券商、军工、芯片ETF规模暴增,谁在提早布局?背后“买手”名单曝光

作者:王彭

来源:上海证券报

今年以来,证券、军工、芯片、新能源等板块的多只ETF规模出现大幅增长。而7月以来,上述板块中多只ETF的涨势也十分喜人,量价齐升的背后,有哪些提前布局的资金赚了个盆满钵满?

随着基金半年报披露结束,上述ETF规模暴增的“幕后推手”浮出水面:多只ETF前十大持有人中出现了保险、券商、基金等机构持有人的身影。

多只ETF获机构提早埋伏

先来看一下今年以来部分ETF规模增长情况。

部分ETF规模增长情况(截至9月2日)

显然,证券、军工、芯片、5G、新能源板块相关ETF受到了资金的热烈追捧。

作为市场投资的风向标,ETF的规模变动情况往往代表着机构投资者对后市的看法。而这些ETF的幕后“金主”也随着基金半年报浮出了水面。

以今年以来份额增长十倍的平安中证新能源汽车产业ETF为例,截至上半年末,基金前十大持有人均为机构投资者。其中,华西证券持有8955.8万份,持有比例为2.17%,为第一大持有人;中国平安财产保险和华泰证券紧随其后,分别持有7951.8万份、6859.4万份。

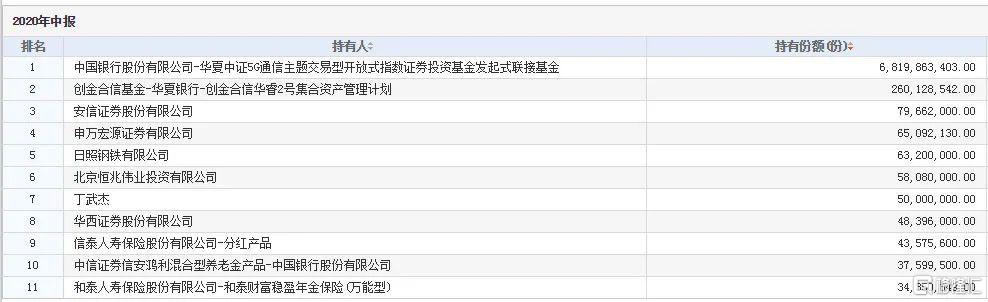

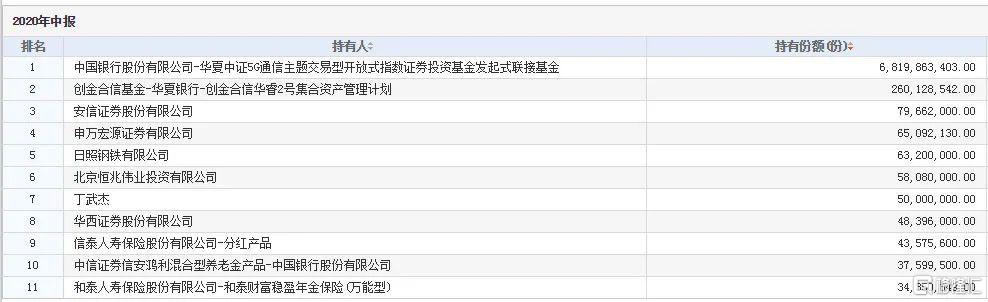

华夏中证5G通信主题ETF最新披露的主要持有人也发生了较大变化,截至去年年底,基金前十大持有人中有五位个人投资者。到了今年6月底,主要持有人中仅有一位个人投资者,其余席位均被保险、券商、公募基金等机构投资者占据。

华宝中证全指证券公司ETF则被中国人寿保险、华夏人寿保险、信泰人寿保险、西南证券、国泰君安证券等机构扎堆持有。

券商、军工ETF大幅上涨

下半年以来,随着券商、军工等ETF大幅上涨,提早埋伏相关ETF的机构也赚得“盆满钵满”。

东方财富Choice数据显示,7月以来截至9月2日,军工板块四只ETF——易方达中证军工ETF、广发中证军工ETF、国泰中证军工ETF和鹏华中证国防ETF均涨逾40%。此外,富国中证全指证券公司ETF、华宝中证全指证券公司ETF、国泰中证全指证券公司ETF均涨逾20%。

“市场资金涌入券商板块实际上是在表达其对后市整体看好。对手握重金的机构投资者而言,买入券商板块ETF是配置券商股最直接的方式。”沪上一位基金经理称。

国泰基金量化投资事业部总监梁杏认为,支撑券商股后市走强的理由主要有以下几点:证券板块基本面坚挺;估值现阶段来说相对合理;有较多利好政策支持;证券公司和银行合并的预期存在;未来居民财富或将逐步向资本市场转移。

军工板块同样是机构较为看好的领域。

“我们认为军工行情可能才刚刚开始。”富国基金量化投资部ETF投资总监王乐乐称。王乐乐表示,当下军工行情有点类似2012年到2013年的情况:从初期的开始跑赢大盘、到后来取得非常高的超额收益。而军工行情启动的背后,对应着市场风险偏好的提升。

在王乐乐看来,创业板指的走势可以反应市场风险偏好,军工跑赢大盘的时期,往往是创业板大涨的时期。当下创业板已经连续大涨、其反应市场风险偏好大幅提升,但军工板块相对收益仍旧落后。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.