騰訊控股(00700.HK):疫情衝擊下仍保持“騰訊牛“,20Q1業績表現大超預期,維持“推薦”評級

機構:方正證券

評級:推薦

事件:公司公告2020Q1財報,實現營收1080.65億元(YoY+26%,QoQ+2%),營業利潤372.60億元(YoY+1%,QoQ+30%),淨利潤294.03億元(YoY+6%,QoQ+31%),歸母淨利288.96億元(YoY+6%,QoQ+34%)。

我們的觀點:

1、主要財務指標分析:整體表現超預期,增值服務、網絡廣告、金融科技與企業服務三大板塊全線增長,毛利率、營業利潤率持續改善。

(1)20Q1業績總覽:實現營業收入1080.65億元(YoY+26%,QoQ+2%),高於彭博一致預期的1010.71億元;實現營業利潤372.60億元(YoY+1%,QoQ+30%);歸母淨利潤288.96億元(YoY+6%,QoQ+34%),遠超彭博一致預期的236.42億。

(2)20Q1分業務收入及毛利率:①增值服務收入624.29億元(YoY+27%,QoQ+19%),營收佔比58%,毛利率59.0%(YoY+1.5pct,QoQ+9.0pct)。其中網絡遊戲收入372.98億元(YoY+31%,QoQ+23%),營收佔比35%(YoY+1pct,QoQ+6pct);社交網絡收入為251.31億元(YoY+23%,QoQ+14%),營收佔比23%(YoY-1pct,QoQ+2pct)。②金融科技及企業服務收入為264.75億元(YoY+22%,QoQ-12%),營收佔比25%,毛利率27.9%(YoY-0.6pct,QoQ-0.2pct)。③網絡廣告業務收入達177.13億元(YoY+32%,QoQ-12%),營收佔比16%,毛利率49.2%(YoY+7.3pct,QoQ-5.1pct)。其中媒體廣告收入達31.21億元(YoY-10%,QoQ-21%),社交及其他廣告145.92億元(YoY+47%,QoQ-10%)。

(3)20Q1費用情況:銷售費用率7%(YoY+2pct,QoQ持平),管理費用率(包含研發費用)13%(YoY持平,QoQ-2pct),研發費用率7%(YoY持平,QoQ-1pct)。

2、春節疊加疫情,20Q1整體手遊業務增勢迅猛(YoY+64%,QoQ+34%),《王者榮耀》《和平精英》等手遊長期位居IOS遊戲暢銷榜TOP2,遞延收入創歷史新高,《PUBGMOBILE》等遊戲出海表現亮眼,騰訊躍居20年3月中國發行商出海收入榜TOP2,全球化能力不斷增強。目前儲備包括《一人之下》(預計5月27日全平台上線)、《地下城與勇士手遊》(預計20年暑期上線)、《英雄聯盟手遊》、《使命召喚手遊》(國服版)、《天涯明月刀手遊》等多款重磅遊戲。

3、視頻及音樂流媒體增長趨勢向好,付費訂閲用户增速強勁,2020Q1騰訊視頻、騰訊音樂的訂閲用户分別同比增長26%、50%至1.12億、4270萬;閲文集團管理團隊調整有望加強IP聯動,輸出更多優質改編作品;短視頻起量,微視DAU增長顯著,微信視頻號正式開啟內測。

4、20Q1廣告業務逆勢實現強勁增長(YoY+32%),疫情期間用户APP內使用時長的增加使得廣告曝光量增加明顯,帶動社交廣告實現47%同比增長,但展望全年,仍面臨較多挑戰。

5、疫情導致公司金融科技與企業服務收入增速短期回落(YoY+22%/QoQ-12%),但支付數據已出現反彈,4月最後一週日均商業交易額恢復至19年底水平,且公司及時把握遠程辦公、視頻、教育等業務機會,雲及其他企業服務業務的長期增勢不改。

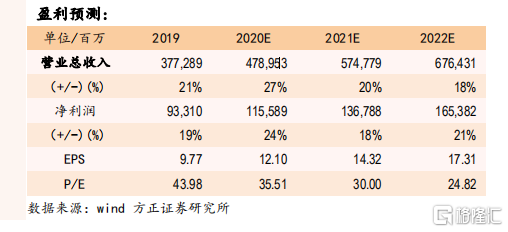

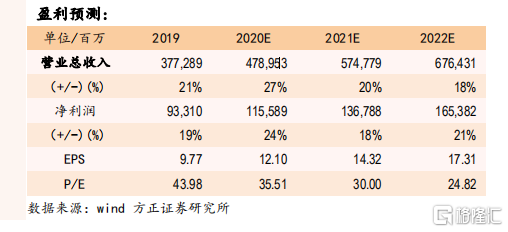

6、盈利預測與投資評級:我們預計公司FY20-22年營收分別為4790/5748/6764億元,歸母淨利潤分別為1156/1368/1654億元,對應EPS為12.10/14.32/17.31元,對應PE分別為36/30/25X,維持“推薦”評級。

7、風險提示:活躍用户增速放緩風險、遊戲內容監管風險、新遊審批進度風險、穩定優質內容生產風險、互聯網信息發佈政策變更風險、視頻內容監管風險、內容成本快速增加風險、渠道成本快速增加風險、競爭風險、反壟斷風險、金融政策變更風險、投資風險、估值調整風險、匯率風險等。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.