市值逼近千億!周大福(1929.HK)創2年來新高,內地復甦提升業績預期

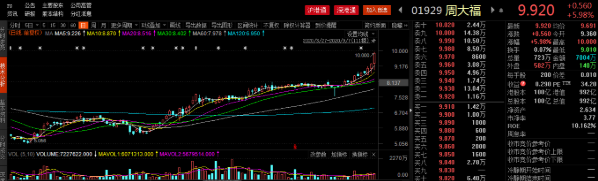

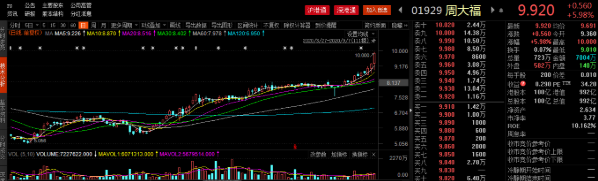

9月7日,周大福(1929.HK)午後漲勢明顯,盤中最高漲至10.00港元,創逾2年新高,目前漲近6%,最新總市值992億港元。其股價從8月25日以來累計漲幅近20%。

數據來源:Choice

究及該股近期漲勢不減的原因,即受到市場對其前景走勢的看好支撐所致,即在後疫情時代,內地經濟發展迴歸正軌,有效驅動周大福的業務正向發展,乃至利於其基本面的修復。

新冠疫情使得全球經濟蒙上陰霾,其中,基於疫情防控不夠及時、本地社會事件衝突頻發等原因,香港地區的經濟受到了較為深刻的負面影響,如今還處於艱難復甦的進程之中。

根據香港特區政府統計處數據顯示,7月零售業總銷貨價值臨時估計為265億港元,同比下跌23.1%,已是連續第18個月出現下跌。

而置身於這一環境之中的珠寶巨頭周大福的經營日子自然不好過,業績直面受到衝擊。

由於第四季度受疫情、國際金價飆升等因素的影響,截至今年3月31日,2020財政年度全年公司營業額567.51億港元,同比下降14.9%,淨利潤29.01億港元,同比下跌36.6%。

然而,儘管香港地區的銷售情況陷入疲軟境地之中,但內地業務的有效回暖或將為其“撐起一片天”。

根據截至2020年6月30日止三個月(“第一季度”)若干未經審核主要經營數據,雖受疫情影響,香港及澳門的同店銷售表現依舊不給力,分別下跌72.5%及93.2%,但本季度內周大福內地的同店銷售隨着業務恢復已較上一季度有顯著改善,內地同店銷售跌幅收窄至11.2%。

數據來源:官方公告

“周大福內地同店銷售表現由2021年度首財季下跌11.2%,回升至7-8月約5%的增長,主要因為新店開張,而各條產品線的平均售價亦見增長,抵銷了商品價格上升令金飾銷售轉淡的影響。”——野村

整體來説,雖然香港本地零售業的經營環境受疫情影響或將依舊面臨較為嚴峻的挑戰,但基於內地疫情趨於常態化管理,較為平穩,經濟發展持續向好,消費氣氛進一步得到釋放,被釋放的消費力會使得銷售有所好轉,從而推高了市場對後期周大福業績反彈的想象空間。

麥格理指出,市場低估了周大福業務的韌性,以及其可受益於金價上升的趨勢。由於內地業務有更好的復甦,加上金價上升令其毛利率擴張的影響,上調周大福2021和2022財年盈利預測分別29%和3%。目標價升至14港元。野村此前預計公司下半年可持續復甦勢頭,將內地同店銷售增長預測微升至18%。

野村發表研究報告稱,周大福約72%銷售及90%營業利潤來自中國大陸,相信該公司將較其香港同業更能受惠於內地市場復甦;同時,封關令香港7-8月銷售表現持續受壓,估計銷售跌幅會由首季的75.5%收窄至第二季的大約60%,預期今年香港成本可以明顯節省;考慮到商品價格走勢和產品組合改善後,預計周大福全年度毛利率可升至30.6%。因此上調周大福2021-23年度盈利預測10-12%,以反映內地業務反彈和香港營運開支減低的影響,目標價由89.港元調升至9.9港元,評級維持買入。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.