港股收評:恆指收漲1.66%,航空及香港本地股集體大漲

今日,港股三大指數午後拉漲,恆指尾盤一度漲近2%,收漲1.66%報24770點,國指漲0.99%報10066點。大市成交額為1300億港元。

板塊方面,航空股全日強勢,香港本地股午後爆發,帶動市場情緒升温、地產投資、電池股、半導體、手機概念股、汽車股板塊現普漲行情;昨日強勢的消費股回落明顯。

具體來看,航空服務板塊領漲市場,其中美蘭空港、北京首都機場股份、中國南方航空股份均漲超10%,中國國航、國泰航空等跟漲。消息面上,國內航空單日客運量逼近百萬人次,熱門線排班量恢復至近8成。航空客運量單日再創1月27日以來新高。後續客運量評估來看,預計6月國內線或恢復到去年同期水平的7成以上。

半導體板塊漲幅居前,華虹半導體漲逾9%,中芯國際、ASM太平洋均上漲。據悉,中芯國際的科創板上市申請狀態變更為“已問詢”。

地產投資整體漲近4.4%,板塊內的華人置業飆升60.22%,九龍倉置業、太古地產、九龍倉集團等股跟漲。大和發表行業報告稱,在評估香港地產行業需應對的若干宏觀發展等因素時,認為現時到了“別人恐懼時貪婪”的時機,重申對行業“正面”看法,而部分地產股的股息率仍達逾5釐。

濠賭股延續漲勢,新濠國際發展、美高梅中國、永利澳門、金沙中國有限公司紛紛上漲。大摩近日發研報指,5月份澳門賭收按年跌93%至17.64億澳門元(下同),好過預期跌95%,日均賭收約為5,700萬元,較上月增逾一倍,主因貴賓廳收入增加。行業股價年初至今表現與恆指大致同步,但相信隨着限制在未來數週放寬,濠賭股會開始跑贏大市。

影視娛樂股普漲,貓眼娛樂漲7.87%,IMAX 中國漲5%,歡喜傳媒、阿里影業也紛紛上漲。

恆指成份股中,僅3股下跌,包括蒙牛乳業、恆安國際、騰訊控股;其餘成份股悉數上漲,恆生銀行大漲8.45%領漲,九龍倉置業、新世界發展、長實集團、瑞聲科技、中國聯通等個股漲幅居前。

港股通中,華南城漲超20%領漲,華潤醫療、北京首都機場股份、山東墨龍等股漲逾10%,華虹半導體、上海電氣等個股漲逾8%;新東方在線跌6.03%領跌,金川國際、鄭煤機、宇華教育、拉夏貝爾等股下跌。

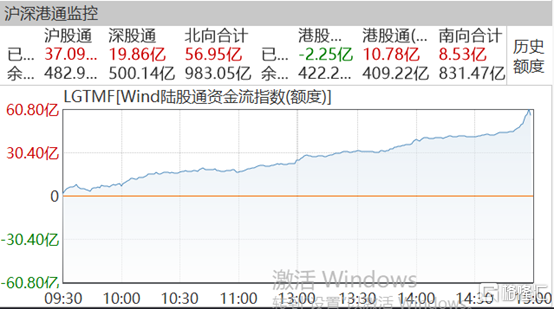

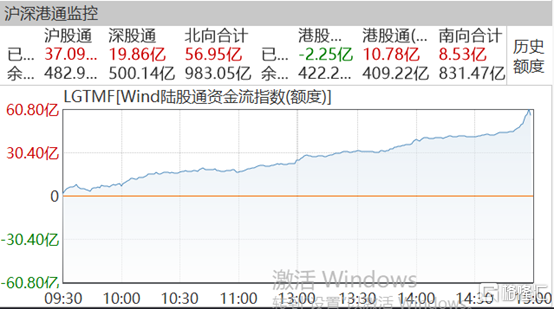

截至收市,南向合計淨流入8.53億元,其中港股通(滬)淨流出2.25億元,港股通(深)淨流入10.78億元。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.