機構:廣發證券

評級:買入

目標價:29.02 港元

核心觀點:

擬分拆傳奇生物赴美上市,金斯瑞仍具控制權。金斯瑞公告擬分拆細 胞治療平台傳奇生物赴美上市,並於 3 月 9 日向美國 SEC 保密提交了 F-1 註冊聲明草案。金斯瑞目前對傳奇持股比例約 85%,傳奇 IPO 後 其持股比例會被稀釋,但稀釋程度有限,報表仍然合併。分拆傳奇成為 上市公司有利於增強金斯瑞和傳奇的經營聚焦度與戰略發展,更好匹 配管理團隊的責任和權力,提升財務透明度和公司治理,增強傳奇和金 斯瑞的財務靈活度,提高傳奇和金斯瑞的品牌價值和市場影響力。

美國上市所需時間較短、進度相對可控、後續再融資簡便。通常美國 SEC 需要幾個月的時間審核上市,傳奇將根據 SEC 的回覆更新註冊 聲明草案。赴美上市所需時間相對較短、進度可控,再融資簡便。靈活 的融資方式便於傳奇迅速補充研發資金,有利於傳奇研發管線的推進。

傳奇主營主體與主要銷售市場均在美國,核心產品年內將於美國報產。 傳奇研發進度最快的核心產品為 BCMA CAR-T,先後獲得美國 FDA 孤 兒藥資格認證、歐洲 PRIME 藥物資格和 FDA 突破性療法認證,表明 歐美藥監部門對其優秀療效和創新性的認可。該產品為強生與傳奇合 作開發,創下中國創新藥對外授權最高首付款和最優合作協議。該產品 有望在 2020 年 Q3 向美國 FDA 提交 BLA 申請,美國也是其未來主要 的銷售市場,銷售前景值得期待。且傳奇在 2020 年會有更多產品向美 國 FDA 申報 IND 並在美國推進臨牀,傳奇赴美上市為合理選擇。

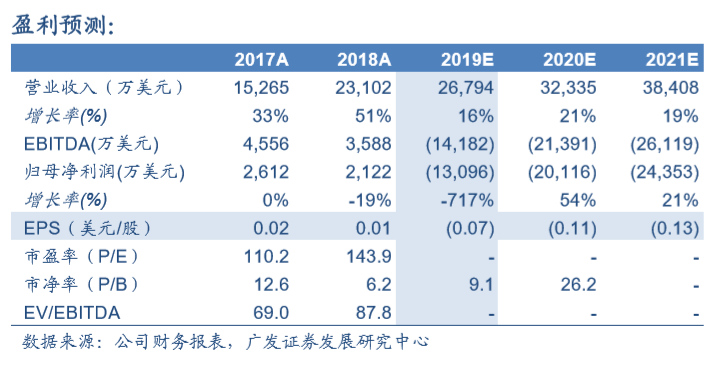

投資建議:預計 2019-2021 年收入 2.7/3.2/3.8 億美元,同比增長 16%/21%/19%。採用 SOTP 方法得到公司合理價值為 29.02 港元/股。 公司傳統業務發展穩健,CAR-T 產品上市後將貢獻較大利潤彈性,傳 奇 IPO 融資有望推進其產品研發進度,維持“買入”評級。

風險提示 費用投入超預期;研發進展低於預期;臨牀數據不達預期