人瑞人才 (6919 HK):新經濟領域的靈活用工解決方案龍頭,給予“買入”評級,目標價56.00港元

機構:第一上海

評級:買入

目標價:56.00港元

新經濟需求紅利疊加靈活用工市場紅利:受益於新經濟公司下沉市場策略的擴張需求和客户在新區域進行業務調整時團隊規模靈活調整的特點,短中期來看,公司將持續獲得新經濟領域公司的需求紅利。2019 年新經濟客户收益佔公司總收益的 85.4%,公司業務的擴張速度將緊跟新經濟公司的發展速度。長期來看,相比歐美和日本等發達國家,中國大陸靈活用工市場在企業端和勞工端目前僅有較低的滲透率,而靈活用工能夠解決摩擦失業的重要意義決定其將長期發展;公司自身專業的服務能力將能夠持續佔領市場份額,增加其服務在市場中的滲透率。

靈活用工模式具備高經營槓桿:公司的靈活用工崗位以中低層通用性職位為主,向高端崗位發力,毛利率水平有望穩中有升。此外公司的 BPO 業務近年來高速增長,主要來自於現有客户對公司服務範圍的延伸,公司有望從交叉銷售中獲益。O2O 的招聘模式使管理層豐富的線下能力與平台完整的線上能力相結合,大幅縮短招聘流程的週期和招聘成本,為客户快速組建供給。相較於傳統的勞務派遣,公司具備高經營槓桿,利潤轉化效率高。

先發優勢和規模壁壘,公司持續享受市場紅利和規模:靈活用工屬於密集型供給的商業模式,先發優勢將作為行業中公司競爭的重要籌碼。在供給端,公司作為靈活用工平台的早期進入者,能夠率先進入和滿足客户需求,且容易在客户羣體中形成良好口碑和默契合作,導致客户的轉移成本增加;在需求端,人才庫的積累能夠為更多客户提供較大的供給彈性,滿足客户更多元更靈活的用工需求,規模上相較於後進者具備規模壁壘,也更容易對客户的需求做出快速響應。

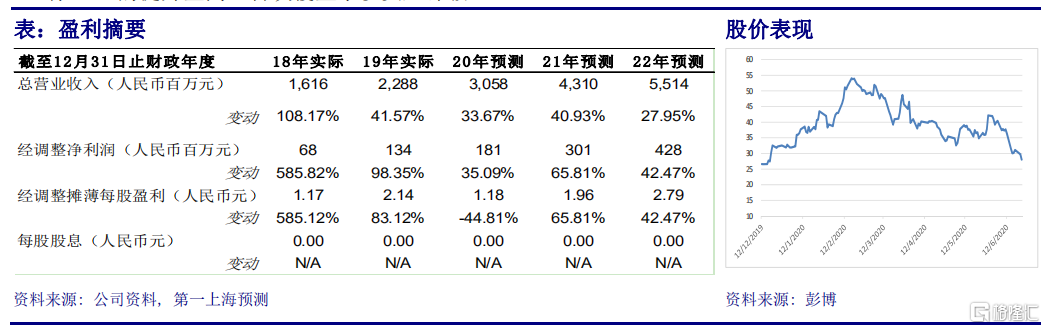

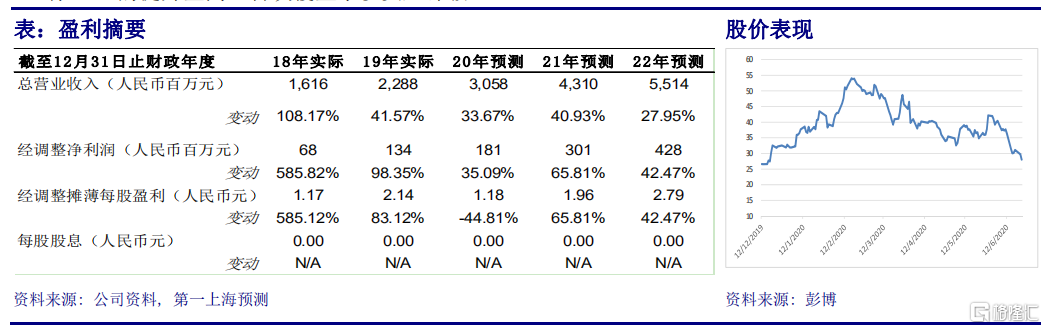

目標價 56.00 港元,買入評級:綜合分析,通過對靈活用工市場的趨勢,以及人瑞人才的核心能力、客户特點和行業壁壘的討論,我們看好公司在後續的靈活用工市場格局中的表現,能夠持續在客户需求紅利和市場擴張紅利中搶佔市場份額。基於以上邏輯,以及疫情考慮,我們預計未來三年公司在收入端和利潤端均能保持高速增長。因此,我們根據公司的利潤增速以及同業可比標的的估值情況,採用 PE 估值法,予以估值中樞 25 倍 PE,並根據 2021 年預計利潤計算得出目標價為 56.00 港元,較上一收盤價有 100%的提升空間,首次覆蓋予以買入評級。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.