数据君带你看港股(9月17日)

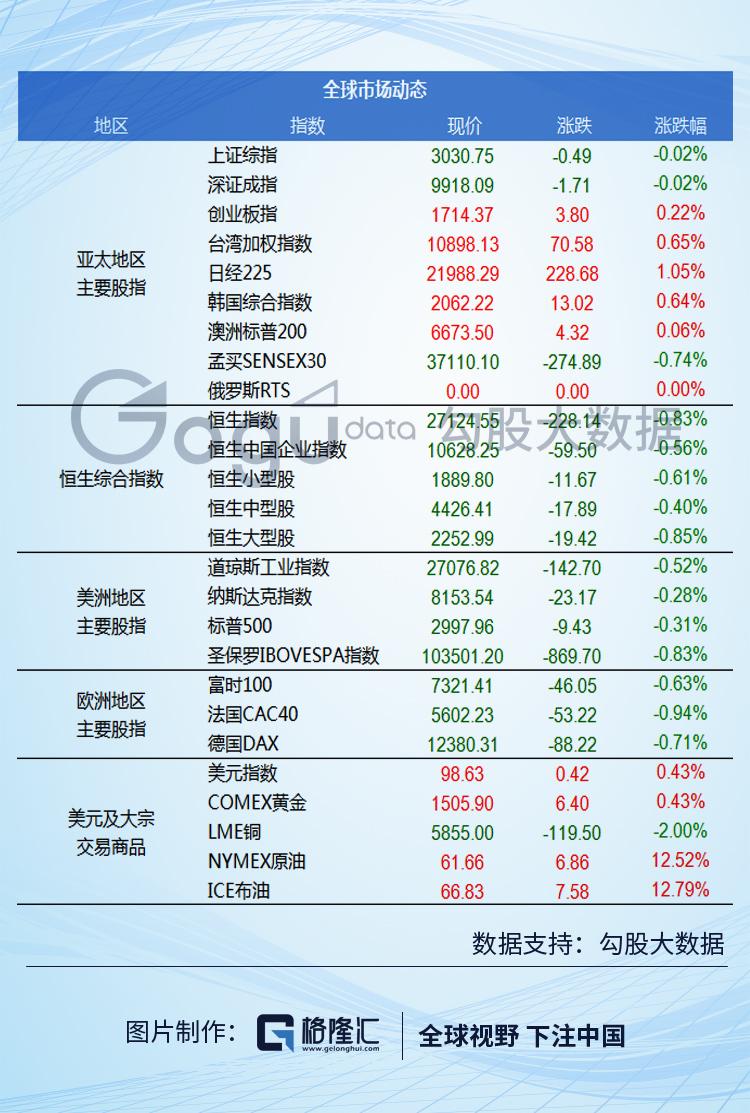

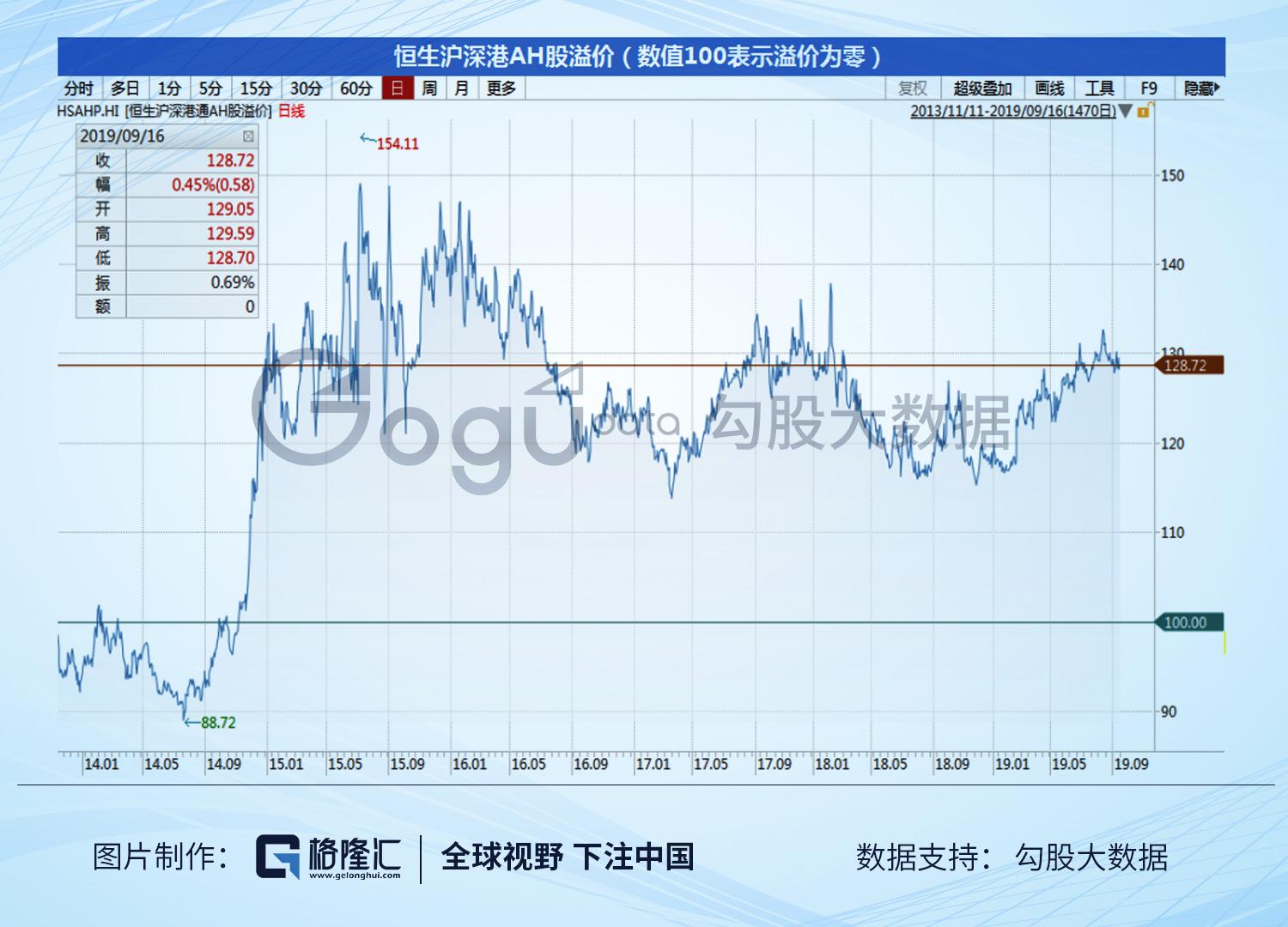

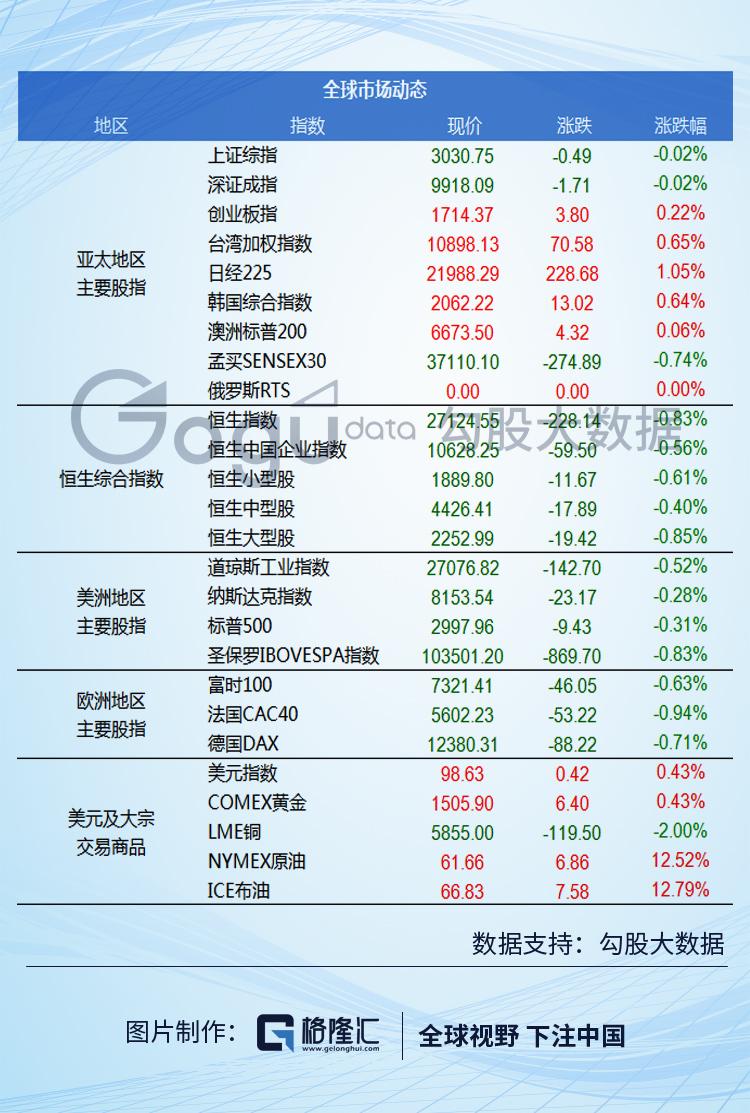

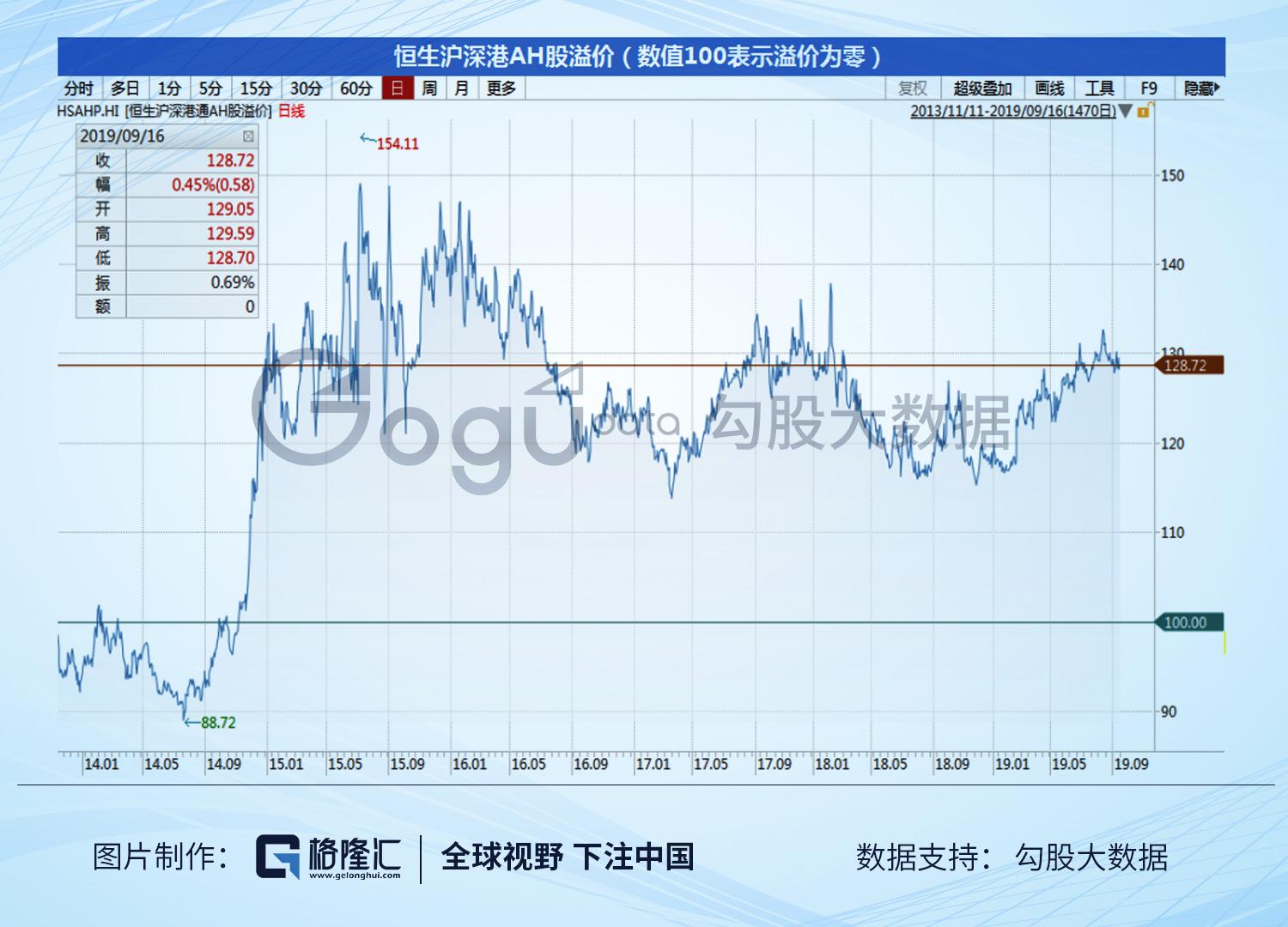

【港股】 周一港股市场总体现普跌行情,主要股指皆下挫。恒指早盘一度跌超1.3%,盘中短暂失守27000点关口。行业板块多数下跌,因国际原油飙涨,石油股全日保持强势。临近收盘主要股指现大单直线拉涨。截至收盘,恒指跌0.83%,报27142.55点。国指跌0.56%,报10628.25点。主板全日成交813.81亿港元,港股通净流入0.35亿港元。从板块表现看,石油股板块强势领涨,油气设备、半导体、影视娱乐、地产代理、农业股小幅上涨,航空股大跌近4%领跌,濠赌股、物管股、重型机械股、中资券商股、教育股等皆下跌。个股方面,三桶油逆势领涨大市,中海油大涨7.39%领涨蓝筹,中石油升超4%,中石化涨近2%;吉利汽车跌逾3%为最差蓝筹股;港交所、银河娱乐、蒙牛乳业、长和、中国人寿、腾讯等皆下挫;港股通标的股易鑫集团大幅飙升24%,控股股东易车获腾讯等私有化邀约;金山软件逆势升超5%;三大航空股皆重挫,东航跌逾5%,国航跌4.6%,南航跌近4%。

【A股】 昨日A股主要股指整体呈高开低走之势,沪指收跌0.02%,报3030.75点;深成指跌0.02%,报9918.09点;创业板涨0.22%,报1714.37点;上证50跌0.57%。两市成交额逾5800亿,北上资金净流入近16亿。盘面上,行业板块涨跌参半,券商、保险板块跌幅居前;运输服务、化纤、工程机械、多元金融等板块跌幅靠前。石油板块表现最为突出,板块内个股集体上涨,通源石油、贝肯能源涨停,中国石油涨超3%、中国石化涨逾2%;矿物制品、元器件、半导体、互联网等板块涨逆势上涨。

【美股】美股周一收盘全线下跌。道指下跌142.70点,跌幅为0.52%,报27076.82点,终结八连涨走势;标普500指数跌9.43点,跌幅为0.31%,报2997.96点;纳指跌23.17点,跌幅为0.28%,报8153.54点。标普500指数11个板块中有8个板块下跌,3个板块上涨,其中材料和非必需消费品板块领跌,能源板块领涨。布伦特原油期货收涨14.61%,创1988年以来最大单日涨幅。

数据看市

新股IPO

财经日历

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.