吉利汽車(00175.HK)重大事項點評:5月起進入批發高增長階段,維持“強推”評級,目標價16.1 港元

機構:華創證券

評級:強推

目標價:16.1 港元

事項:

吉利公佈5月產銷快報,批發10.9萬輛,同比+20%、環比+3%。

評論:

5月批發符合預期,雙位數增長狀態估計可持續到年底。全月10.9萬輛,同比+20%、環比+3%,同比增幅較高除行業終端需求繼續恢復外,還因為吉利去年5月開始進入低基數時段。受需求恢復、低基數影響,吉利批發雙位數增長估計將持續到今年年底。

?估計5月渠道庫存延續增長狀態。我們估計5月上險9-10萬輛,同比-14%至-4%、環比+9%至+22%,渠道庫存+0.6至+1.6萬輛,庫存係數持平至-0.3,約1.8至1.5。此外注意,今年疫情後吉利終端折扣較競品明顯增加,對終端銷量起到拉動作用。

領克新車為品牌帶來增量。5月產品銷售結構變化中注意,低端線遠景系列佔比為15%,同環比皆下降,分別-5PP、-6PP。博越在競品開始給出折扣的影響下,實現批發2.0萬、同比-10%、環比+7%;帝豪轎車+帝豪GL也開始面臨競品壓力,5月批發2.3萬、同比+9%、環比+14%。領克:01-05分別為2642、2280、5977、2051輛,合計1.3萬輛,同比+41%、環比+28%,01下滑的量被03增量和05填補,其中03+為933輛,持續的新車上市為品牌帶來生命力。

預計2Q20公司批發同比+15%至+25%。2季度各車企都受益於需求恢復、新車上市、促銷和地方補貼加碼,以及渠道補庫,5-6月行業和前列車企延續數據上升勢頭,我們估計行業2Q20批發+5%以上。初步預計吉利2Q20總批發同比增長15%-25%。全年預計公司批發143萬輛/+5%,其中ICON+豪越+Preface合計帶來約9萬增量,領克05+06帶來4萬增量。豪越6月7日已開啟預售,預售價10.88-14.88萬元。

本輪景氣變化後吉利份額有望再次提升,行業地位預計強化。本輪景氣下行過程中,弱自主與弱合資開始掉隊,但在總量萎縮的情況下不容易看出給頭部車企留出的餘量,預計在景氣回升過程中,龍頭公司的增量體現會更明顯,吉利作為自主龍頭,份額和銷量也將不斷提升。中長期看,吉利未來成長空間還包括中高端車型、海外市場,公司管理層正與沃爾沃汽車探討業務合併重組的可能性,合併後公司將成為一家擁有豪華、中端、低端產品的全球性車企。

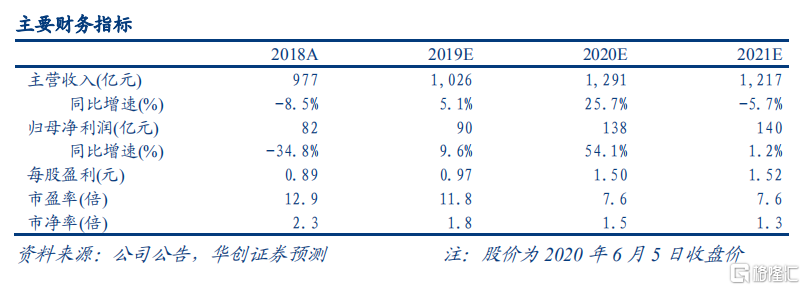

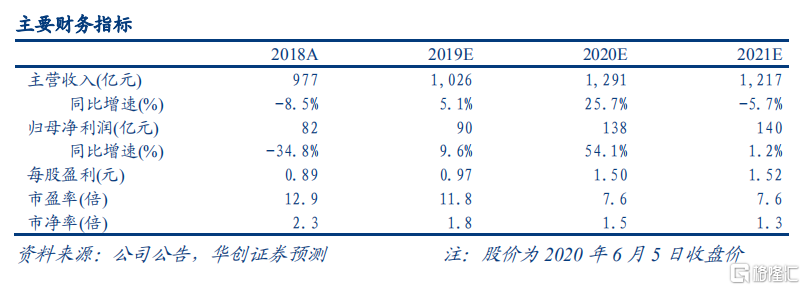

投資建議:吉利作為自主龍頭,國內份額、中高端車型、海外市場皆有充足成長空間,有望成為中國的大眾豐田。與沃爾沃合併是大勢所趨,將強化研發、管理、全球化的協同。疫情衝擊不影響長期成長路徑,2021年有望隨行業恢復迎來量、價雙升。不考慮重組,維持2020-2021年淨利預期90億、138億元,對應PE12倍、8倍,維持目標價16.1港元,維持“強推”評級。

風險提示:海外疫情對國內經濟影響高於預期,新車型銷量低於預期等。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.