是紙業普漲的背後原因。因為我國造紙業原材料主要依賴外國採購,受益於人民幣升值影響,造紙成本將降低。

原料紙漿價格在進入8月後突破了維持近3個月的底位震盪區間,開始上行,9月的前兩天一度突破6000元大關,後回落至4000元左右。

但考慮到近期人民幣升值的幅度,紙漿漲價的程度被大幅縮減。同時,部分業內人士對紙漿後市持看空態度,認為即便需求大幅回暖,但仍不足以支撐這麼大幅度的上漲,因此原料成本仍將維持在比較低的水平。

同時,進入9月以後,紙板漲價風潮逐步蔓延。山鷹紙業、玖龍紙業等造紙企業連續發出漲價函,帶動了期貨、股票市場的連鎖上漲。上週,銅版紙、白卡紙、箱板紙、瓦楞紙等都有0.5%-1.5%的價格上漲。

除短期人民幣升值帶來的成本下降以外,“史上最嚴”限塑令是紙業需求迅速回暖的主要原因。

根據國家發改委、生態環境部等9部委發佈的通知,明年1月1日起,將對零售、線下餐飲、外賣、電商等各大領域全面禁用塑料袋、塑料餐具及塑料吸管等。因此市場對傳統塑料替代品的關注迅速增強,許多上市公司正在積極擴產,以解決可降解塑料或紙包裝成本高企、產能不足的問題。

禁用一次性吸管後,紙吸管是目前主要的替代品,不過由於使用體驗不佳,紙吸管還不足以接手塑料吸管市場。可降解塑料吸管可能是塑料吸管的最優替代品,不過目前亟需解決的是可降解塑料吸管存儲期較短、難以貯藏的問題。

同時,國內可降解塑料產能水平短期內難以填補塑料製品退出後需求的巨大空白,而紙包裝供應端有30%左右的產能可以在短期內快速進入一次性塑料替代品市場。因此限塑令出台後對紙業的刺激最為明顯。

紙包裝的原材料以瓦楞箱板、白卡白板等包裝原紙為主。因此,在“限塑令”的出台給予了國內紙製品需求良好的增長預期。

以理文造紙為代表的主營紙包裝的企業受需求回暖影響積極擴產,產量提升的同時成本下降,在2021年的收益可能會有明顯的提振。因此麥格里發佈研報,重申了理文造紙“跑贏大市”的評級,目標價為7港元(當前最新價為5.32港元)。

另外,玖龍紙業將在下週二發佈2020年度業績,麥格里預測其表現將超過預期10%左右,體現了機構對造紙企業今年和明年業績的普遍看好。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.