新股配售 | 綠城管理一手中簽率40%,公開認購11.2倍,國配5倍,有綠鞋

uSMART友信智投7月9日消息,綠城管理控股有限公司(09979)發佈《發售價及配發結果公告》。

【綠城管理的配售簡況】

1、發售價:2.5港元,為招股價(2.2-3港元)的偏中間價位

2、有效申購人數:22,594名(甲組:22,543名,乙組:51名)

3、中簽情況:一手中簽率40%,申購10手穩中1手;甲組最多中51手,乙組穩中193手-2065手

4、頂頭槌單:3張(每張穩中2065手)

5、公開認購:11.2倍(甲組:11.44倍,乙組:10.96倍)

6、回撥情況:無回撥,最終公開的比例為10%,國配的比例為90%(於任何超額配股權獲行使前)

7、國際配售:5倍,合共105名承配人

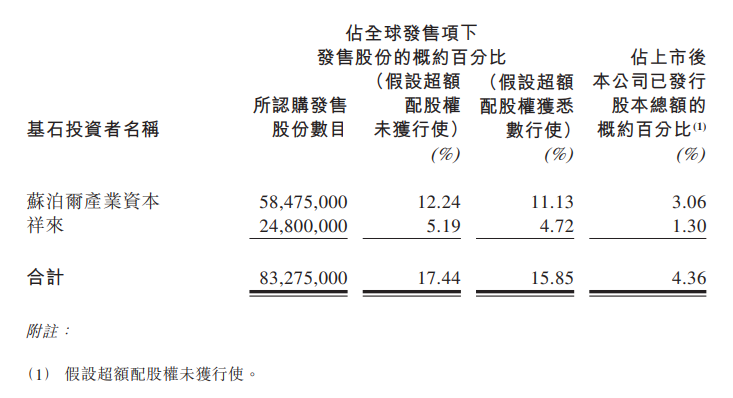

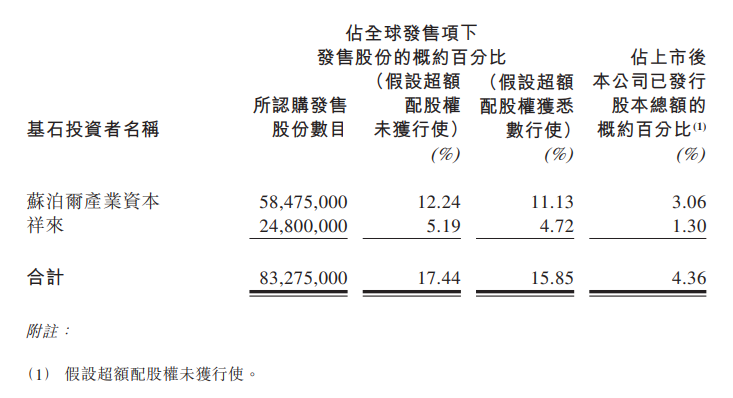

8、基石投資者(2名):鎖定17.44%的發行股份(於任何超額配股權獲行使前)

9、超額配股權:已超額分配47,756,000股股份,有綠鞋

10、關聯客戶(2名):合共6,000,000股發售股份配售給包銷商雷根國際證券的關連客戶

11、穩定價格操作人:瑞士信貸(香港)有限公司

12、優先發售:0.382倍

13、uSMART友信智投APP暗盤交易時段:7月9日16:15-18:30

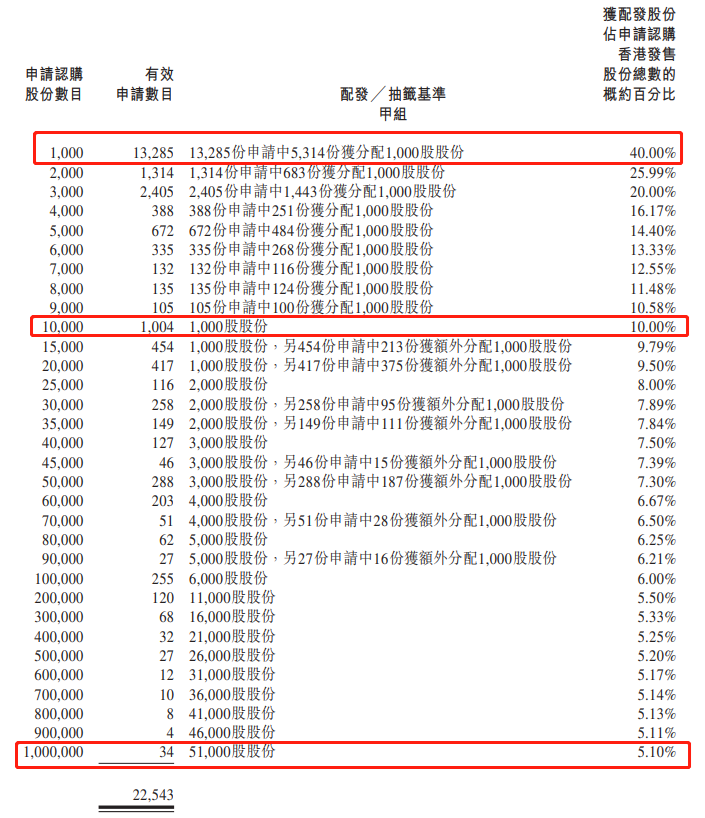

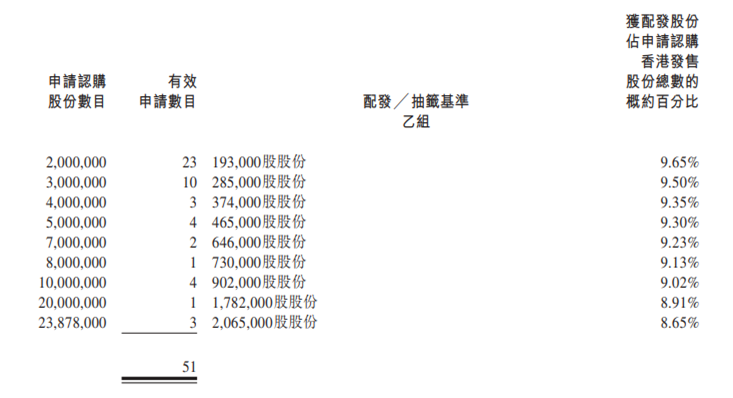

【中簽率詳情】

甲組最多中51手

乙組穩中193手-2065手

甲組:

一手中簽率40%

申購10手穩中1手

申購25手穩中2手

申購40手穩中3手

……

申購1000手穩中51手

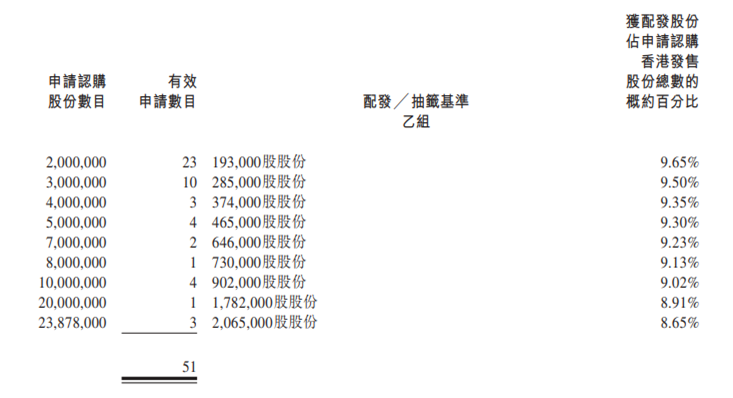

乙組:

申購2000手穩中193手

……

申購23878手穩中2065手

以下為中簽分配基準:

圖片來源:披露易

【優先發售的分配基準】

合資格綠城股東於優先發售中獲分配的預留股份最終數目為18,245,585股預留股份,約佔全球發售項下初步可供認購發售股份的3.82%(超額配股權獲任何行使前及29,510,415股未獲認購的預留股份已重新分配至國際發售)。該等18,245,585股預留股份已分配於合共15名合資格綠城股東。於合資格綠城股東獲分配的預留股份中,6,560,030股預留股份將分配於合資格綠城股東作為彼等的保證配額,11,685,555股預留股份將根據合資格綠城股東就超額預留股份作出的有效申請分配於合資格綠城股東。

【基石投資者】

【關聯客戶】

點擊可閱讀《綠城管理的發售價及配發結果公告》PDF原文

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.