聯邦制藥(03933.HK)2019年報點評:胰島素業務快速增長,維持“買入”評級

機構:光大證券

評級:買入

◆全年淨利潤6.76億元,業績略超預期。公司發佈19年業績,全年實現收入83.9億元,同比增加11.7%;淨利潤6.42億元,同比減少6%;合EPS0.39元。扣除可換股債券嵌入式衍生工具公平值變動等非現金影響,全年核心淨利潤6.76億,相較於18年核心淨利潤5.99億元同比增加13%,業績略超預期,派發末期股息每股7分人民幣。

◆改革成效顯着,胰島素業務快速增長。製劑板塊19年實現收入35.2億元(+21.9%),分部利潤7.8億元(+27.3%),公司加強胰島素業務學術推廣,完成銷售部門改革,胰島素業務快速增長。1)二代胰島素收入6.87億元,銷量同比增長12.7%至1680萬支,預計2020年銷售額增速有望接近10%。2)甘精胰島素收入2.23億元,銷量同比增加158.5%至160萬支,已在全國25個省份中標,快速放量,預計2020年銷售額增速有望超過80%。3)其他品種銷售穩健,鹽酸美金剛實現0.8億元收入(+77.0%)。口服抗生素、維生素C等產品受疫情影響,預計2020年有望實現增長。

◆中間體及原料藥業務20年有望迎來快速增長。中間體板塊收入12.8億元(+3.8%),原料藥板塊收入35.9億元(+6.0%),分別實現分部利潤0.9億元(-69.6%)和2.4億元(+124.2%),19年初以來由於產能供給恢復,6-APA價格逐步下跌至低位。20年以來,6-APA價格企穩回升,最新報價(含税)185元/公斤。總體來看,中間體與原料藥業務板塊價格回暖,有望貢獻穩定利潤。此外,考慮到海外疫情蔓延,阿莫西林、頭孢和克拉維酸鉀等原料藥出口銷售有望迎來顯着增長。

◆現金流大幅改善,研發穩步推進。19年8月,公司公告以10.3億元出售四川成都商業地塊;期後,公司10.95億元公司債券於20年2月償還,均將改善公司的現金流。研發方面,公司儲備品種豐富,在研品種達29種:門冬胰島素和門冬胰島素30已報產,有望於20Q3獲批;德谷胰島素於19年9月獲批臨牀;利拉魯肽進入臨牀試驗,目前各項進展順利。此外公司還重點佈局抗乙肝、類風關、眼科等系列產品,並計劃向新藥領域拓展。

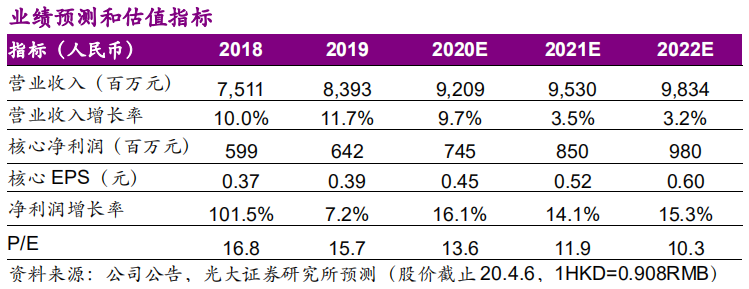

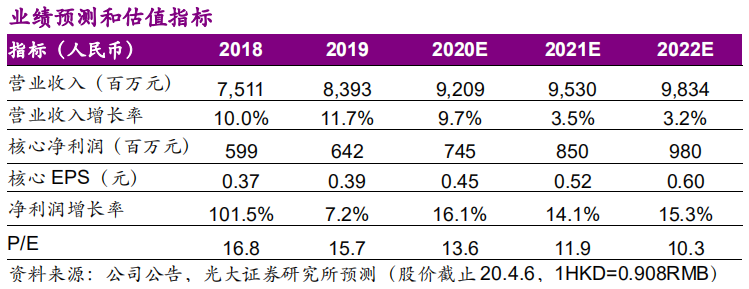

◆維持“買入”評級。公司已於2月下旬逐步復產,考慮COVID-19疫情有望驅動部分出口原料藥量價齊升,上調公司20-21年的核心EPS分別為0.45/0.52元(原0.40/0.47元),新增22年EPS預測為0.60元,同比增長16.1%/14.1%/15.3%,公司業務經營穩健,維持“買入”評級。

◆風險提示:招標降價壓力,原料藥價格波動,新產品推廣不及預期。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.