配售結果 | 海吉亞醫療:1手中簽率8.8%,超30萬人申購,公開認購608.56倍,國配認購25倍

uSMART友信智投 06-26 10:47

uSMART友信智投6月26日消息,海吉亞醫療於今日公佈中簽結果,並將於16:15進行暗盤交易。

【配售概況】

1、發售價:18.5港元,為招股價17-18.5港元的上限

2、公開發售認購倍數:608.56倍,其中甲組290.98倍,乙組926.13倍

3、公開認購人數:30.3678萬人,其中甲組29.6756萬人,乙組6922人

4、公開部分中簽人數:10.286萬人

5、1手中簽率:8.8%,申購50手穩中1手

6、頂頭槌張數:254漲

7、回撥比例:50%

8、國際發售認購倍數:25倍

【基石投資者】

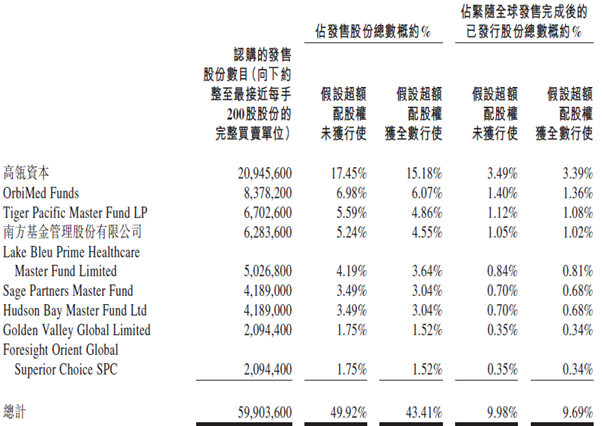

高瓴、奧博資本、南方基金等9位基石投資者已認購5990.36萬股,佔發售股份的49.92%(綠鞋前),均有6個月禁售期。

【超額配股權】

已超額分配1800萬股股份,佔發售股份的15%,以補足國配的超額分配。穩定價格操作人為摩根士丹利,穩定價格期將於7月19日結束。

【中簽表】

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.