比亞迪電子(00285.HK):綜合能力打造平台型企業,多賽道拓展利潤空間,維持”買入“評級,目標價:39港元

機構:國元證券

評級:買入

目標價:39港元

公司2020年H1收入逆勢增長,營收和利潤創歷史新高

公司上半年實現營收人民幣313.86億元,同比增長34.8%;毛利41億,同比增長164.3%;毛利率13.06%,同比增加6.4個百分點;歸母淨利潤24.73億元,同比增長329.8%。

手機:業務結構向高價值方向調整,客户結構有效抵禦行業波動

公司上半年手機及筆電業務收入為185億元,同比下降7%。其中:組裝業務收入99億元,同比下降16.5%;零部件業務86億元,同比增長6.9%。從業務結構來看,公司的重心逐步向高價值量、高毛利率的零部件轉移。根據彭博數據,今年上半年全球手機(含智能手機和功能機)總出貨量為6.95億部,同比下降18.1%。其中:蘋果逆勢增長5.2%,小米下降3.5%,華為下降11.1%,增速均高於行業增速。

在當前國際博弈背景下,公司的客户結構有望有效抵禦行業波動風險。

北美大客户業務進入高速成長期,多業務領域增長潛力巨大

北美大客户方面,公司2020年Pad預計出貨量為數百萬台,並開始佈局海外產能,未來有望成為Pad產品線的龍頭供應商。公司不僅提供組裝業務,還能導入金屬和玻璃結構件;公司成為可穿戴新產品玻璃前蓋的主要供應商,將於2021年年中量產;公司持續拓展北美大客户的更多核心產品業務。公司在智能家居、無人機、電子霧化器以及物聯網等多個領域的產品也存在巨大增長空間。

維持“買入”評級,上調目標價至39港元:

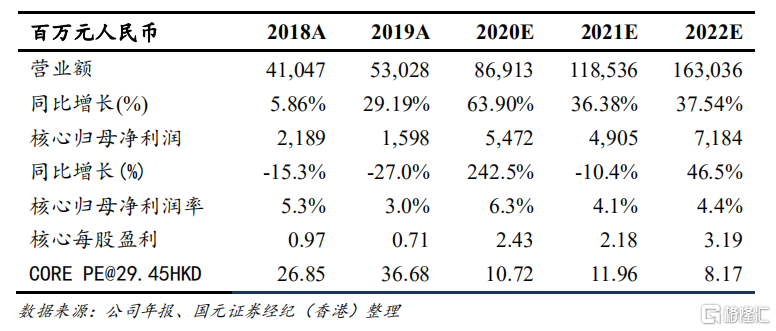

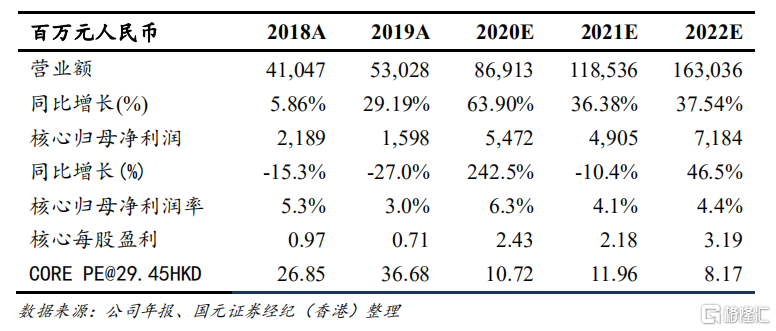

我們上調公司2020~2021年業務收入預測至869億(+64%)、1185億(+36%)和1630億元(+38%),淨利潤54.7億(+243%)、49.1(-10%)億和71.8億元(+47%),按照2021年16倍PE估值,公司合理價格為39港元/股。維持“買入”評級,股價有33.9%潛在上漲空間。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.