What is “Grid Trading”?

What is “Grid Trading”?

No matter how the market fluctuates, there are three patterns in the market: rising, consolidation, and falling.

“Grid Trading Order” is a programmatic trading strategy which does not rely on human thinking. It aims to buy low and sell high within a stock price range during market fluctuations which can reasonably control the position, avoid chasing the winner and cutting the loser. The advantages of grid trading are strong anti-risk ability and considerable returns during the consolidation.

Grid Trading Order is suitable for customers who have basic positions and are willing to fulfill the concept of grid trading.

Instruction

If you believe that a stock will oscillate and consolidate within a certain range in the future. You can set certain conditions through “Smart Order” – “Grid Trading”, buy when the stock falls and sell when the stock rises to get the margin in between.

Let's look at the steps:

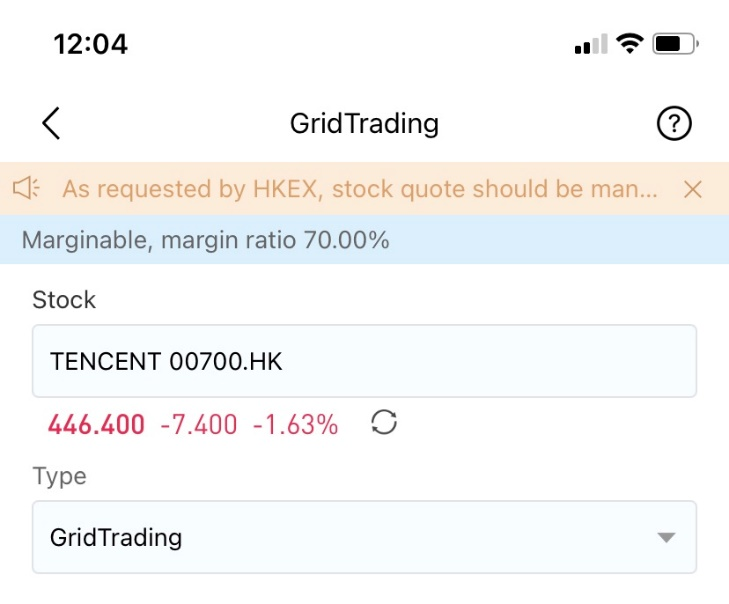

STEP 1 Select stock

Enter the stock for “Grid Trading”, typically are the stocks with better fundamental, continuous price fluctuations and less gaps.

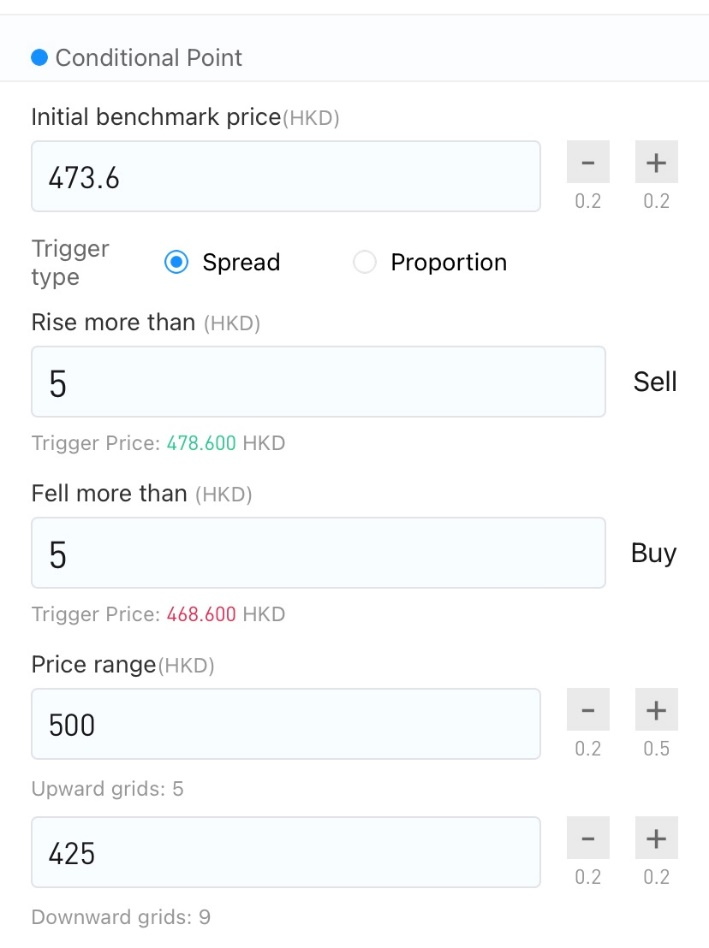

STEP 2 Set Conditional Point

Enter the initial base price, generally is the price for bottom position which should not be too high.

Select Trigger Type, spread or proportion can be chosen. Input the appropriate spread according to your analysis of that stock. If the benchmark price rises by the specified spread or percentage, the sell order will be triggered. If the benchmark price falls by the specified spread or percentage, the buy order will be triggered.

*The spread and the percentage should not be too small, you should set a profitable value considering the transaction cost.

Input the Price Range. After input the upper limit and lower limit, our system will calculate the upward and downward price range automatically.

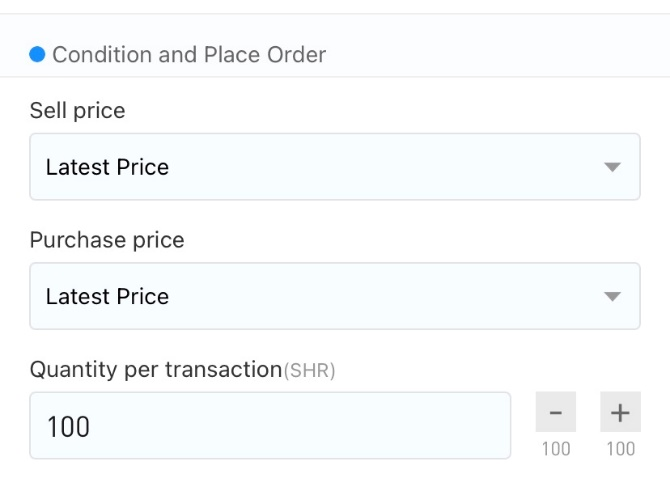

STEP 3 Set condition

Input the sell price and purchase price. HK stock supports order of latest price, 1 bid & ask price and 5 bid & ask price, while US stock supports order of latest price and 1 bid & ask price.

Input the quantity per transaction, the same amount is entrusted each time the order is placed.

Click “More settings” to set the largest position, minimum bottom position and multiple commission.

*Multiple commission means that if there is a gap in the market, the number of orders will be multiplied according to the grids.

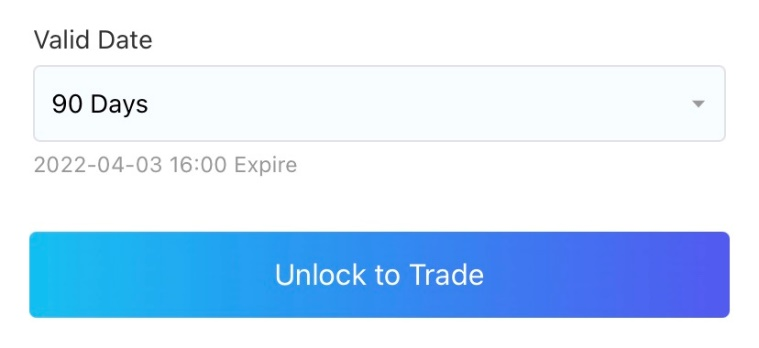

STEP 4 Select effective time and place order

For the valid date, same day/ 2 days/ 3 days/ 1 week/ 2 weeks/ 30 days/ 60 days/ 90 days are available, and can be extended by changing the order.

Click unlock to trade and submit order. The submitted order can be viewed under the smart order page, and the order can be modified as needed.

*You are not allowed to modify if the “Grid Trading” order has been triggered, but you may cancel the order.

Order time

Anytime

Order valid date

Same day/ 2 days/ 3 days/ 1 week/ 2 weeks/ 30 days/ 60 days/ 90 days are available, and can be extended by changing the order.