北京首都機場股份(00694.HK):免税收入計算未考慮保底,業績提前觸底,維持“強烈推薦”評級

機構:東興證券

評級:強烈推薦

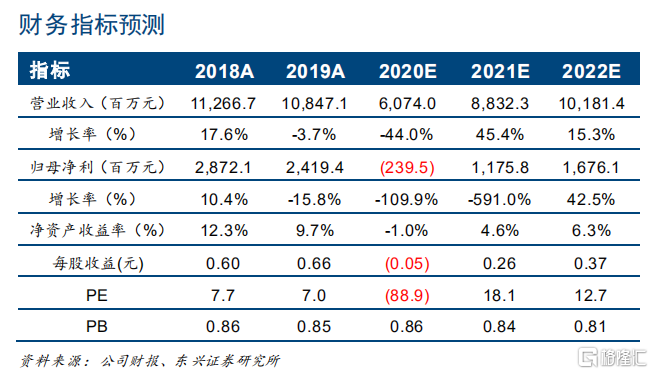

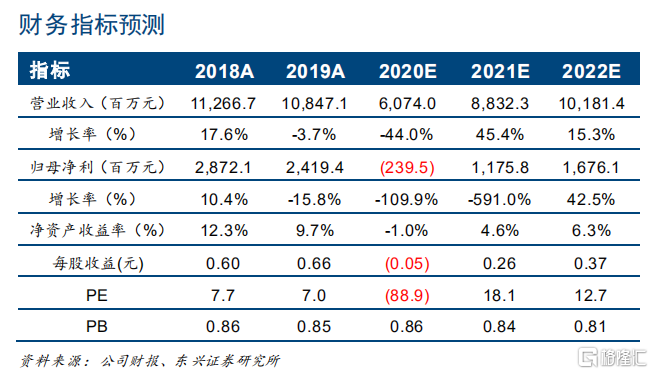

事件:2020 年上半年,公司實現營收19.83 億元(-63.1%),其中航空性收入 5.70 億(-72.0%),非航收入 14.13 億(-57.8%),受疫情影響皆大幅下滑。歸母淨利潤-7.38 億元,較上年同期的 12.90 億元大幅下滑。

受疫情影響航空性收入鋭減 : 上半年首都機場飛機起降架次同比下降59.5%,加上疫情期間一二類機場起降收費基準降低 10%的政策性減免,導 致起降相關收入下滑68.5%;旅客吞吐量同比下降73.6%,導致旅客服務費下降 75.6%。航空性收入降幅與業務量降幅基本匹配,符合預期。

非航收入大幅下降,免税收入計算未考慮保底:公司非航收入主要由特許經營收入和租金兩部分構成。租金收入由去年同期的 6.6 億降至今年的5.1億,降幅相對較小。特許經營收入由去年同期的26.0億降至今年的8.9億是非航收入大幅下滑的主因。

特性經營收入中,零售(即免税)與廣告兩項比重最大。廣告收入報告期同比僅下滑 6.2%,而免税收入由去年的 17.7 億降至今年的 1.76 億,主要系公司計算營收時採取了謹慎原則,未考慮免税協議中的保底收入條款,而是以實際銷售額計算保底分成,造成營收大幅下降。

但營收未考慮保底收入並不意味着公司無法獲得保底收入。中國中免的其他應付款項目由去年年報的 20.6 億大幅上漲至中報的 54.5 億元,主要就是考慮到與幾大機場簽訂免税合同附帶的保底收入條款。謹慎考慮,我們在盈利預測時假設今年公司能夠獲得 60%的保底收入。

運維費用及特許經營管理費明顯下降:上半年公司經營成本同比下降約6.92 億,主要系特許經營管理費減少4.03億元。此外,員工費用、運行服務費以及航空安保費分別同比下降36.4%、24.7%與15.9%,整體運行成本得到有效控制。

業績提前觸底,中報反映了最悲觀預期。上半年北京新發地疫情的反覆使得首都機場吞吐量的恢復進度慢於其他樞紐機場,海外疫情無法完全控制導致國際航線至今未有明顯恢復。但公司採取非常謹慎的財務處理,基本反應了對免税業務最悲觀的預期,故我們認為公司業績已經提前觸底。而隨着下半年國內航線逐步恢復,公司業績將有所好轉。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.