小米集團Q1業績大超預期,股價半年已飈50%

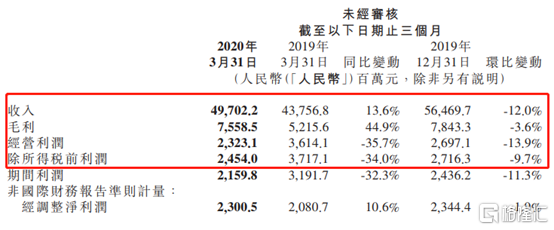

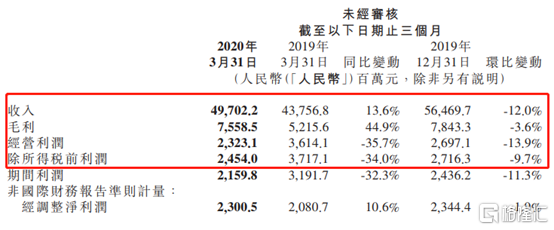

今日盤後,小米集團公佈今年一季度“成績單”。據財報披露,總營收為497億元(單位:人民幣,下同),同比增長13.6%;經調整淨利潤達到23億元,同比增長10.6%。在新冠疫情之下,如此體量能實現雙位數的增長,實屬不易。

(來源:小米財報)

受益於小米全球手機市佔率的增長,小米全球MIUI月活躍用户達到3.3億,同比增長26.7%。小米智能手機於季內毛利錄得24.52億元,同比大增177.1%。

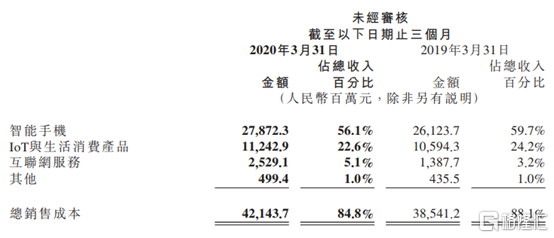

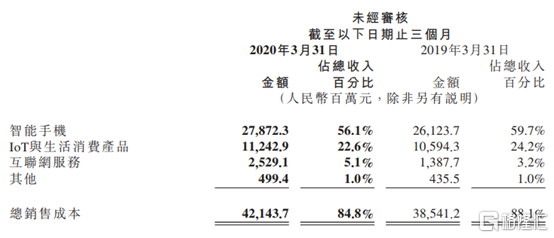

分業務看,智能手機收入303億元,同比增長12.3%。其中,售出2920萬部智能手機,而去年一季度售出2790萬部,同比逆勢提升4.66%。另外,平均單價從去年一季度的968.3元提升至今年一季度的幣1038元,同比提升7.2%。ASP上升主要是由於一季度發佈的5G及其他高端智能手機型號拉動所致。

(來源:小米財報)

IoT與生活消費產品方面,營收為130億元,同比增長7.8%。主要是由於智能手環及路由器等若干IoT產品需求快速增長。不過,智能電視及筆記本計算機的銷售收入為46億元,同比減少8.2%。這主要是由於疫情影響導致銷售活動減少及生產中斷所致。

互聯網服務業務,營收為59億元,佔總營收比例的5.1%,較2019年提升1.9%。這是一個好的現象。

再看關鍵經營指標——毛利率。小米一季度整體毛利率為15.2%,相較去年一季度的11.9%,提升3.3%。

分開看,一季度手機業務毛利率高達8.1%,而去年同期僅為3.3%。一季度發佈的Mi10和Mi10Pro等數款熱門機型憑藉其優越的性能深受市場歡迎。

loT與生活消費產品分部毛利率為13.4%,同比提升1.4%。互聯網服務分部毛利率為57.1%,同比下滑10.3%,主要系遊戲及其他增值服務業務的收入佔比上升。

整體而言,小米一季度業績超出市場預期,表現驚豔,尤其是手機業務逆勢擴張,實屬不易。根據Canalys的統計,2020年第一季度,小米全球智能手機出貨量的市場佔有率上升至11.1%,排名全球第四,是五大手機廠商中僅有的兩家維持出貨量同比增長的廠商之一。

尤其在歐洲市場,小米表現強勢。據調研機構Canalys公佈的數據,小米市佔率高達14%,位列第四,同比大增58%。而三星、華為、蘋果則出現不同程度的下滑。

展望未來,小米認為,危機是企業價值、模式和生長潛力的試金石。也期待工作和生活逐漸恢復正常,在各項戰略的持續推進中,重新激發市場活力。

在港股市場,小米5月以來逆勢大漲25%。如果從去年11月底統計至今,股價更是大漲50%左右。曾經讓市場充滿期待的小米,是不是又回來了呢!

(來源:Wind)

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.