半导体行业到底有多火?一份季报给出了答案

作者:李兴彩

来源: 上海证券报

刚刚宣布冲刺科创板,中芯国际又披露其一季度实现营收和利润高增长,且二季度业绩指引依然保持乐观,半导体行业的高景气度可见一斑。

营收和利润大增

中芯国际5月13日晚间在港交所发布一季度报告,今年第一季度实现收入9.05亿美元,环比去年第四季度增加7.8%,同比去年一季度大增35.3%,创历史新高;实现净利润6416.4万美元,环比减少27.7%,同比增加422.8%。

对于靓丽的一季报,中芯国际联合首席执行官赵海军和梁梦松表示,由于市场需求和产品结构优于预期,公司一季度营收创出新高。产品方面,通讯、电脑与消费电子相关营收同比增长,逐步增加市场份额。

中芯国际营收再创新高的同时,毛利率也大幅提升。公司第一季度毛利率25.8%,环比去年第四季度的23.8%、同比去年第一季度的18.2%,均有提升。

12nm业务已贡献业绩

纵览一季报,虽然中芯国际没有特别提及先进制程,但各种迹象表明,其在先进制程量产方面又取得了新进展。

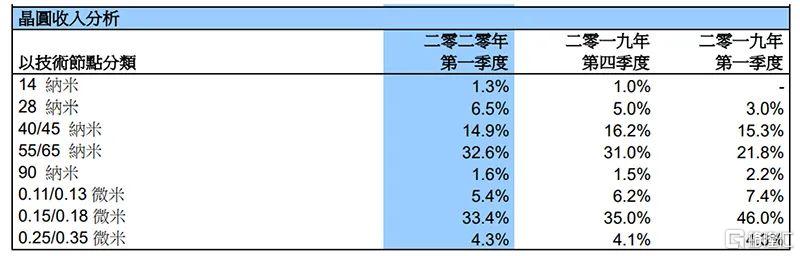

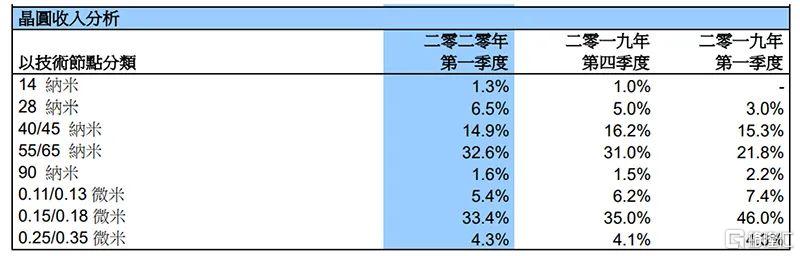

具体到一季报中,中芯国际在28nm上的业务营收占比为6.5%,去年第一季度、第四季度的占比分别为3%、5%;在14nm上的营收占比则为1.3%,也高于去年四季度的1%。

上证报记者获悉,除了14nm工艺的营收继续增长,中芯国际的12nm工艺也已经开始贡献业绩。更有业内人士对记者透露,相比14/12nm这个过渡性工艺,中芯国际的“N+1”更为值得期待。

此前,中芯国际在2019年财报中透露,公司已经开发了14/12nm多种特色工艺平台,N+1的研发进程稳定,已进入客户导入及产品认证阶段。

二季度业绩指引折射高景气度

在一季报中,中芯国际给出了令人期待的第二季度业绩指引。

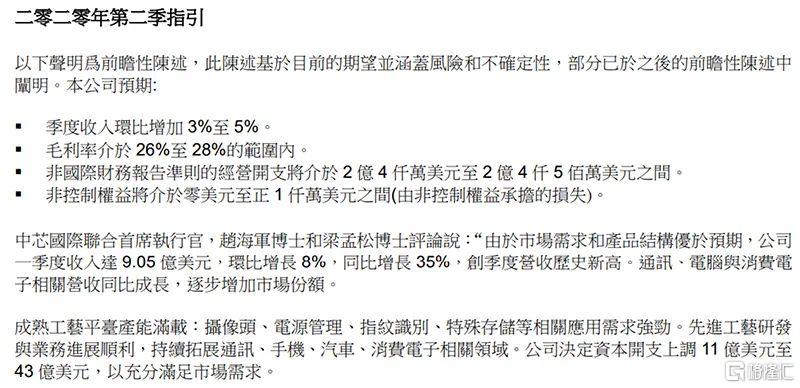

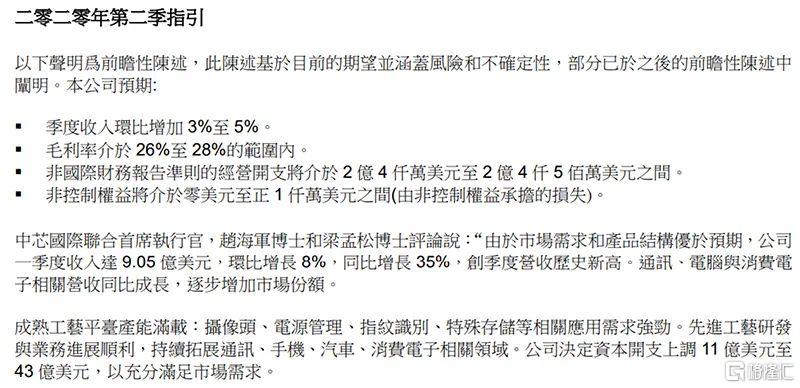

根据指引,中芯国际预计第二季度的收入环比增加3%至5%,毛利率在26%至28%之间。第二季度非国际财务报告准则的经营开支将介于2.4亿美元至2.45亿美元。

更为重要的是,中芯国际表示,由于市场需求旺盛,公司决定继续增加资本支出,将资本开支上调11亿美元至43亿美元,以充分满足市场需求。

中芯国际是中国大陆半导体产业的风向标,其增加资本开支,意味着行业景气度持续走高。那么,产业的需求都在哪里?

中芯国际在第二季度业绩指引中披露,成熟工艺平台产能满载,摄像头、电源管理、指纹识别、特殊存储等相关应用需求强劲。先进工艺方面,研发与业务进展顺利,持续拓展通讯、手机、汽车、消费电子等相关领域。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.