药明生物 ( 02269.HK) 2019年中报点评:生物制剂CDMO龙头,业绩高速增长,给予“买入”评级

机构:国信证券

评级:买入

生物制剂CDMO龙头,业绩保持高速增长

公司是中国市占率第一的生物制剂研发服务提供商,在全球收入排名第三,随着生物制剂研发外包需求的增长,公司2014-2018归母净利润CAGR高达96.87%。2019H1实现营业收入16.07亿元(+52.4%)、归母净利润4.50亿元(+80.3%)、经调整后归母净利润5.22亿元(+76.0%)。收入65%来自海外,中国地区增速53%,北美42%,欧洲和其他地区超过110%。

随着生物药研发生产进程推进,收入快速增长

公司业务覆盖药物发现、生物药研发到商业生产,提供一体化解决方案,生物大分子研发技术壁垒高、耗时长、费用高,客户在开发过程中很难随意更换服务商,客户黏性强,公司的收益会随着生物制剂开发过程的推进并最终商业化生产而呈几何级数增加。截止2019H1,综合项目数224个,其中临床前项目106个,临床早期项目102个,临床后期项目15个,商业化生产项目1个,项目涵盖单抗、双抗、融合蛋白、ADC等各类生物药,其中有58个项目属于First-in-Class。未完成订单已达46亿美元,市场份额不断扩大。本年度获得疫苗服务外包项目,为全球首例,有望成为未来新的增长点。

具有技术平台优势,产能全球布局

公司拥有WuXiBody双抗平台、WuXia细胞系平台、WuXiUP连续生产平台等技术,具有通用性,可快速、高效表达蛋白,缩短药品研发周期,利用公司的技术,除了根据项目所需成本和时间收取服务费,还可以获得里程碑收入和产品商业化之后的销售分成,截止2019年中报,WuxiBody已授权15个项目。2019年拥有产能5.2万升,2022年预计扩张到28万升,海外新增爱尔兰生产基地,执行全球双厂策略,更容易实现技术转移。

风险提示:生物药市场需求不及预期;产能利用率下降;行业竞争激烈等。

投资建议:首次覆盖,给予“买入”评级

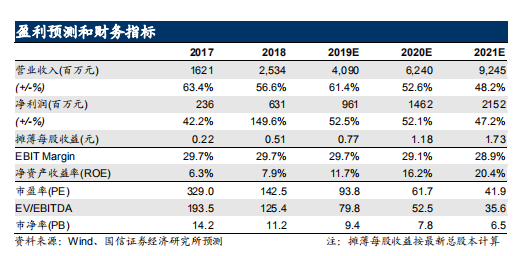

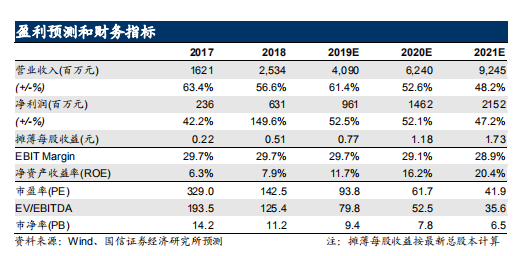

预计2019-2021年归母净利润9.61/14.62/21.52亿元,同比增速53/52/47%;摊薄EPS为0.77/1.18/1.13元,当前股价对应PE为94/62/42x。公司作为生物制剂CDMO龙头企业,未来三年业绩维持CAGR51%的高速增长,首次覆盖,按照2021年PE48~52x,合理估值94.6~102.5港元,给予“买入”评级。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.